WeWork’s management issued the dreaded “going concern” warning to investors alongside its second-quarter earnings report on Tuesday, admitting that “losses and negative cash flows” have left them considering all “strategic alternatives” to keep their office-space leasing business afloat—including bankruptcy.

A going concern warning can be filed by auditors or a company’s management and serves to caution investors that “it is probable” the firm in question won’t have enough cash to pay its debts over the next 12 months, leaving substantial doubt that it can continue to operate.

WeWork stock has plummeted roughly 40% this week to just $0.13 per share on the news, leaving it down more than 98% since its $13-per-share peak in October 2021. That’s roughly $9 billion of value washed away in less than two years. But zooming further out to the heady pre-pandemic days of 2019, when WeWork was highly touted on Wall Street, it’s an even steeper drop. Japan’s investment conglomerate SoftBank, which has plowed nearly $20 billion into WeWork to date, tagged the firm with a $47 billion valuation prior to its failed attempt at an initial public offering in 2019.

For the second quarter, WeWork posted revenues of $844 million, an increase of 4% year over year, and a net loss of $397 million compared to $635 million in the same period last year. While the earnings showed an improvement from 2022, both the revenue and earnings-per-share figures still missed analysts’ consensus estimates. Naturally, the remote-work era has been tough on the firm that, perhaps more than any other, epitomized the office-centric culture of the 2010s.

In a statement to Fortune, a representative for WeWork said that the going concern warning was merely an “accounting determination” and argued that it does not fully reflect recent improvements to the company’s balance sheet.

WeWork remains focused on the transformation plan that it introduced after pulling its attempted IPO in 2019, she said, which includes controlling expenses, increasing sales, and seeking additional capital. To her point, since the fourth quarter of 2019, WeWork has cut $2.3 billion in recurring costs by slashing administrative expenses and “optimizing” its real estate portfolio. And in a statement accompanying the second-quarter earnings results, interim CEO David Tolley added that he remains “confident” that WeWork will be able to meet the needs of the evolving workplace. “Our long-term company vision remains unchanged,” he said. (Tolley took the reins in May after predecessor Sandeep Mathrani left the firm for a job at Sycamore Partners.)

A fallen giant

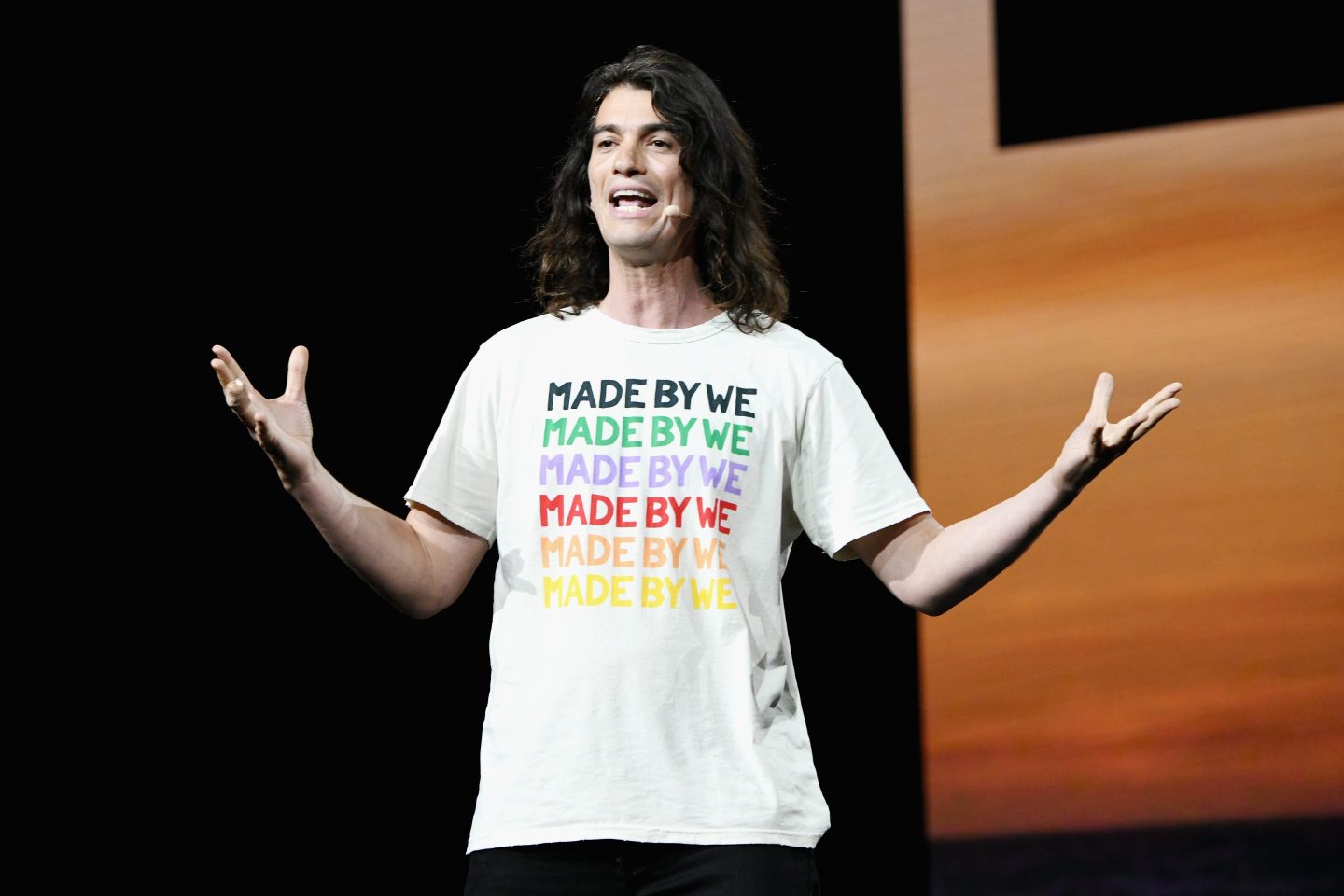

WeWork’s fall from grace began in 2019, after a poor market reaction to its S-1 form ahead of its planned IPO. Investors questioned the firm’s creative accounting (e.g., the bizarre and bespoke metric of “community-adjusted EBITDA”), its potential path to sustainable profitability, and the special treatment enjoyed by founder and then-CEO Adam Neumann. WeWork lent Neumann large sums with low interest rates and rented out buildings that he owned. By late 2019, after the failed IPO, Neumann was given a golden parachute and left the company to start a new venture.

The fiasco left SoftBank founder Masayoshi Son regretting his decision to invest in Neumann’s company. “It was foolish of me,” he told investors in a May 2020 earnings call. “I was wrong.”

Despite its issues, WeWork eventually managed to go public through a merger with a special purpose acquisition company (SPAC) called BowX Acquisition Corp in October of 2021, leaving the firm with a $9 billion valuation. But shares have plummeted since then amid pressure from rising interest rates and the remote-work trend.

WeWork’s market cap is now around $270 million. And SoftBank revealed in an SEC filing this week that its cumulative loss on its investment in the company is sitting at $18.6 billion.

A challenging environment and bearish news

On Tuesday, WeWork’s interim CEO Tolley acknowledged that the company has faced a “difficult operating environment” this year.

“Excess supply in commercial real estate, increasing competition in flexible space and macroeconomic volatility drove higher member churn and softer demand than we anticipated, resulting in a slight decline in memberships,” he said in the firm’s earnings report.

Even with aggressive cost cuts, WeWork posted a net loss of $696 million in the first half of the year. And as of June 30, the firm had just $680 million of liquidity, split between cash and first lien notes (funds secured using real estate as collateral), compared to $2.9 billion in long-term debt.

Tolley said that despite the challenges, he remains “confident” in WeWork’s long-term vision. But Wall Street analysts aren’t so bullish.

“Flexible workspaces have a future in the office ecosystem, but WeWork, in its current state, may not,” BTIG analysts wrote Wednesday, moving their 12-month price target for the company from $2 to just $0.20, per Reuters.

In another bearish sign, WeWork has brought in a group of new board members with experience in restructuring companies post-bankruptcy. This followed the resignations of three board members—Daniel Hurwitz, Vivek Ranadivé, and Véronique Laury—the prior week because of “a material disagreement regarding board governance and the company’s strategic and tactical direction,” as previously reported by the Wall Street Journal.

As for SoftBank’s Masayoshi Son, he is all in on his favorite new investment: artificial intelligence. In June of this year, he greeted shareholders at the firm’s annual meeting with a lengthy PowerPoint and an impassioned speech about how contemplating A.I. moves him to tears. “What is mankind?” he asked, before answering that humanity plus A.I. will lead to the “birth of superhuman.”

Correction: This article has been updated to clarify that Adam Neumann secured a package worth up to $1.7 billion when he exited WeWork in 2019, however, a representative told Fortune that only approximately half of that was actually executed, worth hundreds of millions of dollars.

Editor’s note: This article has been updated to clarify that Adam Neumann secured a package worth up to $1.7 billion when he exited WeWork in 2019, however, a representative told Fortune that only approximately half of that was actually executed, worth hundreds of millions of dollars.