Good morning from Miami’s South Beach, where we’re about to start Day 2 of the FII Priority Summit. This is the annual U.S. gathering of the Future Investment Initiative (FII) Institute, a nonprofit foundation run by Saudi Arabia’s Public Investment Fund (PIF) that convenes leaders worldwide to debate key trends in policy, investment, and innovation. The conversations are similar to what you’d hear at the World Economic Forum in Davos: the institute’s flagship summit in Riyadh is even dubbed “Davos in the Desert.”

The lineup of speakers this week–which includes CEOs like Michael Dell, Julie Sweet, Jenny Johnson, Stephen Schwarzman, Vimal Kapur, Barry Sternlicht, Marcelo Claure, Pamela Liebman, and Alex Karp–is a testament to the growing attraction of Saudi Arabia as an investor, partner, and place to do business.

PIF Governor Yasir al-Rumayyan opened the conference by announcing the sovereign wealth fund planned to annually deploy up to $70 billion in capital after 2025, having already invested about $100 billion in the U.S. alone since 2017. With a wildly profitable energy sector that’s now shifting amid the energy transition, al-Rumayyan may be right in predicting Saudi Arabia could be an AI hub.

Saudi Arabia has already introduced reforms in areas like gender rights, tourism, and investment, but critics still balk at its continued lack of freedom for women, LGBTQ+ citizens and the press, among other things. For business leaders, the dilemma is how to support change in a fast-growing part of the world without breaching corporate values.

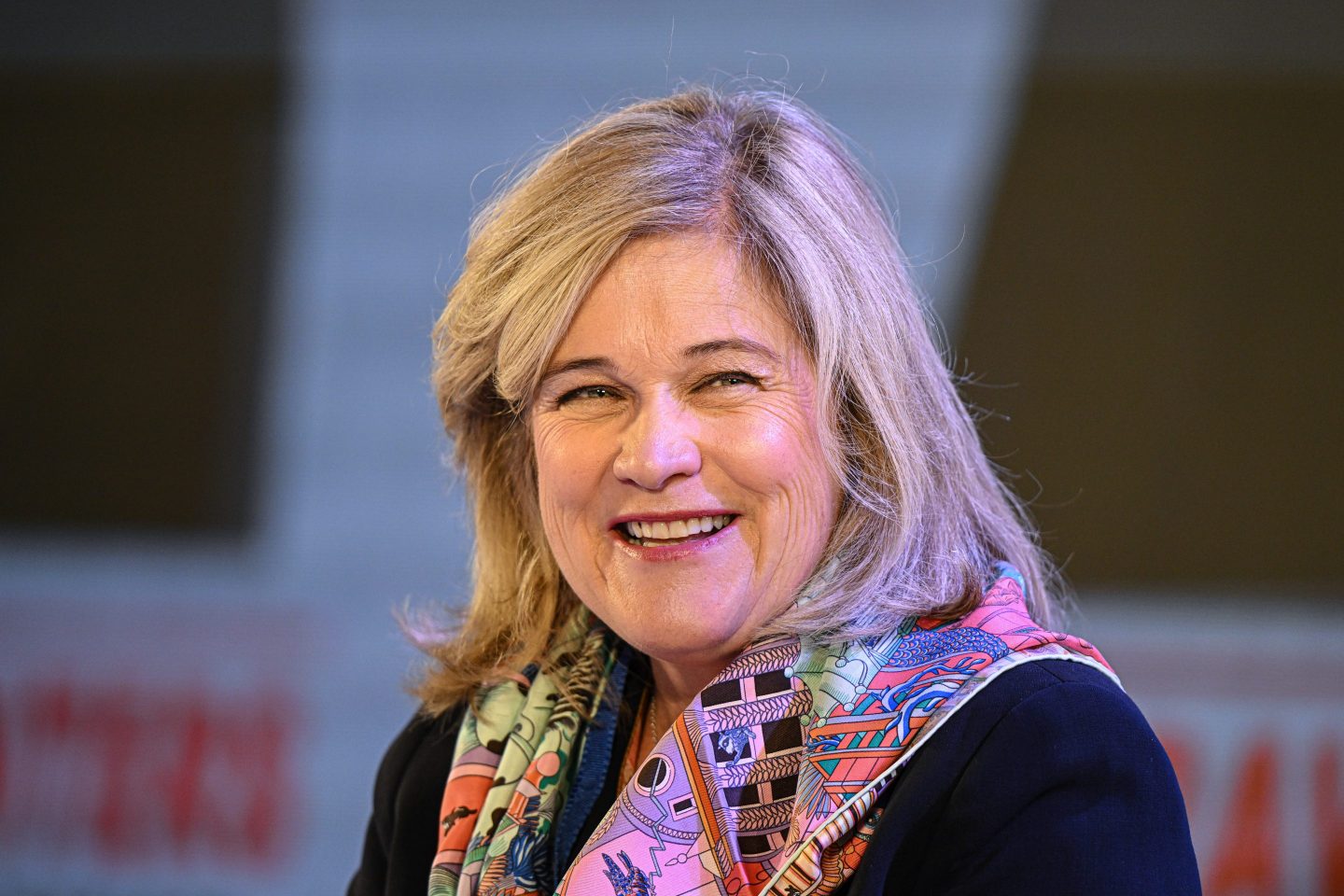

For that, one inspiration is Jenny Johnson, the president and CEO of Franklin Templeton, which has $1.5 trillion in assets under management worldwide. Along with transforming the company that her grandfather founded into a digital leader, she’s deeply attached to creating an inclusive culture wherever Franklin operates. Its newly created entity in Saudi Arabia is led by CEO Muneera H. AlDossary, a woman with a proven track record and deep knowledge of the local market.

Johnson takes a similar on-the-ground approach in markets like China, which former Secretary of State Mike Pompeo roundly criticized as a place to do business during a fireside chat with Fox News anchor Maria Bartiromo on Thursday. Johnson, like many business leaders, argues against disengaging with the world’s second largest economy.

Moving into new countries brings new customers and new opportunities to create products that invest across different asset classes, sectors, and geographies. “My grandfather got into this business because the average person couldn’t access the returns of the equity markets,” Johnson says. Mutual funds offered a basket of stocks at a reasonable price. With AI, blockchain, and an expanding universe of alternative assets, she believes we’re at another inflection point for innovation in investing.

Richard Attias, the longtime executive producer of WEF who’s now CEO of FII, says the goal of this initiative is to establish a more inclusive network to foster conversations that bring in more young people, business leaders and policymakers from parts of the world that often weren’t on the radar for WEF. FII is creating new indices, an ESG framework, and investments.

“We don’t pay anyone to come,” says Attias. The resources and relationships of FII’s main benefactor are enough to create a powerful lineup of leaders in Miami. “When you leave, you will have a better understanding of where the money is going.”

Diane Brady

@dianebrady

diane.brady@fortune.com

TOP NEWS

Can Nvidia meet expectations?

Nvidia’s market value rose to $1.9 trillion on Thursday, a $250 billion one-day gain equal to 40% of Tesla’s market cap. Yet Fortune’s Shawn Tully argues that surge only increases the money Nvidia will need to make to justify its value. To give a 10% return at a (better-than-average) price-earnings ratio of 25, Nvidia must earn $200 billion in profit by 2034—twice as much as what Apple and Microsoft make now. Fortune

Reddit plans to go public

Social media company Reddit is diving into the IPO market right as investors are more skeptical of high-growth, unprofitable companies. The company reported a 2023 net loss of $90.8 million in its IPO filing on Thursday. Another worry: Reddit makes almost all of its revenue from advertising, a revenue source that’s come under pressure as companies trim spending. Fortune

Underage accounts on Instagram

Meta safety staff worried last year that some parents were using paid-subscription tools on Instagram and Facebook to exploit their children. "Parent-managed minor accounts" offer additional content—sometimes to male audiences—in the hope of boosting audience numbers and getting their children a head-start in the influencer world. Meta reportedly rejected internal proposals that the company force accounts selling subscriptions for child-focused content to register for monitoring. The Wall Street Journal, The New York Times

AROUND THE WATERCOOLER

Fear is your friend, and embrace your failures: Leadership advice from Nvidia CEO Jensen Huang as the company shatters a new record by Emma Burleigh

Sam Altman is set to be one of biggest winners in Reddit’s IPO, with a stake that could be worth $435 million by Kylie Robison

Tesla competitor Rivian predicts zero growth this year as founder blames the Fed for making him cut a tenth of his staff by Christiaan Hetzner

Rolls-Royce’s Tufan Erginbilgiç called the engine-maker a ‘burning platform’ when he took over as CEO. One year later, profits have doubled by Prarthana Prakash

Four-day weekends from home are over: Fridays are increasingly just another office day, data shows by Orianna Rosa Royle

The Biden administration highlights a new alleged national security threat: Cheap cranes from China by Lionel Lim

This edition of CEO Daily was curated by Nicholas Gordon.

This is the web version of CEO Daily, a newsletter of must-read insights from Fortune CEO Alan Murray. Sign up to get it delivered free to your inbox.