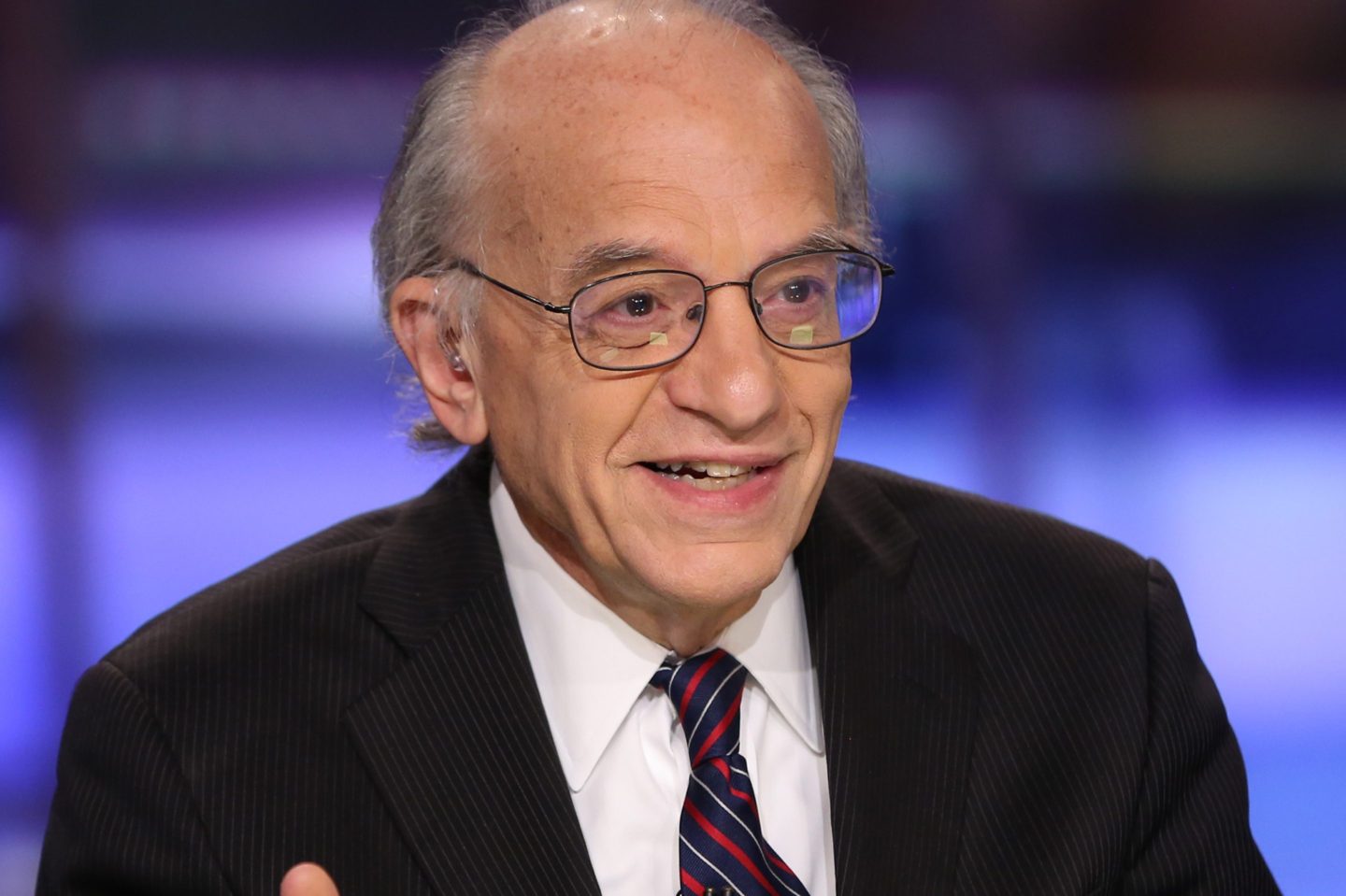

Wall Street has been wobbling under the weight of a potential U.S. debt default over the past few weeks. Investors are concerned that a deal to raise the debt ceiling could be hard to come by amid political gridlock in Washington. Worryingly, many House GOP members seem to be laughing off the seriousness of the threat, mocking Treasury Secretary Janet Yellen’s apocalyptic warnings of crossing the X-date, when the U.S. will default, as something from a “Ouija board.” But Wharton professor Jeremy Siegel isn’t concerned. The veteran market watcher has seen this dozens of times before and continues to believe lawmakers will come to an agreement.

“There is zero chance the debt issue will not get resolved even though there will be posturing and debate right up to the last minute before timelines are extended or the debt limit is raised,” Siegel wrote in his WisdomTree commentary this week.

Treasury Secretary Yellen has been using “extraordinary measures” to keep the government running since hitting the $31.4 trillion national debt ceiling in January. She’s also repeatedly warned the U.S. faces “economic and financial collapse” if the deadline to increase the debt ceiling passes. That could be as soon as June 1, according to Yellen, but Goldman Sachs estimates the true X-date won’t be until mid-June.

Yellen isn’t the only one worried about the fallout from the debt ceiling drama, of course. Economists across the nation have argued that a debt default could have disastrous consequences for the U.S. economy, with Moody’s Analytics estimating in January that it could wipe out $12 trillion in household wealth in a job-killing recession that would be “comparable to that suffered during the global financial crisis.”

Even though the debt ceiling has been raised or altered 78 times since 1960, this latest debt ceiling crisis is one of if not the worst in history. Solita Marcelli, chief investment officer of the Americas at UBS Global Wealth Management, explained in a recent research note that “the risks associated with the debt ceiling debate are admittedly higher today than at any time since 2011” when it took until just two days before the X-date for lawmakers to agree to raise the debt ceiling.

Still, Marcelli, and most Wall Streeters, continue to believe the debt ceiling will be raised in time. “After some acrimonious exchanges in recent weeks, both political parties have arrived at the negotiating table and appear genuinely interested in avoiding a fiscal calamity,” she wrote.

Wharton’s Siegel believes it all comes down to politics, and lawmakers don’t want to look foolish, which ultimately will lead to “another kick the can down the road measure” to extend the debt ceiling at the last minute.

“I believe Democrats feel pressured to meet the Republicans in some way. I think if they met them halfway, that is a good political position for the Democrats. If the Republicans get half of what they want, it can be regarded as a victory,” he wrote in his Wisdom Tree commentary last week. Republicans have been pushing for the typical spending cuts, in addition to work requirements for Medicaid and other federal assistance programs, which Democrats have called a “nonstarter,” while the White House is seeking tax increases for the wealthy and some large companies while holding the line on spending.

George Mateyo, chief investment officer at Key Private Bank, a wealth manager with over $50 billion in assets under management, also believes lawmakers will ultimately come to an agreement.

“The debt ceiling issue will get resolved,” he told Fortune. “But there’s going to be some more market volatility in the near term.” Mateyo pointed to 2011, where markets faced some pain as the debt ceiling came close to not being raised, but eventually “resumed an upward trend and almost never looked back.”

David Bahnsen, chief investment officer of wealth management firm the Bahnsen Group, told Fortune “a debt ceiling deal is a certainty.”

“Every market actor knows it,” he said. “The only issue along the way is short-term traders playing the ebbs and flows of the process, and we call that noise. Our main message to investors is to ignore the debt ceiling noise and pursue investments that provide growing cash flows, which largely coincide with companies that have a long history of growing their dividends.”