In about 2000, then-JPMorgan Chase & Co. boss Douglas “Sandy” Warner told banker Jes Staley he should meet a man named Jeffrey Epstein.

“He’s one of the most connected people I know of in New York,” Warner told Staley, according to documents filed in Manhattan federal court Monday.

Epstein would go on to generate more than $8 million in revenue for JPMorgan’s private banking investment business, the documents show. The financier referred a roll call of American billionaires to the bank, including Google co-founder Sergey Brin.

But the relationship also would become one of JPMorgan’s most controversial. The US Virgin Islands, where Epstein had a private retreat and brought some of his victims before his death in 2019, is suing the bank for allegedly enabling his sex-trafficking. The territory is seeking at least $190 million from JPMorgan, accusing the company of putting the revenue it generated from Epstein’s business and connections ahead of acting on warning signs.

In a court filing Monday, USVI laid out its case against the bank after several months of discovery turned over hundreds of thousands of pages of internal bank documents and led to the depositions of current and former banking staff. It seeks partial summary judgment in its suit filed last year alleging JPMorgan ignored signs that Epstein was using his bank accounts to finance trafficking of young women for sex.

The bank has denied any knowledge of Epstein’s crimes and said it regretted retaining him as a client.

JPMorgan, in a separate filing Monday seeking partial summary judgment, argued the USVI suit is flawed. The bank said the territory enabled Epstein’s crimes by waiving his sex offender monitoring requirements, organizing visas for his victims and looking the other way when he arrived at local airports with young women and girls.

JPMorgan also denies the suggestion it let Epstein fly under the radar, stating it filed about 150 currency transaction reports related to Epstein between 2002 and 2013.

Spokespersons for JPMorgan and Alphabet Inc., the parent company of Google, did not immediately respond to requests for comment.

The USVI, in its court filing, pointed to emails between compliance officers and executives about Epstein to allege the bank knew or ought to have known he was involved in sex trafficking. While compliance staff pushed in 2011 to have the bank fire Epstein, the internal emails showed, his interest in young women was also the butt of jokes.

‘Fewer Nymphettes’

In one instance recounted in the USVI’s filing, JPMorgan’s former asset and wealth management chief financial officer David Brigstocke compared another client’s house to Epstein’s: “Reminded me of JE’s house, except it was more tasteful and fewer nymphettes.” The email was sent to Mary Erdoes, the current asset and wealth management chief, in 2012. Erdoes fired Epstein as a client a year later, after Staley, his chief supporter, had left JPMorgan.

Yet JPMorgan continued to do business with Epstein behind the scenes in the years up until his death, according to the USVI.

The bank leaned on him for potential client referrals, the territory alleges. A former private banker at JPMorgan met with Epstein on as many as 10 occasions, including about business with private equity titan Leon Black, who was once an Epstein client.

The USVI also highlighted the dozens of wire payments Epstein made between his accounts and the accounts of young women. Every person publicly identified in police or press reports as a victim of Epstein or as a recruiter of young women for him banked with JPMorgan, according to the USVI.

“JPMorgan knowingly handled virtually every financial transaction Epstein needed to operate his sex-trafficking venture,” the territory said in the filing. “From the millions in cash withdrawals and payments to co-conspirators, recruiters, and victims, to the millions in payments to lawyers and publicists for the ongoing cover-up.”

Epstein’s banking relationship was centered around Staley, the former private banking chief.

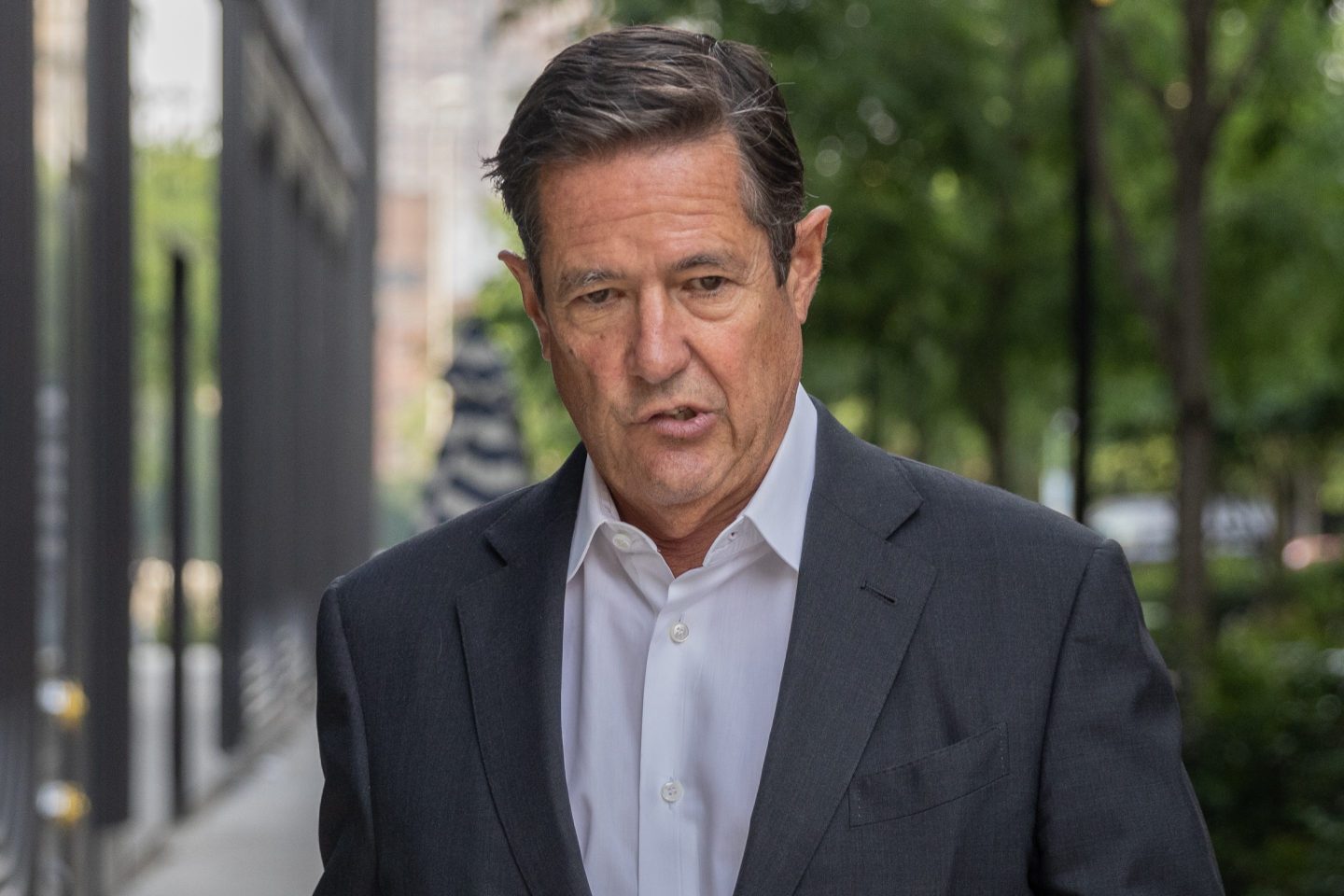

Jamie Dimon

When Epstein was indicted for soliciting a minor for prostitution in 2006, Staley, who was deposed as part of the USVI lawsuit in June, claimed that he raised the “very public” issue with JPMorgan Chief Executive Officer Jamie Dimon.

Dimon has denied any involvement in Epstein’s accounts, claiming he never knew or met him. And Dimon testified that he never spoke to Staley about Epstein.

The lawsuit, and another class action the bank recently settled with one of Epstein’s victims, has unearthed fresh details about the depths of the relationship between Staley and Epstein.

In addition to penalties and disgorgement, the USVI is seeking reforms at JPMorgan to protect against human trafficking.

The case is USVI v. JPMorgan Chase Bank, 22-cv-10904-UA, US District Court, Southern District of New York (Manhattan).