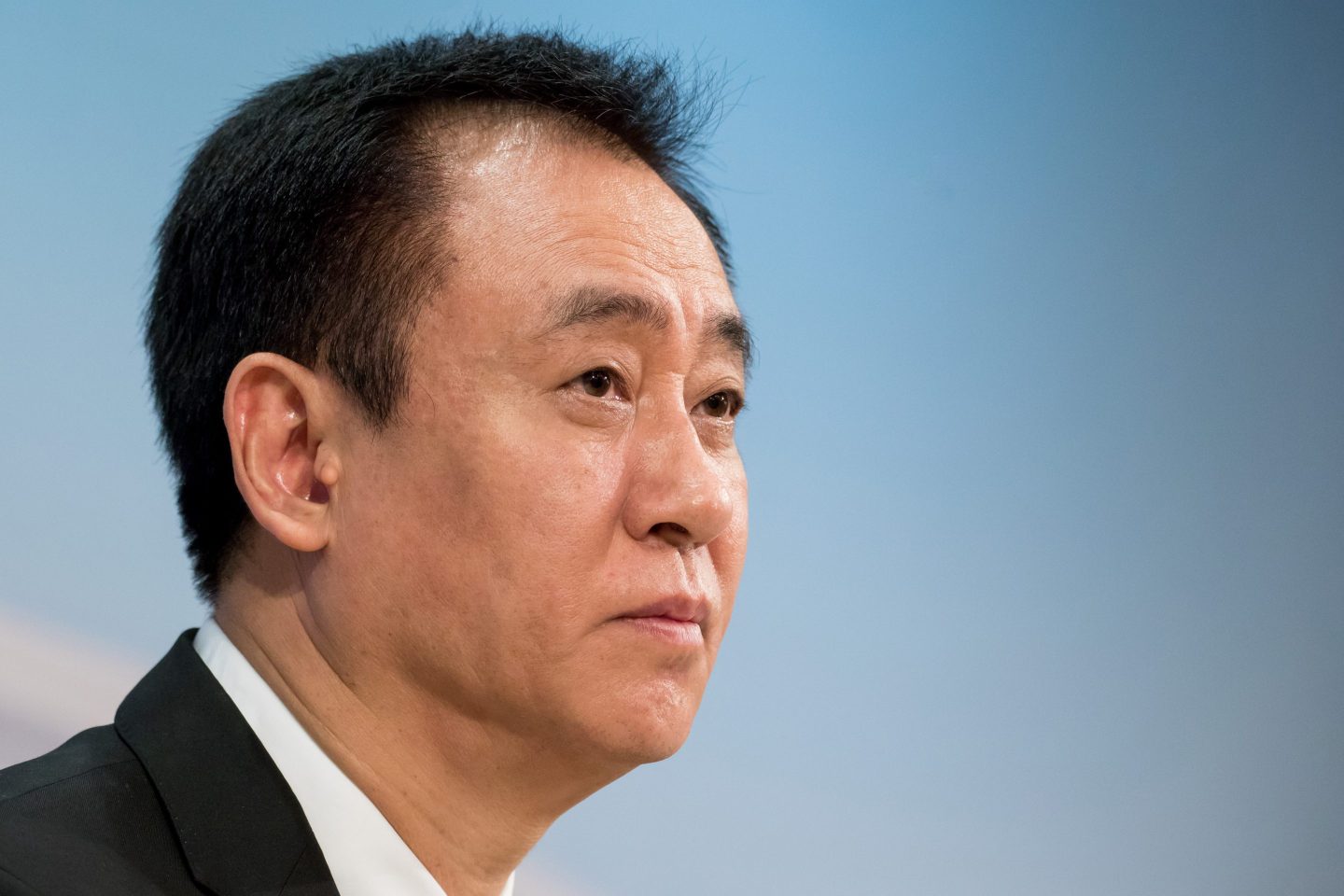

Hui Ka Yan, the billionaire chairman of beleaguered property developer China Evergrande Group, has been placed under police control, according to people with knowledge of the matter.

Hui was taken away by Chinese police earlier this month and is being monitored at a designated location, the people said, asking not to be identified because the matter is private.

It’s not clear why Hui is under so-called residential surveillance, a type of police action that falls short of formal detention or arrest and doesn’t mean Hui will be charged with a crime. Still, the measure means he is unable to leave the location, meet or communicate with others without approval, based on China’s Criminal Procedure Law. Passports and identification cards must be handed to police but the process shouldn’t exceed six months, according to the law.

The move is the latest sign that the saga at the world’s most indebted developer has entered a new phase involving the criminal justice system, after authorities earlier this month detained some staff at its wealth management unit and two former executives were also reportedly held. It adds to questions over the fate of Evergrande after setbacks to its restructuring plan in recent days roiled financial markets and raised the risk of a liquidation.

“It is too early to say Evergrande will end up in liquidation, but such risk is clearly rising,” said Gary Ng, senior economist at Natixis Asia. “For the government, it shows no single developer is too big to fail in China.”

For Hui, who controlled one of the world’s biggest fortunes when Evergrande’s shares peaked in 2017, the development is another blow in a remarkable fall from grace. Once considered among the most politically connected businessmen in China with ambitions ranging from electric cars to soccer, the tycoon has now become the most high-profile casualty of President Xi Jinping’s crackdown on excessive leverage and speculation in the real estate sector.Play Video

Guangdong police and Evergrande didn’t respond to requests for comment.

Evergrande sits at the center of a years-long property crisis that has hurt the Chinese economy and hammered confidence in the housing market. On Friday, the developer said it scrapped key creditor meetings and has to revisit its plan to restructure its offshore debt. Since then, it has disclosed it was unable to meet regulatory qualifications to issue new bonds — a key component of the debt overhaul — while its mainland unit failed to repay an onshore note.

The company faces an Oct. 30 hearing at a Hong Kong court on a winding-up petition, which could potentially force it into liquidation.

“It is still possible for Evergrande to have a new restructuring plan should it fulfill the regulatory requirement, but the process can be longer than before and it is uncertain whether creditors would accept the likely worse terms,” Ng said.

Shares of Evergrande fell 19% to HK$0.32 on Wednesday. The company’s dollar bond prices remain indicated at deeply distressed levels at below 5 cents.

A Bloomberg Intelligence gauge of Chinese developer stocks dropped 3.5% to the lowest level since 2011. Homebuyer sentiment remains fragile ahead of a key holiday sales period that will test the effectiveness of stimulus measures rolled out in recent weeks.

The son of a wood cutter who grew up in poverty, Hui built Evergrande into China’s largest developer by using leverage to buy massive tracts of land and scoop up rivals, before branching out into industries ranging from bottled water to professional soccer and electric vehicles.

He was once Asia’s second-richest person, only to see his net worth slump as his property empire crumbled. Hui is now worth about $1.8 billion from $42 billion in 2017, according to the Bloomberg Billionaires Index. Evergrande has 2.39 trillion yuan ($327 billion) in liabilities. Play Video

The 64-year-old has been a Communist Party member for more than three decades. In 2008, he was elected to join the Chinese People’s Political Consultative Conference, an elite group comprising government officials and the biggest names in business. He later secured two other five-year terms.

Things took a turn for the worse in 2021, when Evergrande officially became a defaulter and authorities from its home province of Guangdong led what is poised to be one of the nation’s biggest debt restructurings.

Hui had been part of the CPPCC’s elite 300-member standing committee since 2013, but he was told not to attend the annual convention in March last year as his property group became the biggest casualty of the nation’s credit crunch.

China’s central bank has blamed Evergrande’s demise on its “own poor management” and “reckless expansion,” and the government has urged Hui to use his fortune to help repay investors.