About two-thirds of U.S. adults say they are highly concerned about the impact on the national economy if the U.S. debt limit is not increased and the government defaults on its loans, according to a new poll, even as few say they have a solid understanding of the ongoing debt limit negotiations.

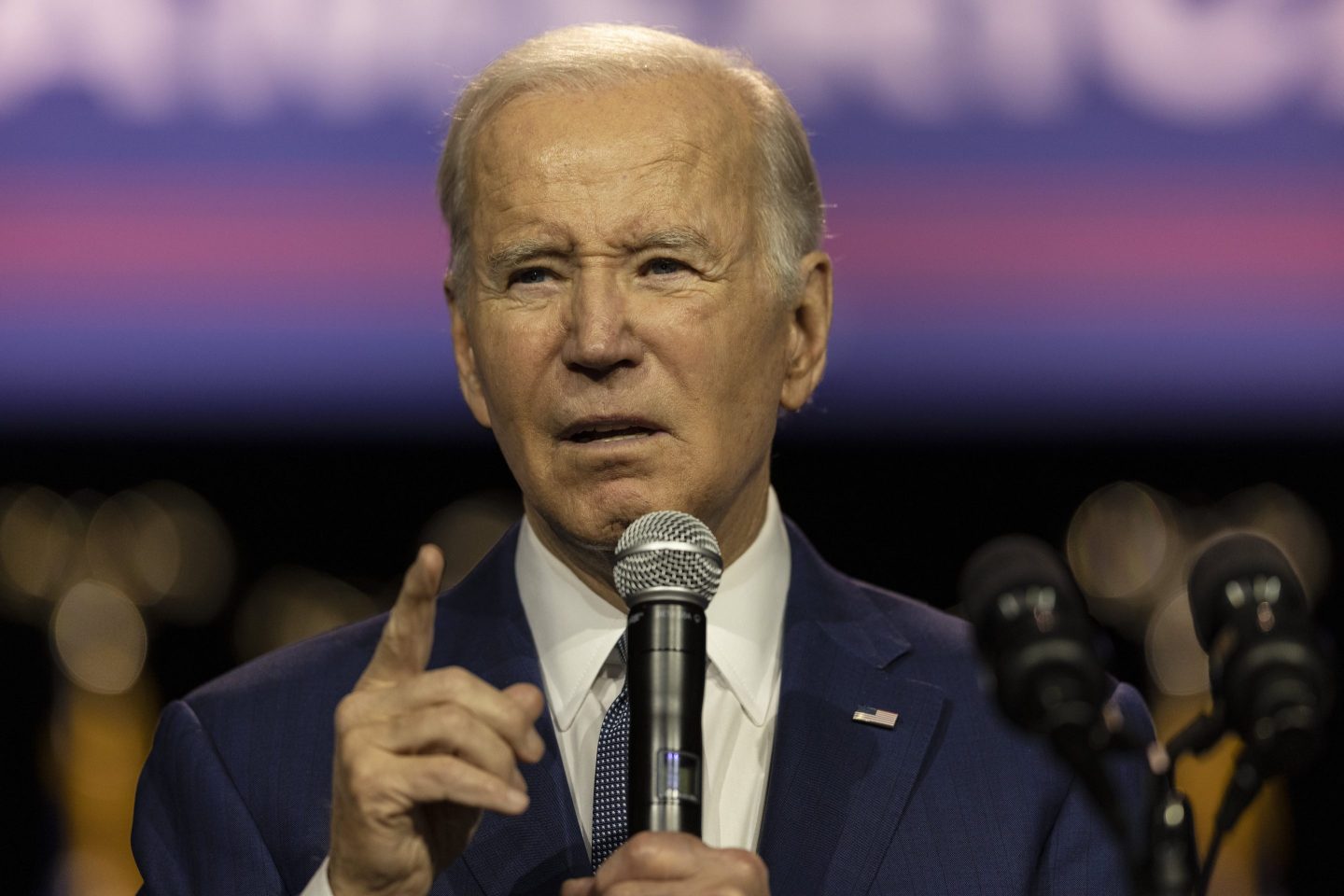

The poll shows about 6 in 10 say they want any increase in the debt limit to be coupled with agreed-upon terms for reducing the federal budget deficit. At the same time, Americans are more likely to disapprove than approve of how President Joe Biden and congressional negotiators on both sides of the aisle are handling negotiations. Still, slightly more approve of Biden’s handling of the situation than of congressional Republicans.

The new poll from The Associated Press-NORC Center for Public Affairs Research shows 27% say they approve of Biden and 26% say the same about congressional Democrats, while 22% approve of congressional Republicans. Close to half disapprove of each.

Sixty-six year-old Robert Hutchins says he somewhat approves of how House Speaker Kevin McCarthy and Republicans in Congress are handling negotiations.

“At least he’s trying to do something,” the Republican from Milton, Delaware, said of McCarthy’s leadership over his conference. “The Democrats want to spend more money and they don’t want any limit to it.”

Hutchins said he doesn’t have “any confidence whatsoever” in Biden and doesn’t believe in abolishing the debt ceiling, as it serves as a constant reminder of the nation’s debt load, which currently stands at $31.4 trillion.

Otherwise, “you just think you have an unlimited credit card and you can spend whatever you want,” he said.

Overall, about 2 in 10 U.S. adults say they are following negotiations over raising the debt limit extremely or very closely, and about 4 in 10 are following somewhat closely. Similarly, about 2 in 10 say they understand the situation very well and about 4 in 10 say they understand it somewhat well.

Still, a clear majority — 63% — say they think negotiations over the debt limit should be coupled with terms to reduce the budget deficit. Nineteen percent say the debt limit should be raised without conditions and 16% say it should not be raised at all. Overall, the adults who say they understand the debate best are especially likely to say the debt limit should be increased without conditions — 37% say so, compared with 50% who say it should be tied to terms about reducing the budget deficit.

A default would likely spell catastrophe for the U.S. economy, with spillover throughout the globe, and would prompt a probable recession.

Treasury Secretary Janet Yellen warned this week that a national default would destroy jobs and businesses, and leave millions of families who rely on federal government payments to “likely go unpaid,” including Social Security beneficiaries, veterans and military families.

An AP-NORC poll conducted earlier this year also shows little consensus on cuts that would make a dent in the deficit: While most Americans said the government spends too much overall, majorities favored increased spending on popular and expensive programs including Medicare and Social Security.

Similar percentages of Republicans and Democrats say they are following and understanding negotiations, and concern about the economy if the U.S. defaults is widely bipartisan. But about a third of Democrats say the national debt limit should be increased without conditions, while just 6% of Republicans say the same.

Twenty-three percent of Republicans but just 7% of Democrats say the national debt limit should not be increased under any circumstances.

Aaron Loessberg-Zahl, a 33-year-old Democrat from San Jose, California, said the debt ceiling should be raised without conditions, and called the statutory limit on borrowing “arbitrary.”

“Congress already controls the purse strings, they approve the annual budgets for our government,” Loessberg-Zahl said, “and I think that’s plenty of control over the spending.”

He called the debate over whether and how to raise the debt ceiling “not productive” and said he approves of the president’s handling of negotiations.

Loessberg-Zahl said, “My belief is that those people probably don’t understand the full ramifications of what would happen if the country were to default.”