The prospects of a soft landing seem more remote by the day. Economists and CEOs say a recession is likely, if not imminent. Even Fed Chairman Jerome Powell now calls a downturn “a possibility,” extraordinarily bearish talk for a central banker.

Add to that an energy crunch, a food crisis, war, runaway inflation, profit warnings, layoffs, and you can see why stocks have tumbled into a bear market, giving investors the worst start to a year in a half-century.

And yet equities analysts look out on the benchmark S&P 500 and see no reason for investors to change strategy. They rate stocks an overwhelming buy, and that’s puzzling stock market watchers.

“Despite higher inflation, rising interest rates, military conflict in Ukraine, fear of recession, and stock price declines, analysts continue to have an unusually high number of buy ratings on stocks in the S&P 500,” John Butters, the senior earnings analyst at FactSet, pointed out in a recent research note.

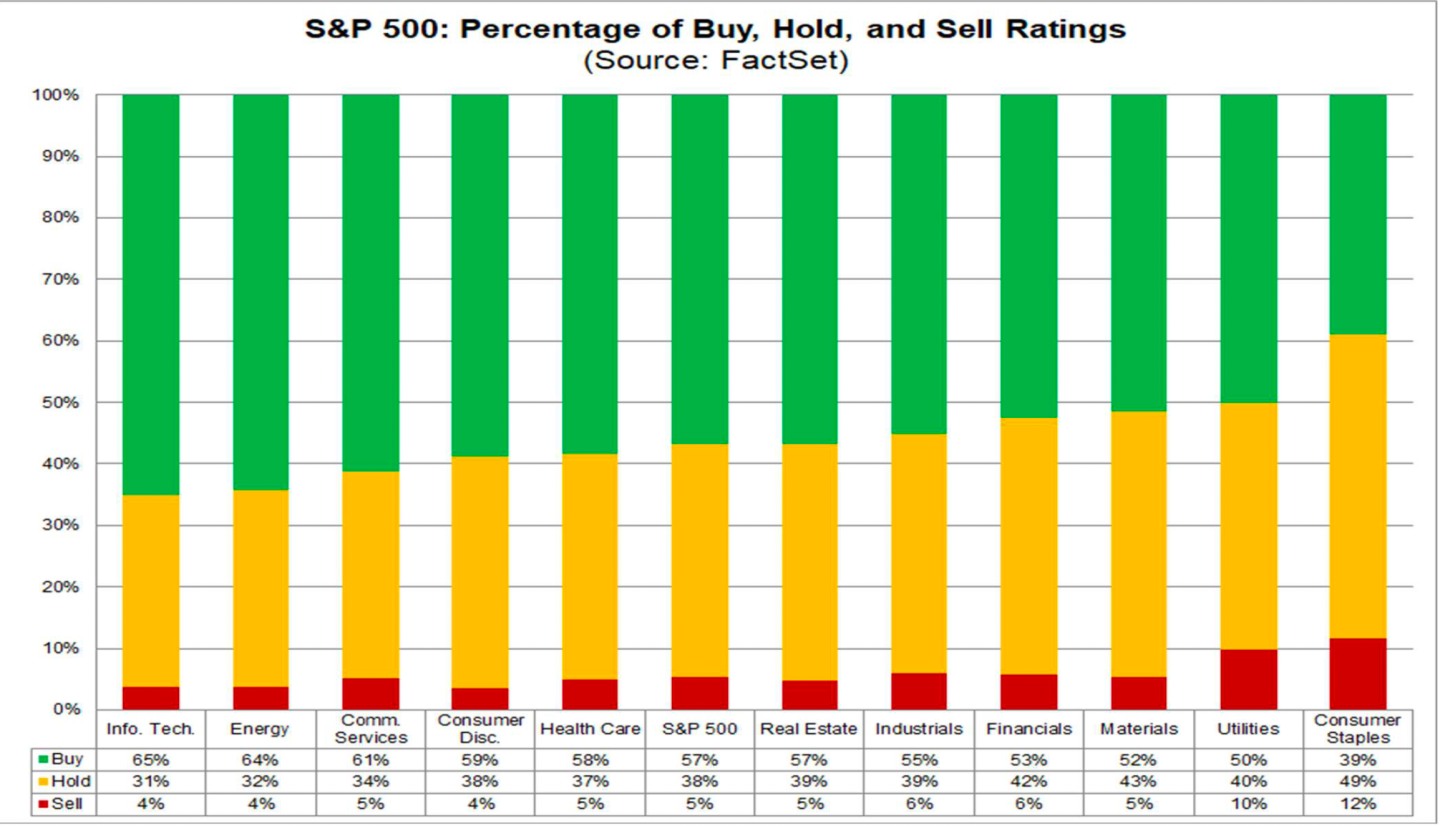

FactSet broke down all 10,708 ratings on stocks listed in the S&P 500 and found that the vast majority continue to be a “buy.”

Butters notes that analysts have reduced fractionally the number of buys they’re doling out in recent months, but the ratio of “buy” to “sell” remains the most optimistic in over a decade, dating back to 2011.

That comes even as companies continue to revise lower their sales and profits guidance. According to FactSet, the reporting period that just passed was, by any measure, a lousy one.

“More S&P 500 companies”—72—“have issued negative EPS guidance for Q2 2022 compared to recent quarters,” Butters wrote in the June 17 report. “This is the highest number of S&P 500 companies issuing negative EPS guidance for a quarter since Q4 2019…and above the 10-year average.”

But despite fundamentals trending lower, Wall Street is still bullish on stocks.

The influence of analyst ratings on stock-market price moves has long been debated. On the eve of the great bull run in stocks that started at the early part of the previous decade, the consensus research showed that a single ratings change—either good or bad—could have a noticeable impact on investors’ decisions. And in more recent years, the combination of a much larger retail investor base, and the penchant of the retail army to talk up their portfolio on investor message boards on Reddit and other social media forums means analyst ratings get even wider visibility with the stock-picking public.

They’re just not seeing much in the way of cautious guidance.

The rarest of rare: A tech stock with a ‘sell’ rating

Look no further than PayPal, down 61.3% year to date, to see the kind of split reality hanging over Wall Street. The digital payments specialist has announced layoffs and declared two profit warnings in recent quarters as inflation grinds higher and consumers hold back. The gloomy outlook disclosed by PayPal brass in recent months apparently is not shared by the analysts who cover the company, however.

Three months ago, the stock carried 48 ratings, 32 of which were a “buy,” 11 were a “hold,” and zero fell into the “underweight” category, equivalent to a “sell.” Today, the chart for the digital payments company looks even more bullish, if only slightly. There are now 33 “buy” ratings for PYPL, and still no “sell” ratings.

Despite the carnage in tech stocks this year, tech analysts in general remain surprisingly upbeat. Of the 11 industry sectors that make up the S&P, the informational technology grouping has, on average, far and away the most buy ratings. Nearly two-thirds (65%) of all ratings on tech stocks are a “buy.” In contrast, “sell” ratings account for just 4% of the total.

Analysts are least bullish on consumer staples. No surprise there with inflation running at 8.6%, and even Powell warning that the Fed’s move to increase interest rates could plunge the world’s biggest economy into recession.

Still, analysts aren’t exactly telling investors to dump their consumer staples stocks. Just 12% of all ratings in this industry category fall to a “sell” rating.