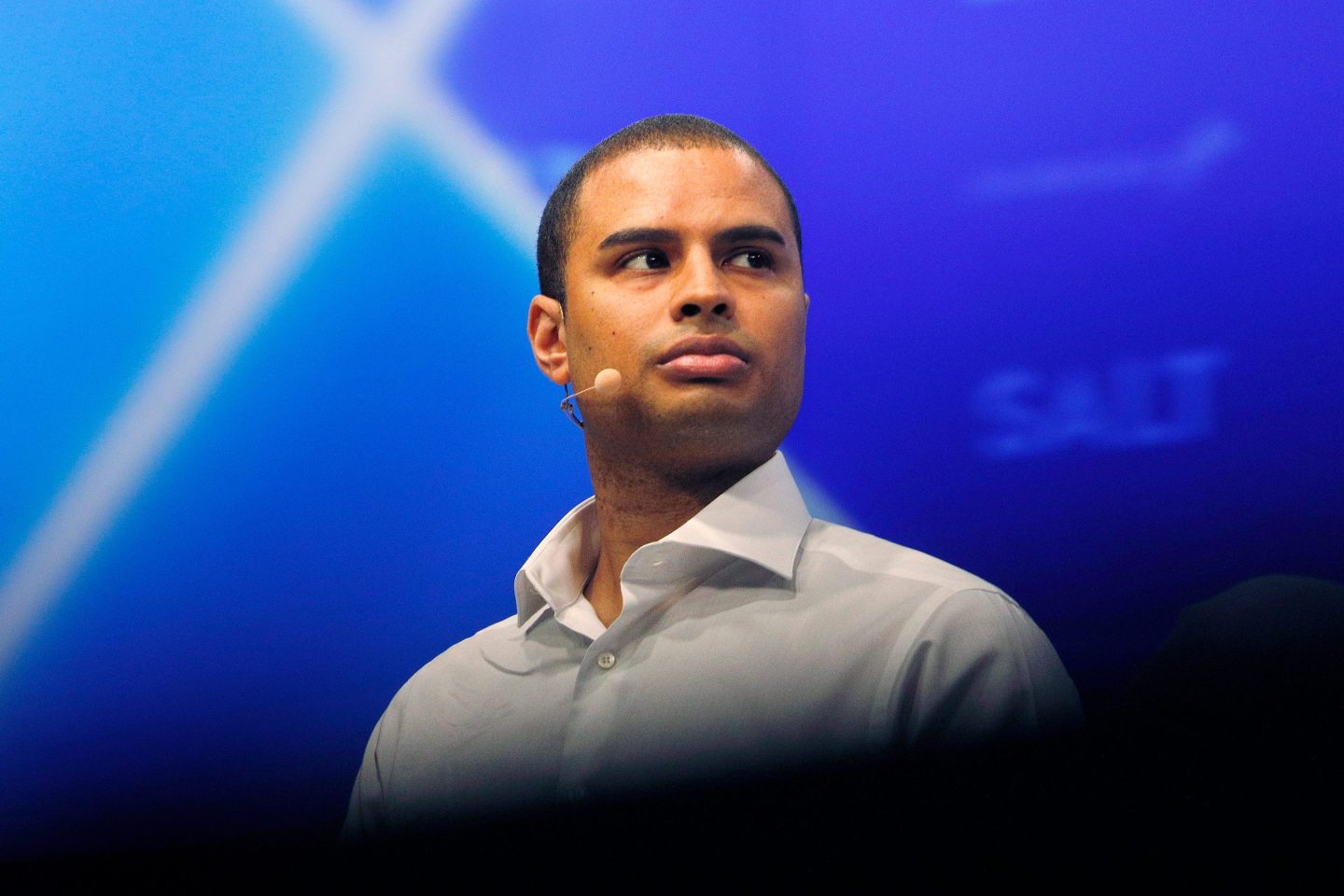

Yieldstreet is acquiring Cadre, a real estate investment platform with a mission to democratize access to investing, particularly in commercial real estate, Fortune is the first to report. Cadre’s founder and chief executive, Ryan Williams, will remain at the helm as the company operates under the Yieldstreet umbrella—while leading a new division focused on broadening access to the institutional audience as Yieldstreet’s global head of institutional partnerships & clients.

The companies declined to release the purchase price, but the two have a collective investment value of over $9.7 billion and investors that have allocated $5.3 billion on their platforms—notching $3.1 billion in returns to date, they say. While the transaction is subject to regulatory review, their goal is to become a leader across the real estate and alternatives investment industry. Cadre has raised $133 million from Thrive Capital, Andreessen Horowitz, Khosla Ventures and others; its latest valuation was $800 million, according to Forbes.

Williams previously told Fortune that his idea to launch Cadre came after visiting his best friend in a predominantly Black part of Atlanta. In an interview today, Williams told me that a year after the housing crash, almost every other home lining the streets were boarded up, or being boarded up. He and some classmates along with others raised money in a syndication format to buy single-family homes and rent them out, particularly to the people whose homes had been foreclosed upon. Some success stories even included those people buying their homes back, he said.

That was all before Cadre launched in 2014, making waves as a startup that allowed individuals to invest in commercial real estate for as little as $25,000. Five years later, Cadre hit a milestone, returning $100 million to its investors after selling two apartment complexes in the Chicago and Atlanta suburbs, as Fortune first reported at the time. Now, the company has slightly more than $4.5 billion in total asset value on its platforms, Williams said—and with Cadre’s partnership with Yieldstreet, an alternative investment platform that launched just a year after Cadre, he hopes they can build what will be the “largest digital alternative asset manager in the industry.”

Yieldstreet’s founder and chief executive, Michael Weisz, shared Williams’ excitement and optimism on our call. “What this transaction does for the industry is clearly define a market leader by a factor of five,” Weisz said.

Williams and Weisz have known each other for years, sharing the same visions that alternative investments need to be a bigger part of individual investors’ portfolios. Cadre did things differently, focusing on real estate, but Williams has always wanted to move beyond the sector.

“That takes time and that takes resources—capital and expertise,” Williams said. “I recognized while we were in the midst of closing a fundraise, that we wanted to not just grow but grow exponentially, and we were going to need to find a partner who offered us diversified investments that we could distribute to our clients in a way that would ensure we were able to navigate any macro or market environment, and I think that’s one of the things Yieldstreet has done incredibly well.”

They’d had previous discussions about combining forces, but the time seemed to be right, so they connected earlier this year to make it happen. For Weisz, and Yieldstreet, it was an obvious decision because there’s an alignment between both companies’ mission and vision—which he said, is typically the hardest part when it comes to bringing two teams together.

“That’s the motivation, to extend our leadership, to set us up for a successful IPO, to build the best business, to serve our customers with the best experience with the best investment product,” Weisz said.

No question it’s been a tough year for real estate. “We’ve been in defense mode,” Williams said, “but we’ve been very proactive on asset management. We’ve made sure that across our portfolio, we had fixed-rate debt in place, we put caps on all of our floating-rate debt, and we’ve been focused on over-communicating with investors about the status of their portfolios.”

Cadre’s portfolio has held up well, he added, because it’s weighted toward multifamily. In the next year, he sees opportunity in mid-cap real estate (properties with $15 to $50 million of equity in total value, in the company’s view). That’s especially true for multifamily and industrial properties with debt coming due, Williams said, to distressed regional banks that won’t allow owners to refinance. This deal with Yieldstreet will allow Cadre to create a new fund that will “capitalize on these dislocations and acquire multifamily and industrial assets that these regional banks are not going to extend loans around, that sellers will be forced to sell,” Williams explained.

Weisz echoed Williams on the challenges surrounding commercial real estate over the past year, while stressing that it’s a priority to focus on real estate moving forward

“A lot of us in the market have been waiting for more opportunities to bubble up,” Weisz said. “We haven’t yet seen a flurry of opportunity come, true distress and true foreclosures, or assets that are really changing hands at prices that seem to be exciting—but we expect that it will come soon.”