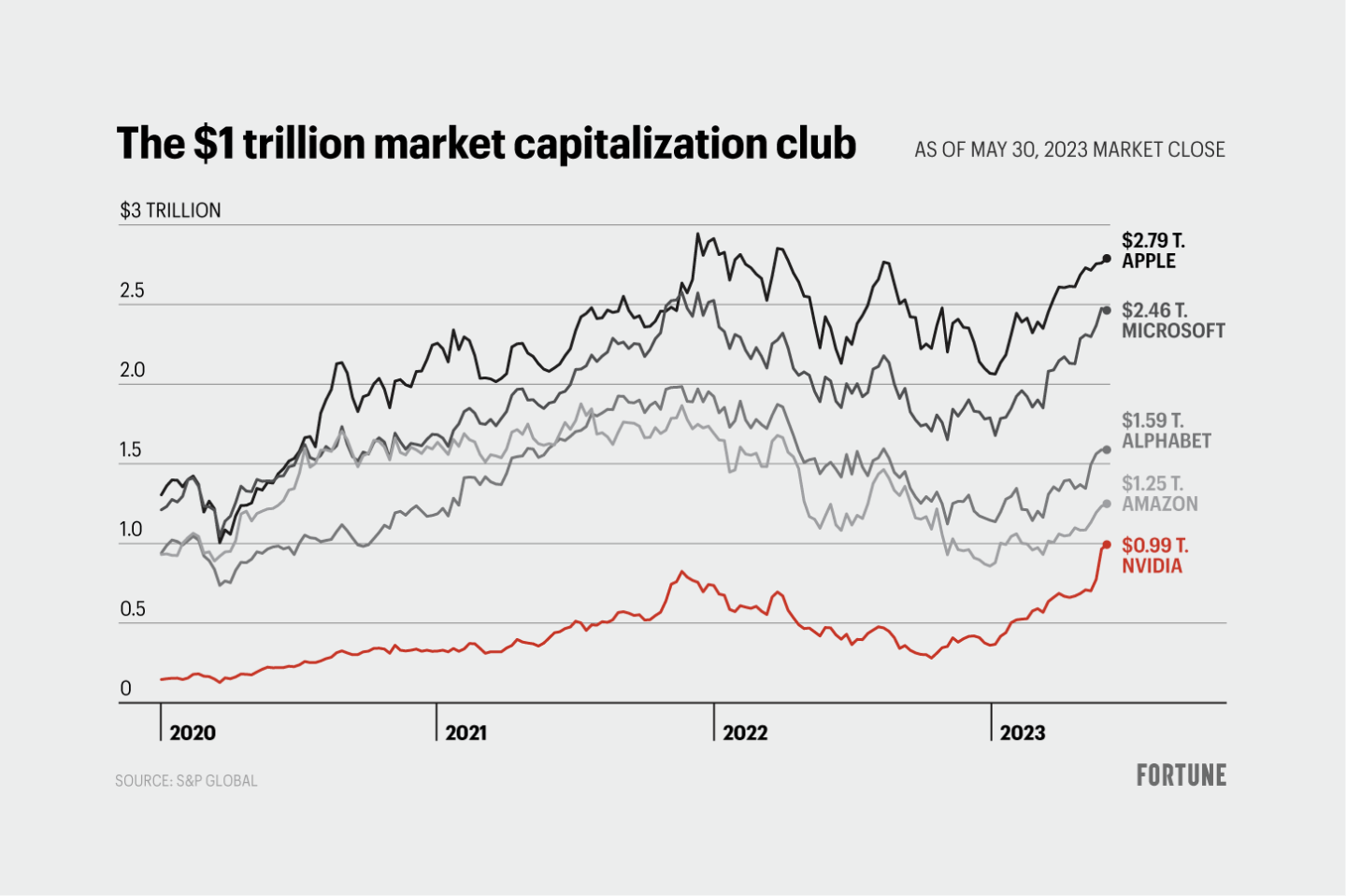

On May 30, Nvidia stole business headlines by reaching the super-exclusive $1 trillion club for the first time. The maker and designer of A.I. hardware and software touched the milestone by raising its valuation an astounding $280 billion or almost 40% since May 15, achieving a moonshot virtually unequalled in the annals of capital markets (it closed just below that mark).

But the Nvidia phenomenon has a dark side. It epitomizes the epic, oversize jump in market cap this year for all members of the Trillion-Dollar Club. Indeed, the five members now sporting 14-figure valuations are virtually devouring the S&P 500 index. That’s not a good thing. Their synchronized surge is the sole force that’s lifted the big cap index this year. And because it’s made enterprises that were expensive before their recent takeoff even pricier, it’s extremely unlikely that they can carry the the markets higher on their fewer than half a dozen shoulders going forward. Most likely, their valuations are already stretched beyond the max, and bound to snap back. And the ultimate example of the froth that’s overtaken the Trillion-Dollar Club is the rise of Nvidia.

The Trillion-Dollar Club accounts for almost all the S&P 500’s gains this year

The Trillion-Dollar Club now comprises Apple, Microsoft, Google parent Alphabet, Amazon, and as of midday Tuesday, Nvidia. From January to May, the group’s members have all gained over one-third in value, with Apple stock rising 35%, Microsoft 39%, Alphabet 41%, Amazon 43%, and Nvidia 176%. Apple and Microsoft each added over $700 billion in market cap in the past five months followed by Nvidia ($640 billion), Alphabet ($460 billion), and Amazon ($371 billion). All told, the Trillion-Dollar Club’s current members have raised their combined market cap by $2.87 trillion since the start of 2023.

The rub is that the total rise in the big cap index is only a hair more, at $2.98 trillion. Hence, the Club contributed 96% of the year-to-date 9.5% increase notched by the 500 this year. Let’s think of the Club as one company we’ll call Big Five Ltd. Its valuation jumped by 46.2%, from $6.2 to $9.1 trillion. By contrast, the other 495 cohorts in the 500 posted a combined gain of just 0.3%. Put simply, without the giant lift from the Trillion-Dollar Club, the S&P would be flat for the year, versus posting what Wall Street touts as a strong comeback.

The Trillion-Dollar Club’s huge weight is making the S&P 500 lopsided

At the close of 2022, the current Club accounted for 17.6%, or around one dollar in six, of the S&P’s total valuation. Today, that number is 25.6%, or more than one dollar in four. In boosting their overall worth by nearly half via adding nearly $3 trillion in market cap, the Big Five have become far more expensive. In five months, their overall P/E—based on their total valuation divided by combined net earnings—has climbed from 27.7 to 40.6, meaning that investors are getting 33% fewer dollars in earnings from every $100 they invest now versus at Christmas of 2022. That current 40-plus multiple, by the way, is almost twice the 23 P/E for the overall S&P 500.

That’s especially troubling because since the onset of the pandemic, the Club has already achieved something of an earnings miracle. In 2022, they Big Five garnered around $224 billion in net profits, 50% more than their pre-COVID, 2019 total. So the big multiple comes on top of what could well be unsustainably high profits.

All of a sudden, investors are expecting extremely rapid earnings growth from four already huge, mature companies—Apple, Microsoft, Alphabet, and Amazon—and incredibly fast growth from Nvidia based on vaunting hopes for A.I. The hopes, and the prices, are just too high. Bottom line: Nvidia’s rise symbolizes that as the tech giants in the Trillion Club got more and more expensive, they made the index pricier and pricier by gobbling such a big share.

The S&P’s comeback this year gets only two cheers. The Trillion-Dollar Club is overperforming, while the rest of the market reflects the reversal of an historic earnings blowout. Soon, the Club will face the same gravitational forces holding back the rest of the market. And when the turnabout comes, it will exert augmented, downward force on the overall index. A few mighty stalwarts can’t pull a caravan loaded with laggards forward forever.