Forget regular old billionaires, or retired captains of industry. Chances are these days that your favorite sports team may be owned by an executive from the alternative asset management industry, the powerful faction of Wall Street that includes private equity, venture capital, and hedge funds.

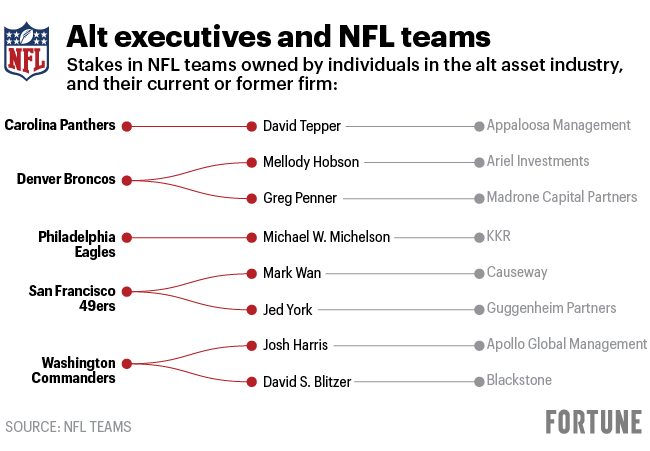

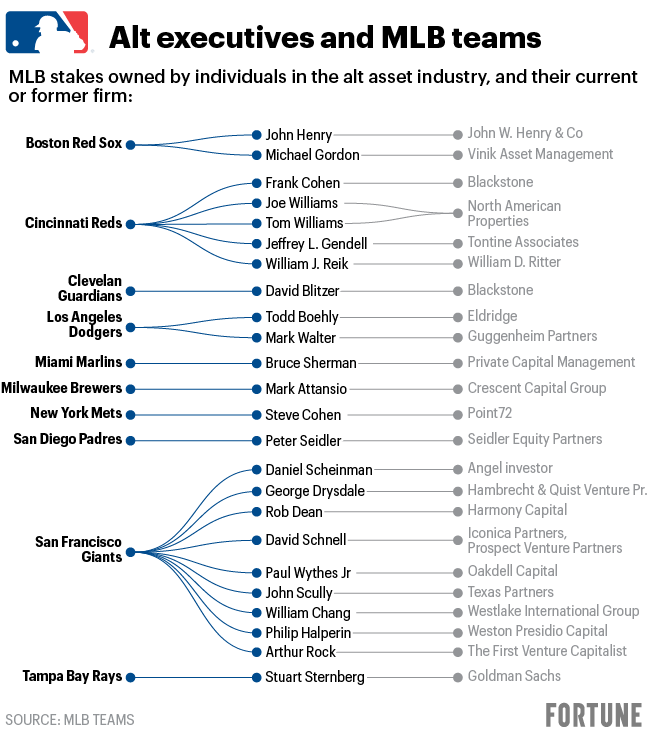

According to an analysis by Fortune, which included scanning the websites and media guides of the roughly 153 teams, as well as speaking to investors and league officials, about 120 alt execs own stakes in sports franchises. Some are well-known, including Steve Cohen, chairman and CEO of hedge fund Point72, who acquired the New York Mets baseball team in 2020 for $2.4 billion; Josh Harris, co-founder of Apollo Global Management, who led an investor group to buy the Washington Commanders, formerly known as the Washington Redskins, for a record $6.05 billion, in May; and Marc Lasry, CEO of Avenue Capital Group, who sold his 25% stake in the Milwaukee Bucks in April.

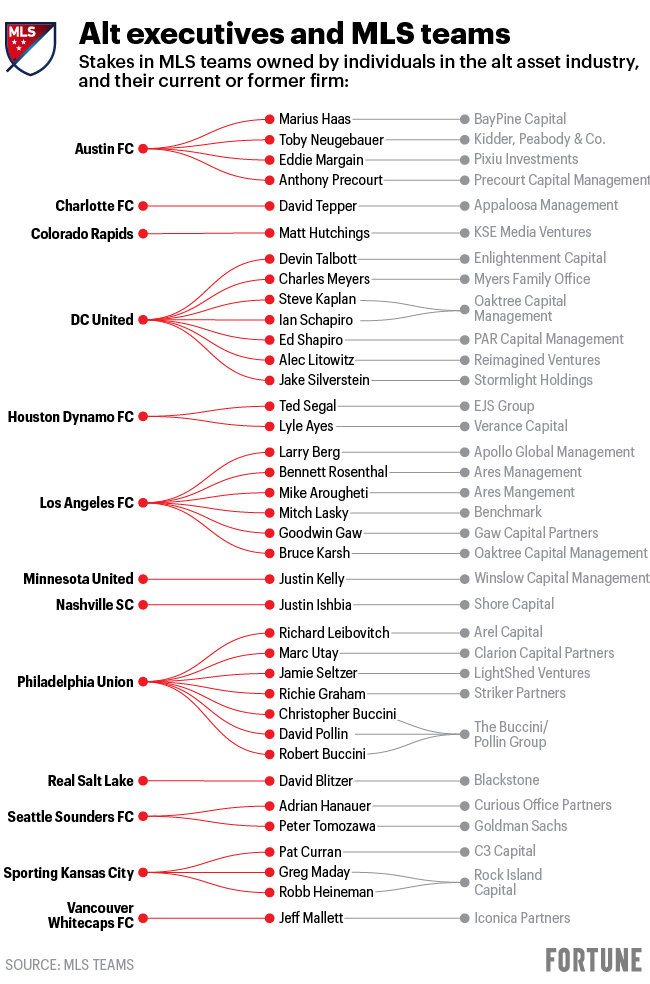

Others are slightly more under the radar, like Jim Cooper, the founder and managing partner of Thompson Street Capital Partners, who owns a stake in the St. Louis Blues. Or Justin Ishbia, founder of private equity firm Shore Capital, who is an owner of the Nashville SC.

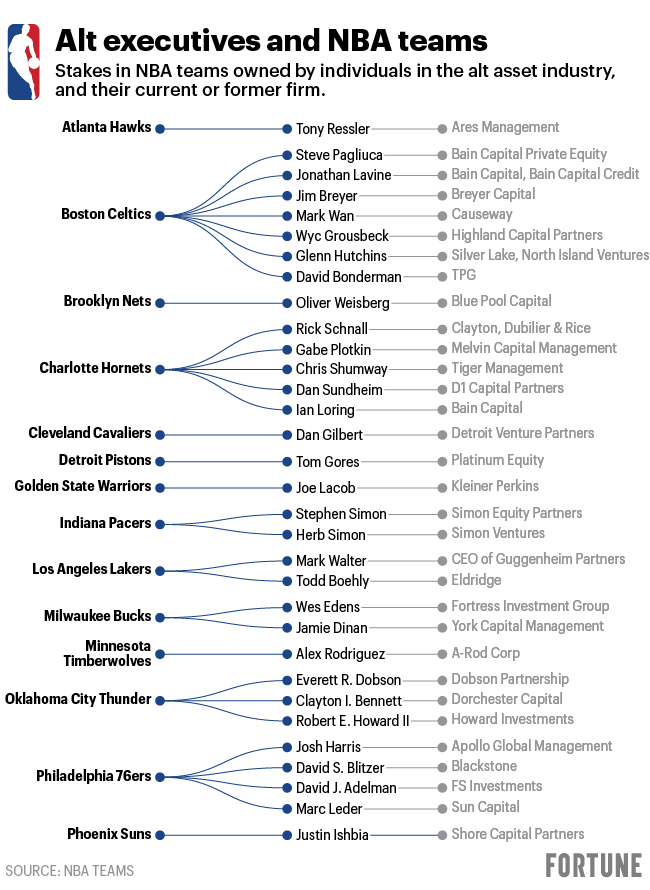

Other teams—like the Boston Celtics—have a panoply of minority owners.

The rise in alt exec ownership is, of course, in part due to the stunning returns alt firms have made in their bread-and-butter businesses over the past 25 years. For example, private equity funds generated an annualized return of 14.8% for the 25 years ended December 2020, more than double the 5.76% produced by the S&P 500 for the same time period, according to a 2022 World Economic Forum study. That coincided with a gradual softening in ownership rules by the leagues themselves. In 2019 Major League Baseball became the first of the professional sports leagues to allow private equity funds to buy passive stakes in teams. The National Basketball Association, the National Hockey League, and Major League Soccer followed, each allowing PE to invest in their teams but only for minority stakes. The last holdout is the National Football League, or NFL, which still bars private equity and sovereign wealth funds from ownership.

One reason for all the deals is skyrocketing valuations, according to bankers and private equity executives. The $6.05 billion clinched by the Commanders beat the $4.65 billion attained by the Denver Broncos when it was sold last year to Walmart heir Rob Walton.

The latest big deal in the sports sector occurred in June, when Michael Jordan agreed to sell his majority stake in the Charlotte Hornets basketball team to an investor group led by Gabe Plotkin and Rick Schnall for $3 billion. Plotkin is the founder and chief investment officer of hedge fund Tallwoods Capital as well as former chief investment officer of failed hedge fund Melvin Capital, which wound down in 2022 after a group of retail investors instituted a short squeeze against the firm’s bearish bets, including GameStop Corp., Fortune reported. Schnall is a partner at PE firm Clayton, Dubilier & Rice. Jordan paid just $180 million for the Hornets in 2010, according to the Charlotte Observer. (Individual investors can’t own stakes in multiple teams, according to an NBA official, and Schnall is currently selling his holding in the Atlanta Hawks.)

Other Hornets buyers include Chris Shumway, former senior managing director of Tiger Management and current managing partner of Shumway Capital, as well as Dan Sundheim, founder and CIO of D1 Capital Partners. Also part of the Hornets investor group is Ian Loring, a tech investor who spent 24 years at Bain Capital and is now a senior managing director and executive chair of Haveli Investments, according to his LinkedIn.

“What’s the last sports team that sold at a loss? I don’t know either,” said Jeff Klein, an attorney with the law firm Clarick Gueron Reisbaum who advises clients in the sports and entertainment industries. “Even teams that aren’t operationally successful, or aren’t successful on a cash-flow basis, are selling at sizable gains.”

Sports teams are good long-term investments. For example, the Boston Celtics were sold in 2002 to an investor group for $360 million, CNN reported. Twenty years later, in 2022, the Celtics were valued at nearly $4 billion, according to Sportico. “The appreciation in value has been amazing over the last 20 years,” one banker said.

Deals involving sports teams are resistant to market fluctuations, said Sal Galatioto, president and founder of Galatioto Sports Partners (GSP), a sports firm that advises on buy-side and sell-side transactions involving teams. The number of U.S. mergers and IPOs has slowed significantly this year due to the stock market downturn, but that’s not happening with sports transactions. “I’ve never seen the level of demand that we’re seeing right now, and I think that will continue,” said Galatioto, who also teaches sports finance at Columbia University Graduate School of Business.

Private equity firms typically target businesses with recurring revenue streams, a strategy also seemingly followed by high-net-worth execs. Sports teams offer several revenue streams including ticket sales, concession, stadium naming rights, sports sponsorships, and even parking. But it’s media rights that have emerged as one of the most lucrative money-making avenues. The global value of sports media rights hit $55 billion last year and is expected to break the $60 billion barrier in 2024, according to SportsBusiness’ Global Media Report 2022. The U.S. remained the most valuable sports market in the world in 2022 at $24.8 billion. That’s expected to remain that way with domestic deals struck by the NFL that will generate $10 billion per year in media rights revenue, the Global Media report said.

In 2021, the NFL signed media rights agreements with CBS, NBC, Fox, ESPN, and Amazon that were worth collectively about $100 billion, the New York Times reported. The deal cemented the NFL’s status as the most lucrative sports league. “The one sure thing that captures eyeballs is live televised sport,” Klein said. “It has no peer. There is an enormous appetite for live television programming by media companies.”

“Media rights are huge, and that’s what is driving up valuations,” added GSP’s Galatioto. The NFL has the highest valuations. The Dallas Cowboys were valued at $7.6 billion in 2022, according to Sportico.

The rise in sports betting, which provides sponsorship revenue for teams, is also helping juice valuations. New Jersey was the first state to legalize sports betting in 2018. Now more than 30 states allow people to place bets on sports teams. In the first quarter of 2023, U.S. consumers wagered a record $31.11 billion on sports, generating $2.79 billion in quarterly revenue, a 70.1% increase year over year, according to the American Gaming Association. “Sports betting indirectly impacts sports by boosting viewership and interest,” Galatioto said.

Some of the biggest funds investing in sports belong to Dyal HomeCourt Partners, which is part of Blue Owl Capital, and Arctos Sports Partners. This year, Arctos has been in the market with its second pool, which has raised more than $2.2 billion on a $2.5 billion target, a person familiar with the fundraising said. Artcos takes passive, minority stakes in professional sports teams; it owns holdings in the Tampa Bay Lightning, and through Smith Entertainment Group, has stakes in the Utah Jazz basketball team and Real Salt Lake soccer.

Dyal HomeCourt Partners has also been fundraising for its first pool, and has raised more than $500 million in commitments, according to a transcript of Blue Owl’s first-quarter conference call in May. Dyal HomeCourt was the first institutional fund allowed by the NBA to buy multiple minority stakes in teams. In 2021, Dyal HomeCourt acquired a stake in the Phoenix Suns at a $1.55 billion valuation and sold the holding earlier this year at $4 billion, a second person familiar with the transaction said. Dyal HomeCourt still owns stakes in the Sacramento Kings and the Atlanta Hawks. Dyal is also part of the investor group buying the Hornets, according to a press release.

Investing in sports teams gained lots of credibility with institutions after funds were formed to invest in the space, GSP’s Galatioto said. “There’s no other content like this,” he said.

Some noted that sports teams are known for their macho ego and prestige. “Not into that,” one banker said. Others wondered if private equity executives, whose firms are known for financial engineering, make the best owners.

Some PE executives are good owners, and some are not, Galatioto said, noting, “However, Joe Lacob has done an amazing job with Golden State.” In 2010, Lacob gave up his managing partner role at venture firm Kleiner Perkins to lead an ownership group that bought the Golden State Warriors basketball team for $450 million. The Warriors have clinched four NBA championships—2015, 2017, 2018, and 2022—during Lacob’s tenure. Lacob is co-executive chairman and CEO of the Golden State Warriors and managing member of the Golden State Warriors’ ownership group. The Warriors in 2022 were valued at $7.56 billion, according to Sportico.

If only all deals were as Golden as Lacob’s.

This article is part of Fortune’s quarterly investment guide for Q3 2023.