Good morning!

It’s markets and economics reporter Will Daniel here again today, filling in for Sheryl Estrada.

What happens if you take the ‘fin’ out of fintech? Clearly, it wouldn’t be pretty, but that’s the dark reality some fintech firms are facing today. Regulators have begun cracking down on the partner banks that enable fintechs to offer banking services, and experts warn that the sectors’ CFOs should expect increased “supervisory pressure” in the short term, and new regulations in the long term, as a result.

Konrad Alt is co-founder of the advisory and investment management firm Klaros Group, which counsels banks and fintechs on management, regulatory, risk, compliance, and board governance matters, and he previously served as counsel to the U.S. Senate Banking Committee and chief of staff at the Office of the Comptroller of the Currency. The industry veteran explained that U.S. banking regulations tend to treat size as a “rough proxy” for risk. That means that large, systemically important banks are forced to spend more on compliance, hold more cash reserves on hand, and complete more stringent stress tests. But this method of measuring risk creates a problem when it comes to fintech firms and their use of partner banks.

“When you look at partner banks, the risk relationship kind of breaks down. It is possible to have a very, very small bank that is moving volumes of transactions that compare with very large money center banks. And so the traditional supervisory framework doesn’t really pick up on the amount of risk in those institutions very well. And I think the regulators have been a little slow to wake up to that,” Alt explained, warning that “they are waking up to it now.”

To his point, on June 6, the nation’s top regulators—The Federal Deposit Insurance Corporation (FDIC), the Board of Governors of the Federal Reserve System (FRB), and the Office of the Comptroller of the Currency (OCC)—issued new guidance on effective risk management for third party banking relationships, like those between fintechs and their partner banks.

Alt also noted that regulators have already begun cracking down on some firms. On April 28, New Jersey’s Cross River Bank, which is a partner to leading fintech lenders like Affirm and Upstart, was given a consent order by the FDIC alleging that it engaged in “unsafe” or “unsound” banking practices. The order required Cross River to increase its supervision over the “system of internal controls, information systems, credit underwriting practices, and internal audit systems related to the consumer protection laws and regulations.”

Alt explained that the Cross River order is “quite stringent” and should be a warning for fintechs who rely on a single partner bank. “Most fintechs have exactly one partner bank. There’s no redundancy whatsoever, they’ve got essentially their entire business concentrated in that relationship. And if something happens to that relationship, it can be fatal, right? And if it’s not fatal, it can certainly be painful. And that’s a big risk,” he said. He offered three pieces of advice to CFOs.

Get familiar with your dance partner

“Make the effort to get as sophisticated as you can about understanding the risks that your partner bank may be under—What are the weaknesses? How might a group of bank examiners look at this bank? What would they worry about?” Alt said. “They can’t tell you about the supervisory dialogue they’re having with regulators. But if you know your partner bank well, you can understand quite a bit about the sorts of issues that it might be experiencing and you can directly ask about them.”

Alt recommended fintech CFOs look over their partner bank’s quarterly call reports, which will detail its financial health, while ensuring that it doesn’t have too much exposure to the ailing commercial real estate sector and is properly managing its relationship with regulators. Do they have experienced regulatory affairs personnel? Are they having an open and continuous dialogue with the OCC and other agencies?

“Some banks will sort of hunker down and say ‘we’re not going to answer any questions from regulators unless we absolutely have to.’ That’s not usually a great attitude, right? The bank you want to be partnered with has got a program to build and maintain a good regulatory relationship,” Alt said, adding that they should be able to say “Here’s the person who’s responsible for that relationship, here’s what we did last quarter, and then openly talk about those things.”

Prepare for higher compliance costs

Second, with regulators moving in, fintech CFOs should start preparing for higher compliance costs now. For years, fintechs have been able to avoid the more stringent regulations that would typically be put on institutions of their size, but that era is over.

“Fintech CFOs should certainly plan that there’s going to be a significant investment in compliance and risk management, generally, and in internal audit. And, probably in better reporting technology,” Alt warned. “You can’t be in this business long term unless you’re prepared to make those investments.”

You may have to diversify your banking relationships

Finally, for fintech CFOs who are worried about their reliance on a single partner bank, it’s time to diversify. Alt said that he has already been contacted by multiple fintech firms who are considering adding new banking partners to de-risk, but he warned that the process isn’t so easy.

“It’s not impossible, but it is very expensive and you can’t do it overnight,” he said. “You may have contractual limits from your existing partner that preclude you from doing it. But it’s something you can work toward over a period of years if you are determined and you seize your opportunities and know what you’re doing. But it’s a very hard problem to solve in the short run.”

Until next time,

Will Daniel

will.daniel@fortune.com

Big deal

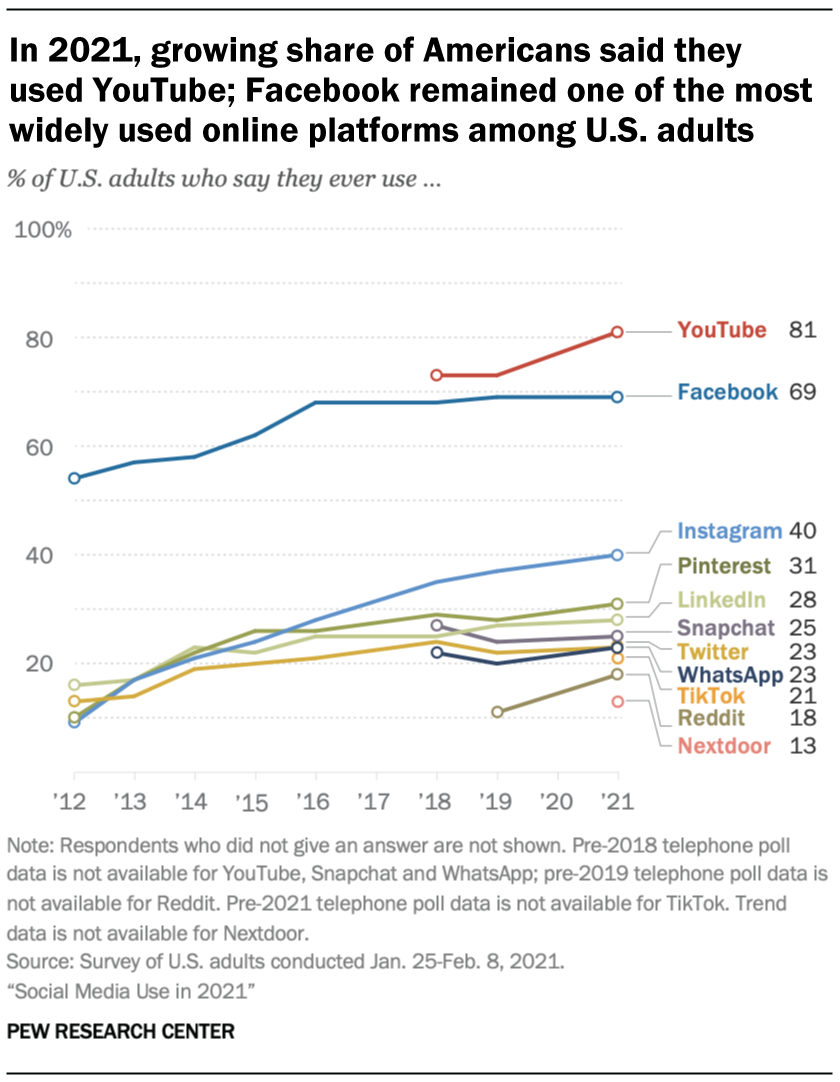

The social media market feasts on itself—you usually can't go more than a few days without people logging on to argue about which social media platforms are dead and which should be dominant. Elon Musk's X, formerly known as Twitter, finds itself amid this back and forth as its controversial rebrand could make it vulnerable to user exodus. Data from a 2021 Pew Research poll shows just how much, or how little, American adults are attached to the platform.

Almost a quarter of U.S. adults surveyed (23%) had used Twitter at least once in early 2021, and after Musk acquired the platform in April of 2022, most highly active users still used the platform but posted less. When users were surveyed again in 2023, women were the most likely to say they had taken a break from the platform in the past year (69%), followed by Black users at 67%. A quarter of all users said they were not very or not at all likely to remain on the app for another year.

YouTube and Facebook were much more popular among the respondents. 81% of those surveyed reported using YouTube before, and 69% reported using Facebook, whose rank didn’t significantly increase or decrease since 2016. Instagram came in a not so close third with 40% of respondents saying they've used the platform before, followed by Pinterest at 31%.

Going deeper

The 34th edition of the Fortune Global 500 list was released last week. It ranks the world’s companies by revenue, and boy did they deliver. The Fortune Global 500 turned in record-high aggregate revenues of $41 trillion in 2022. Walmart took the No. 1 spot on the list for the 10th consecutive year in 2022, pulling in $611 billion. But Saudi Aramco is nipping at their heels after growing revenues 51% year-over-year to $603 billion and claiming the No. 2 spot on the list.

Leaderboard

Derek Lowe will take over as both CEO and CFO of KNOT Offshore Partners LP, effective the week of September 11. Lowe will replace existing CEO and CFO Gary Chapman. Lowe previously worked as the Group Company Secretary of Telford Offshore.

Overheard

We do think that at a minimum, the downgrade adds to concern about the U.S. fiscal position in terms of having a higher debt service burden and, probably in the coming years, not having as much flexibility to enact stimulus programs or additional fiscal spending that might juice the economy. So, there are some effects – or at least some attention being drawn – to what is probably a less robust fiscal spending environment going forward.”

—BMO Wealth Management’s chief investment officer Yung-Yu Ma warned last Thursday that rising interest expenses on the now $32.67 trillion national debt could reduce fiscal spending moving forward and shouldn’t be taken lightly. Fitch Ratings downgraded U.S. debt from its top tier AAA rating to its second tier AA+ rating last week, citing an “erosion of governance” after this year’s debt ceiling standoff and rising budget deficits. Many economists brushed off the move, including former Treasury Secretary Larry Summers who called it “bizarre and inept.”

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get CFO Daily delivered free to your inbox.