Good morning,

The latest talk of a recession is pretty ominous.

The World Bank’s global economic forecast released on Tuesday pointed to a slowdown in global economic growth before the end of the year, and most countries should begin to prepare for a recession and “stagflation,” Fortune reported.

“Several years of above-average inflation and below-average growth are now likely, with potentially destabilizing consequences for low- and middle-income economies. It’s a phenomenon—stagflation—that the world has not seen since the 1970s,” World Bank president David Malpass wrote.

There isn’t a universal game plan for CFOs when it comes to managing risk or measuring productivity in times of economic uncertainty. In fact, measuring productivity is now even more subjective than in the past, Mike Kelly, who leads EY Americas Finance Consulting Go-to-Market, told me. It requires looking at what adds value to the company, such as enhancing revenue, identifying new business models, efficiencies, and more, Kelly says. “It used to be about the throughput or the overall cost of the function over the volume of transactions,” he says.

I asked CFOs in different industries what they prioritize as we could be headed for an economic downturn.

Lineage Logistics CFO Matthew Hardt

“Supply chain issues continue to impact us through inflationary pressures, including labor and energy, among several other operating expenses,” Hardt told me. “To address these inflationary pressures, we are looking inward to drive productivity into our operations with the use of automation and other advanced technology that we’ve deployed with the help of our data science team. We have also had discussions with many of our customers about passing on some of the burdens.”

Lineage Logistics is an industrial REIT and provider of temperature-controlled food products and logistics solutions. The funding of the private company based in Novi, Michigan has reached $8.6 billion, and it has a valuation of $25 billion, CNBC reports. Lineage Logistics’ global network includes over 400 facilities, which spans 20 countries across North America, Europe, and Asia-Pacific, according to the company.

“As we continue to address labor issues, we remain focused on every aspect of employee lifestyle,” Hardt says. “We launched the ‘War for Talent,’ an initiative aimed at improving our work culture and helping us to address staffing needs more efficiently. As a result of the initiative, we have increased wages, revamped our recruiting efforts, and improved the processes for employee onboarding. As the CFO, my team is working with the commercial teams around our global network to ensure we are driving balance.”

Hyatt Hotels Corporation CFO Joan Bottarini

Making quick decisions about how to maximize profit became routine during the pandemic at Hyatt Hotels, Bottarini told me. “Our teams on property have greater autonomy to make decisions than they’ve had historically,” Bottarini says. “Over the past two years, we’ve built what I would say is an incredible muscle for scenario planning to work out the different outcomes,” she says. “We’ve employed data and analytics at the property level, and one of the biggest costs that we have is labor.” The data helps answer the question: “How can we improve productivity?” she says.

ServiceNow CFO Gina Mastantuono

“2020 is the most recent experience that we are bringing forward into the current environment,” Mastantuono told me. “We constantly look at our plans, prioritize, and make adjustments as necessary. We continue to be disciplined in our spending and remain agile.”

ServiceNow, a digital workflow company, remains “focused on balancing both growth and profitability while we continue to hire and invest,” Mastantuono says. “In fact, Q1 hiring was up 28% year over year. We recently announced that ServiceNow plans to triple subscription revenues to $16 billion-plus by 2026.”

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Upcoming event: Fortune’s inaugural in-person meeting of the CFO Collaborative, presented in partnership with Workday, will take place at Miller Union, Atlanta, on Wednesday, June 22, at 6:30 p.m. The featured speaker for the event will be Clint Watts, senior fellow at the Foreign Policy Research Institute and NBC News National Security Contributor. Watts will share his expertise on cyberterrorism, social media influence and Russian disinformation. If you’re a CFO interested in attending, you can find the registration form here. For further information, please email CFOCollaborative@Fortune.com.

Big deal

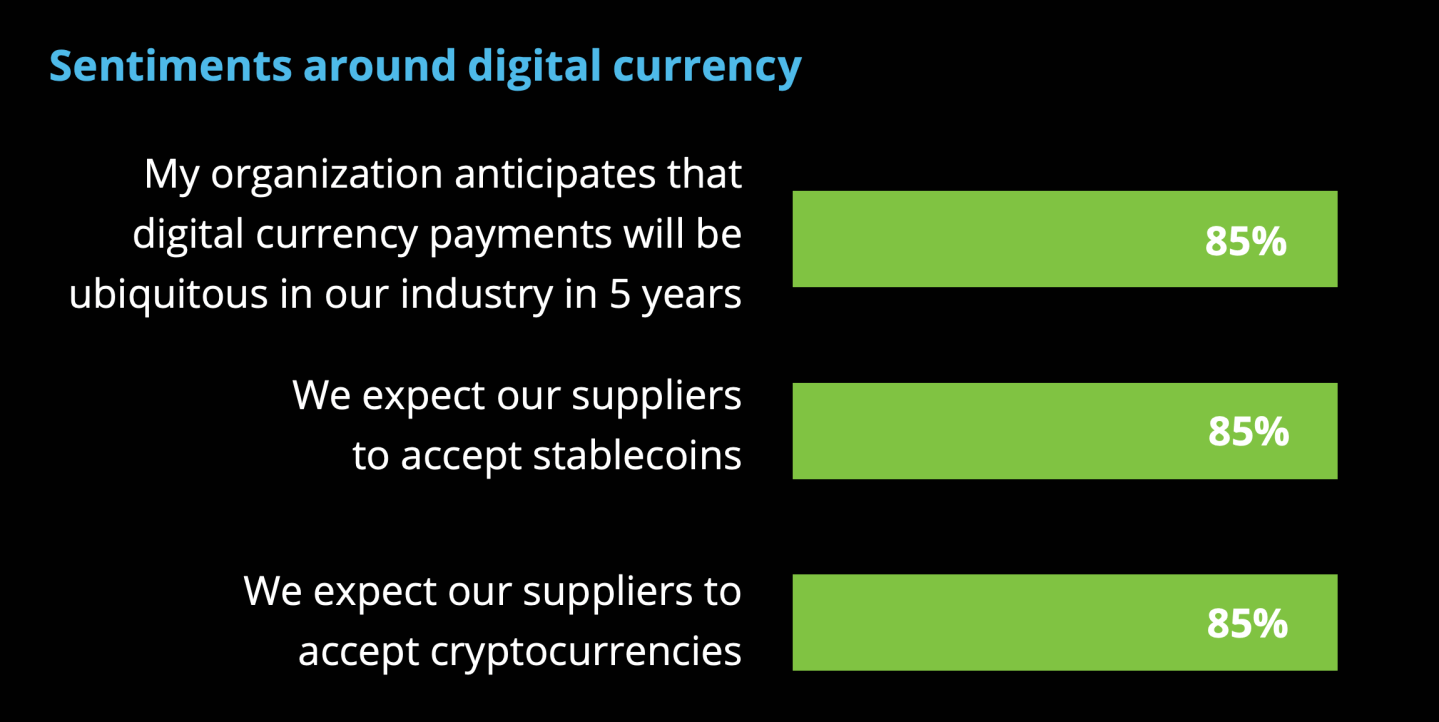

Merchants Getting Ready for Crypto, a survey by Deloitte in collaboration with PayPal, polled merchants on the factors surrounding the increased adoption of cryptocurrencies. As consumers progressively purchase goods and services using digital currencies, 85% of respondents said they anticipate that digital currency payments will be ubiquitous in their respective industries within five years. And 85% expect said they expect suppliers to accept stablecoins and cryptocurrencies. The survey also found that 87% of respondents agreed with the statement that "organizations currently accepting digital currencies have a competitive advantage in the market." However, when it comes to enabling digital currency payments, one of the challenges merchants perceive is the integration with existing financial infrastructure. The findings are based on a survey of 2,000 senior executives at U.S. retail organizations in sectors such as digital goods, electronics, food and beverages, home/garden, hospitality and leisure, and transportation. The survey polled retailers with annual revenues ranging from below $10 million to $500 million and above.

Going deeper

Is Starbucks’s wage increase a shortsighted strategy? What Experts Say, a MIT Sloan Management Review report examines the long-term effects of Starbucks’ wage increase for nonunionized employees. "About 40% of our panelists agreed that yes, Starbucks’ strategy is indeed shortsighted," according to the report.

Leaderboard

Mariana Coontz was named CFO at DigniFi, a FinTech company in the transportation sector. Before DigniFi, Coontz spent the last eight years at Synchrony Financial, serving in various finance and risk roles. She began her career at JPMorgan Chase in a leadership development program. She held roles across the finance organization in increasing responsibility culminating in her role as the assistant treasurer for the consumer and community bank.

Keith A. Goldan, CFO at Optinose (Nasdaq:OPTN), a pharmaceutical company, is leaving to accept a CFO opportunity at another public company, effective June 10. Michele Janis, VP of finance, who joined Optinose in 2011, will serve as the company’s acting CFO.

Overheard

Uber Technologies Inc. is “recession resistant ... the signal on the street is things are really strong, and the spend on services continues to be quite robust."

—Uber CEO Dara Khosrowshahi said during the Bloomberg Technology Summit on Wednesday.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.