The housing correction is losing steam. That’s the conclusion Fortune has reached after analyzing the latest Zillow data.

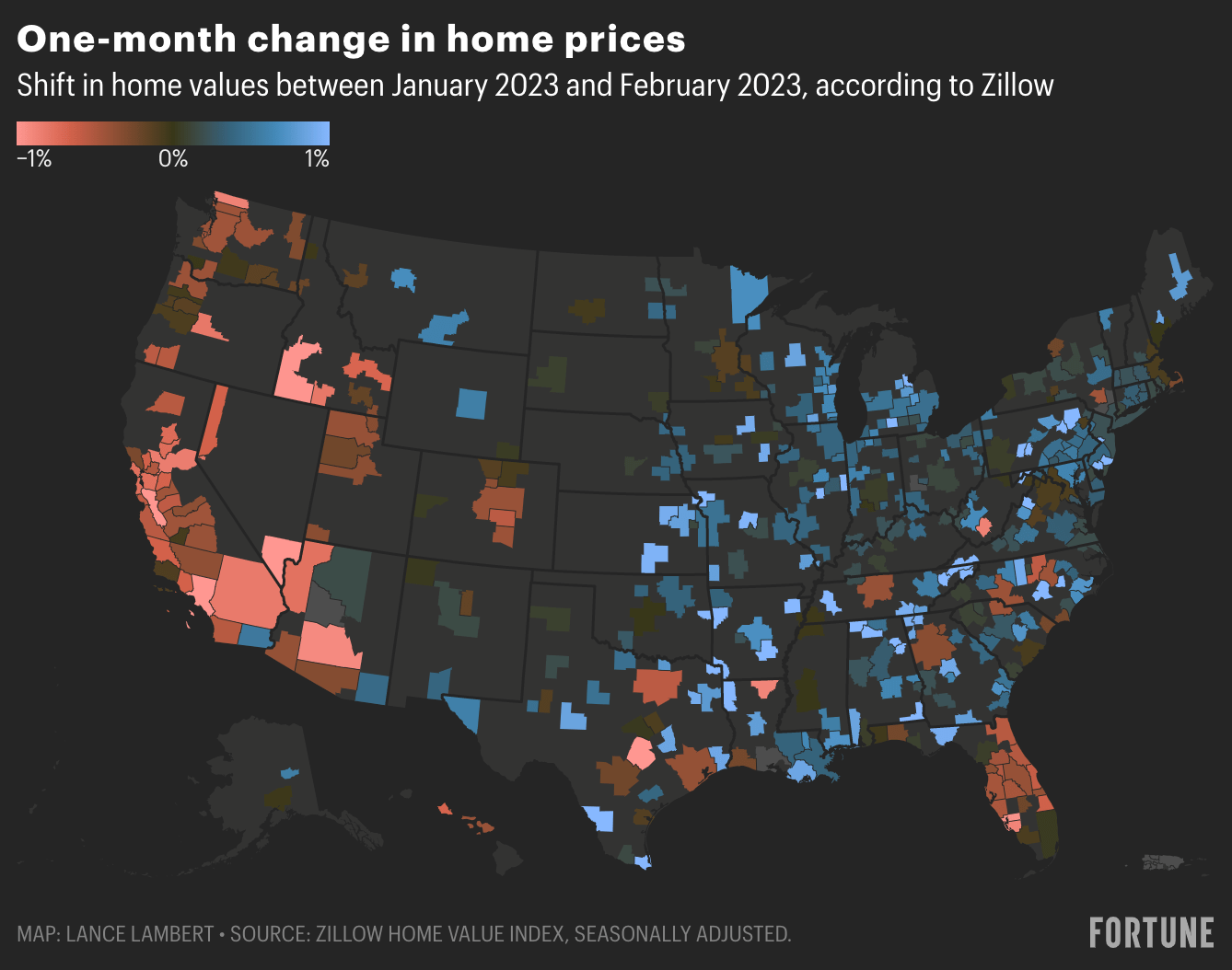

At the height of the correction in September, 303 of the nation’s 400 largest housing markets saw a month-over-month home price decline as measured by the seasonally adjusted Zillow Home Value Index (ZHVI). In October, 292 of those major markets registered a decline. The figure of down markets then fell to 245 in November and 256 in December.

Fast-forward to 2023, and that correction has clearly lost geographical momentum. In January, 171 of the nation’s 400 largest housing markets registered a month-over-month home price decline. And in February, just 133 of the nation’s 400 largest housing markets registered a month-over-month home price decline, while 267 housing markets saw a month-over-month increase in home prices.

To better understand the ongoing home price correction—or lack thereof—let’s take a closer look at the February data. (Keep in mind, the Zillow Home Value Index measures only home values that are in the 35th to 65th percentile, price wise, in a given market.)

As mortgage rates began to spike in 2022, Western markets like Seattle, Boise, and San Francisco were among the very first places to see falling home prices. As the year progressed, and mortgage rates continued to rise, that correction slowly started to spread east.

However, that momentum has already stalled: Through the first two months of 2023, many small and midsize markets in the Midwest, South, and Northeast have shifted from correction mode to growth mode. Meanwhile, many Western markets, like Boise and San Francisco, continue to post home price declines.

Unlike overheated Western housing markets, many Northeast and Midwest markets remained closer aligned to fundamentals during the Pandemic Housing Boom. That put those markets in a better position to weather the affordability crunch brought on by last year's mortgage rate shock.

Now that home price growth is returning to more markets, does that mean the home price correction is nearing its conclusion? Experts are divided.

Heading forward, CoreLogic expects the home price correction to fizzle out nationally, and for U.S. home prices to post a 3% gain between December 2022 and December 2023.

Meanwhile, KPMG expects the home price correction to pick up steam later in the year once the peak spring season is over and as the economy begins to weaken. This year, KPMG expects U.S. home prices as measured by the Case-Shiller index to fall 8%.

"The S&P CoreLogic Case-Shiller Home Price Index is expected to drop another 8% in 2023, or 10.5% from the peak by year-end. That will bring prices to the still elevated levels of late 2021 when the market was red-hot," wrote Diane Swonk, chief economist at KPMG, in a recent report.

Regardless of whether the housing bulls or housing bears are right, the results are going to vary significantly by market.

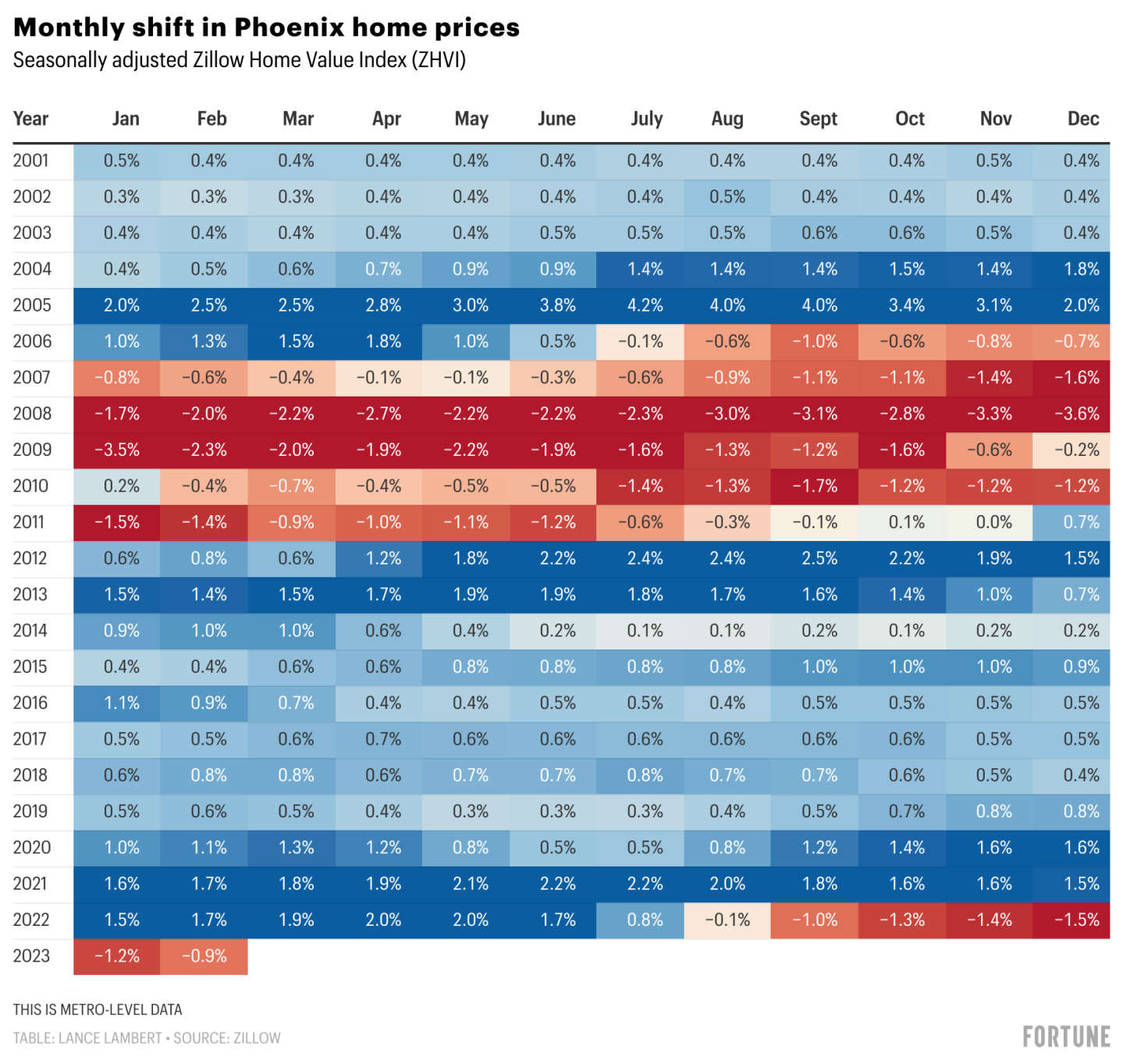

Back in the early 2000s, housing speculators assumed the best bang for their buck would be in fast-growing Sunbelt cities. As it turned out, that flood of investment meant places like Las Vegas and Phoenix got crushed even harder when the housing bubble ultimately burst and spurred the 2008 financial crisis.

Fast-forward to this housing cycle, and Phoenix is once again at the center of the story.

During the Pandemic Housing Boom, Phoenix saw home prices jump a staggering 53.4% between March 2020 and July 2022 as everyone from home flippers to institutional Wall Street firms and Airbnb hosts piled into the market.

But as mortgage rates spiked last year, Phoenix's frothy home prices became a liability. That affordability strain helped push the market into one of the sharpest corrections in the country. Through February, Phoenix home prices as measured by Zillow are already down 7.3% on a seasonally adjusted basis since its peak. Without seasonal adjustment, Phoenix home prices are down close to 10% since its 2022 peak.

If one describes Phoenix's home price correction as sharp, they'd have to call the correction in Indianapolis, well, faint.

Through February, seasonally adjusted home prices in Indianapolis are down only 0.97% from their 2022 peak. And while Phoenix home prices slipped another 0.9% in February, Indianapolis home prices ticked up 0.1% last month.

Indianapolis certainly saw a housing boom during the pandemic. However, it wasn't quite the frenzy that overtook markets like Austin and Phoenix. And unlike those places, Indy also didn't see a supply spike last year. Which explains why Indy has fared better in this higher mortgage rate environment.

If you’re hungry for more housing data, follow me on Twitter at @NewsLambert.