Good morning,

Risk management is certainly top of mind for CFOs this year.

Deloitte’s newly released CFO Signals for Q1 2023, gauges what North America’s top finance executives are thinking. Ninety-three percent of CFOs surveyed are planning for a mild recession. However, the majority of finance chiefs don’t expect inflation to fall much further before year-end, pegging it between 4% and 6%. The survey, which closed on Feb. 21, found the portion of CFOs saying now is a good time to take greater risks increased to 40% from 29% in Q4 of 2022. “CFOs may have been taking into account their own companies’ 2022 year-end results, their expectations for performance and investments, as well as their strategic plans,” says Steve Gallucci, global and U.S. CFO program leader with Deloitte. “Of course, conditions are fluid.”

The research also found that one of the notable actions finance chiefs are taking is strengthening liquidity and cash management. “CFOs have become accustomed to dealing with unexpected shocks over the last several years, and we would expect the same for current events,” Gallucci says.

Cash flow management

Risk management is a high priority for the CFOs I’ve spoken to in the wake of the collapse of Silicon Valley Bank. For companies finding themselves in a sticky situation in the event of a bank closure, “It’s critical to prioritize cash flow management and ensure the company is living within its means,” according to Jack Newton, the CEO and founder of tech unicorn Clio. “Organizations will have to adjust their burn profile to make current available cash last two years. That’s the length of time founders should plan for a turnaround in the investment environment.”

One of the companies affected by SVB’s downfall is streaming platform Roku. The company’s CFO Steve Louden said in a Securities and Exchange Commission filing that as of March 10, SVB held 26%, about $487 million, of the company’s cash or cash equivalents.

Louden made a note in the filing of cash flow metrics to indicate the company will still be able to perform. For the next 12 months and beyond, the company believes “existing cash, cash equivalents balance, and cash flow from operations” will be enough to meet the needs of “working capital, capital expenditures, and material cash requirements from known contractual obligations” he wrote. But soon another CFO will be at the helm. Last week, Dan Jedda, an Amazon veteran, was named the next CFO at Roku, effective May 1. Jedda announced last year that he was leaving the company. He’ll remain through August to facilitate the transition.

Dan DeGolier, founder of Ascent CFO Solutions, a fractional CFO firm based in Boulder, Colo., spoke with me last month about the value proposition for being a fractional CFO—highly-experienced finance chiefs who work contractually. I reached out to him yesterday, as he, and many of the CFOs at his firm, work with early-stage companies.

What key risk metrics are you focusing on? “Cash flow forecasting, runway, and burn rate are more critical now than ever,” DeGolier tells me. “Companies have to get even sharper about understanding their drivers and retaining cash.”

These CFOs are facing uncertainty. “I think the biggest thing that we are seeing right now is that early-stage companies, like those who banked with Silicon Valley Bank or Signature Bank, were already in a situation where raising equity capital was more challenging than last year,” DeGolier explains. “Now there’s uncertainty around their ability to leverage their capital investments with debt since there’s no clear leader for venture lending.”

He continues, “Although the initial crisis with access to deposits is over, there is still a lot of uncertainty about their ability to raise additional debt to extend their runway. If SVB is eventually acquired by a larger bank, will that bank still be lending to companies that are burning cash and don’t have an immediate path to profitability?”

Well, that remains to be seen.

Sheryl Estrada

sheryl.estrada@fortune.com

Sign up here to receive CFO Daily weekday mornings in your inbox.

Big deal

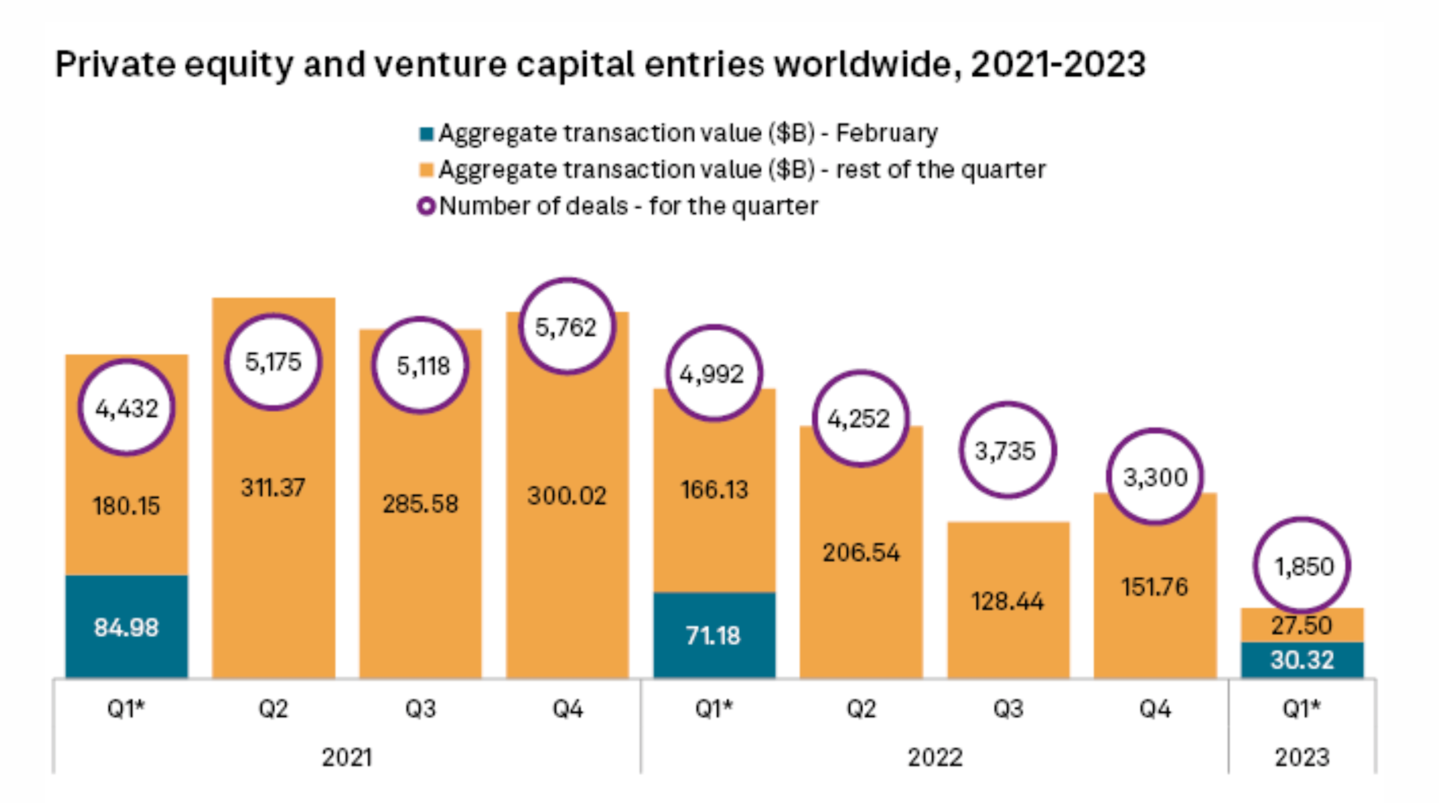

In February, the aggregate transaction value and volume of private equity and venture capital entries globally were down, S&P Global Market Intelligence research finds. Overall private equity entries for the month totaled $30.32 billion, a decrease of 57% from $71.18 billion in February 2021. The number of deals declined 47% to 847, from 1,596 a year earlier, according to the report.

Going deeper

Are you ready for payments transformation? is a new report by U.S. Bank that provides insight into how business owners and finance leaders are preparing for the future through innovation in payment strategies. Fifty-one percent of finance leaders are expanding their digital payment options, and 47% of respondents are boosting spending on contactless devices. In the retail industry, 47% of respondents expect buy-now-pay-later methods to be mainstream in two years.

Leaderboard

Elaine Birkemeyer was named CFO at Tactile Systems Technology, Inc. (Nasdaq: TCMD), a medical technology company, effective March 20. Birkemeyer will succeed Brent Moen, who is retiring. Birkemeyer joins Tactile Medical from UnitedHealth Group Inc., a managed health care company that operates UnitedHealthcare and Optum. She began working for the company in 2014, heading finance for its Optum Operations business as VP and later SVP of Optum Operations Finance. Beginning in 2020, she served as CFO of Rally Health, owned by UnitedHealth Group, and most recently as CFO of UnitedHealth's Care Solutions portfolio.

Sean P. O’Brien was named CFO at UGI Corporation (NYSE: UGI), effective on April 11. O’Brien succeeds Ted Jastrzebski, who announced his intent to retire but will remain with the company until early June to complete a transition period. O'Brien has more than 25 years of experience. Most recently he was with DCP Midstream, where he spent the past 14 years and served as group VP and CFO since 2012. Before DCP Midstream, O'Brien was at Duke Energy Corporation where he gained experience in financial planning and forecasting, economic analysis, and served as a business unit controller and CFO.

Overheard

“What I’ve heard from the advisors that I spoke with yesterday is great confidence in our firm...They know how conservative we are. They know we don’t take risks. That’s why we don’t go out a long way in terms of duration, and that’s why we maintain access to liquidity in the way that we do.”

—Charles Schwab CEO Walt Bettinger told CNBC. Along with other financial firms with massive bond holdings, Schwab took a hit. The company's stock fell nearly 12% on Monday and rebounded 9.2% on Tuesday.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get CFO Daily delivered free to your inbox.