Good morning. Will Daniel here, filling in for Sheryl.

Did “revenge spending” save the economy from recession?

That’s one theory circulating in light of last week’s strong GDP numbers. In brief, the idea is that Americans—still flush with excess savings built up during the pandemic, as well as a strong labor market—flocked to enough Taylor Swift concerts, movie theaters, and hotels to save the economy. But how long can the pattern last? Jeffrey Roach, chief economist at LPL Financial, argued that it’s a last gasp from consumers. “The real question is if the trend can continue in the coming quarters, and we think not,” he said.

As I wrote in Fortune:

The Biden administration was quick to celebrate the surge in U.S. economic growth after years of consistent recession predictions from Wall Street. Ever since inflation surged to a four-decade high of over 9% in June 2022, a chorus of experts has repeatedly warned that the Federal Reserve may need to hike interest rates until the economy slips into recession if it truly wants to restore price stability for consumers. But President Biden rebuked that thinking on Thursday.

“I never believed we would need a recession to bring inflation down—and today we saw again that the American economy continues to grow even as inflation has come down,” he said in a statement. “It is a testament to the resilience of American consumers and American workers, supported by Bidenomics—my plan to grow the economy by growing the middle class.”

However not everyone was ready to pop the champagne.

Mark Hamrick, a senior economic analyst at Bankrate noted the economy still faces “substantial headwinds,” including the Federal Reserve’s “higher for longer” interest rate policy, surging Treasury yields, and the potential for a partial federal government shutdown in November due to gridlock in Washington over the federal budget. On top of that, the threat of geopolitical instability is rising as the Russia-Ukraine and Israel-Hamas conflicts continue.

“Expectations are muted for the intermediate term amid no shortage of sources of uncertainty,” Hamrick said of the economy. “There’s no guarantee that recent substantial momentum can be sustained.”

Hamrick concluded: “Take a good look at the estimate for third-quarter GDP because it could be the highest that we see for a while.”

Will Daniel

Will.Daniel@fortune.com

Leaderboard

Raime Leeby was named CFO at DHI Group, Inc. (NYSE: DHX), a provider of AI-powered career marketplaces. Leeby brings over 23 years of financial experience, including working at public companies and high-growth startups. Before joining DHI, she served as chief strategy officer and interim CFO at US Med-Equip, a company that provides medical equipment and solutions to hospitals across the nation.

Andrew Jackson was appointed CFO at Calidi Biotherapeutics, Inc. (NYSEAM: CLDI), a clinical-stage biotechnology company. Jackson is a financial executive with over 25 years of corporate finance experience. Jackson most recently served as CFO of Eterna Therapeutics Inc. Before that, he served as CFO at Ra Medical Systems for over four years where he led its initial public offering. Jackson also served as CFO at AltheaDx, Inc., a commercial-stage molecular diagnostics company.

Big deal

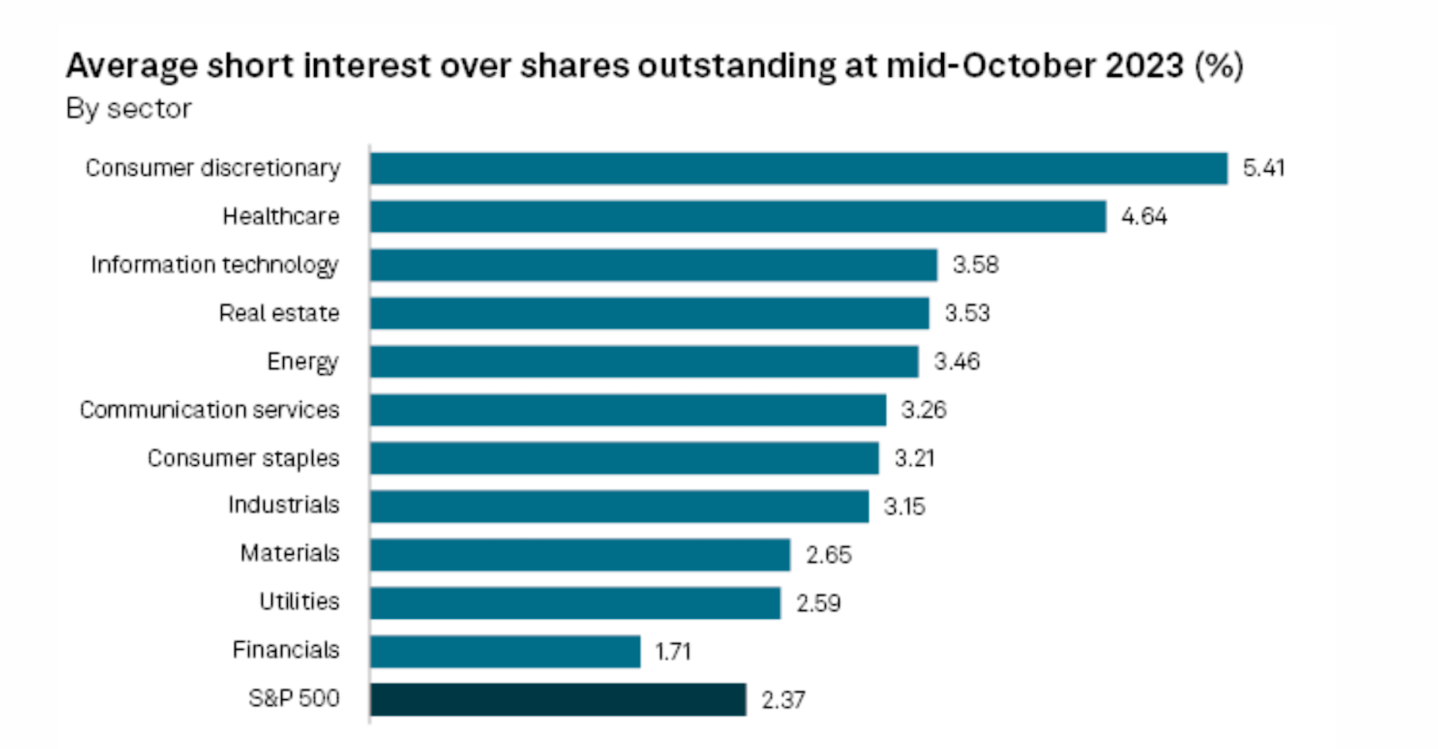

As of mid-October, consumer discretionary stocks continue to draw the highest amount of short interest, at 5.41%, due to investors seeing persistently high inflation impacting consumer demand, according to a new report by S&P Global Market Intelligence.

"Short interest measures the percentage of outstanding shares of a given company or industry held by short sellers, who seek to profit from a stock's decline by borrowing shares to sell at a high price, then repurchasing them after a drop and pocketing the difference," according to the report.

Going deeper

This month, ResumeBuilder.com surveyed 1,000 full-time workers aged 21 to 40 to find out more about career-related information. Half of Gen Zers and millennials are getting career advice on TikTok and 1 in 5 Gen Zers and millennials have made decisions based on advice from TikTok creators. You can read the full report here.

Overheard

"More Americans than ever will be reaching into their wallets and spending a record amount of money to celebrate Halloween this year."

—National Retail Federation (NRF) President and CEO Matthew Shay said in a statement. Total Halloween spending is expected to reach a record $12.2 billion, exceeding last year’s record of $10.6 billion, according to the NRF's annual survey conducted by Prosper Insights & Analytics.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.