Good morning,

Tesla CEO Elon Musk put everything on the table in his bid to buy Twitter. But the biggest losers from the drama may end up being Tesla shareholders.

CEOs and CFOs know that before embarking on a merger or acquisition, due diligence—the act of verifying that the value you expect in a company is actually there—is an important part of the equation. However, Musk didn’t require the right to conduct the due diligence before signing the $44 billion deal to purchase Twitter on April 25, a source told Fortune earlier this month.

Musk tweeted on May 13: “Twitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of users.” In the days following, there have been tweet spars between Musk and Twitter’s CEO Parag Agrawal, including poop emojis. But as the saga continues, Telsa investors are seemingly left in the lurch.

In my colleague Shawn Tully’s new Fortune report, Tesla shareholders are the biggest losers in Elon Musk’s Twitter bid, he explains how this potential deal is affecting the EV company’s stock price.

Tully writes: Between the market close on April 1, just before Musk disclosed his initial Twitter stake, and May 20, Tesla’s stock crumbled 39%. The nosedive erased $433 billion in value, one of the largest wipeouts ever over such a short span. To frame it differently: Tesla’s market cap fell by almost 10 times the $44 billion Musk offered for Twitter.

The Twitter deal isn’t the only reason Tesla is down (the threat of recession is certainly another). But it’s easy to see why it makes shareholders squeamish. The challenge and the cost of fixing Twitter—a company with big cash-flow problems in a low-margin industry—would create a huge distraction for Musk at a time when Tesla faces major challenges of its own. Those challenges, including shutdowns at its gigafactory in Shanghai, falling market share, and burgeoning competition from new EV entrants worldwide, demand Musk’s full commitment. Suddenly, the followers whom Musk has moved to believe in Tesla, are questioning how their hero could embark on a crazy crusade for another company.

Tully also explains how Tesla’s stock losses could affect millions. He writes: As one of the biggest companies in the S&P 500 by market cap, at $687 billion in late May, Tesla is a staple in large-cap index funds. That makes it part of the 401(k)s and nest eggs of tens of millions of Americans. For example, as of April 30, Tesla ranked as the fifth-largest holding in the Vanguard S&P 500 ETF at 2.1%, above Berkshire Hathaway, UnitedHealth Group, and Johnson & Johnson.

In his article, Tully also outlines the five biggest threats that Musk’s Twitter takeover drama poses to Tesla’s future. Here’s one: To help finance the deal, Musk has already sold around 6% of his Tesla holdings, for $8.5 billion. An insider tells Fortune that the deal, if consummated, is likely to leave Musk holding over 50% of Twitter’s shares. But the deal also calls for Twitter to assume a gigantic $13 billion in new debt, costing around $650 million a year in interest. You can read the complete article here.

Meanwhile, to show Tesla shareholders he still cares, Musk tweeted a meme on Thursday with the caption: “To be clear, I’m spending <5% of my time on the Twitter acquisition. It ain’t rocket science! Yesterday was Giga Texas, today is Starbase. Tesla is on my mind 24/7.”

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

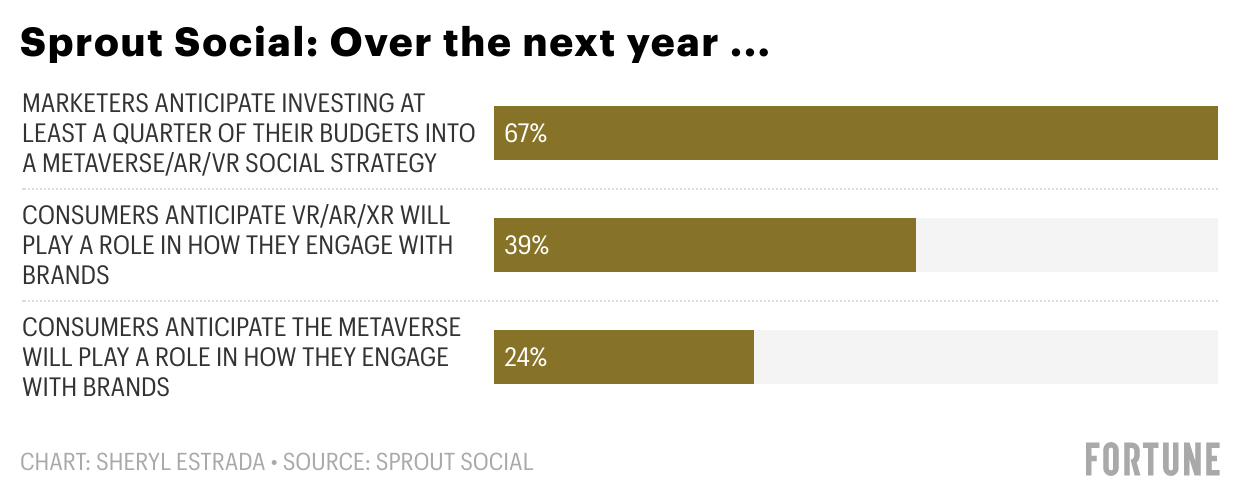

Research from the 2022 Sprout Social Index: U.S. Forecast found that over the next 12 months, 67% of marketers surveyed anticipate investing at least a quarter of their budgets into a metaverse/augmented reality (AR)/ virtual reality (VR) social strategy. Meanwhile, 39% of consumers said they anticipate VR/AR/ extended reality (XR) will play a role in how they engage with brands. And 24% anticipate the metaverse will play a role in how they engage with brands, according to Sprout, a social media management software company. The survey also found that 38% of consumers plan on using TikTok, up from 17% in 2020, and two-thirds of consumers prefer short-form content, up from 50% in 2020. The findings are based on a survey of 500 U.S. marketers and more than 1,000 U.S. consumers.

Going deeper

The turning point: A global summary, released by the Deloitte Center for Sustainable Progress, finds the global economy is at a crossroads. If left unchecked, climate change could cost the global economy $178 trillion in net present value terms from 2021-2070. "The human cost would be far greater: a lack of food and water, a loss of jobs, worsening health and well-being, and reduced standard of living," according to the report.

Leaderboard

Michelle Gilson was named CFO at Arcellx, Inc. (Nasdaq: ACLX), a biotechnology company. Gilson joins Arcellx from Canaccord Genuity, where she most recently served as managing director and senior equity research analyst covering biotechnology companies. Prior to joining Canaccord, she held biotechnology equity research roles at Jefferies, LLC; Instinet, LLC (Nomura Securities); Oppenheimer & Co. Inc.; and Goldman Sachs.

Schond L. Greenway was named CFO at Mind Medicine Inc. (Nasdaq: MNMD), a clinical stage biopharmaceutical company. Greenway joins MindMed after serving as CFO of Avalo Therapeutics, a precision medicine clinical stage biopharmaceutical company. He previously served as VP of investor relations at Mesoblast. Greenway served in a similar role at Halozyme Therapeutics, Inc. and in various roles at investment banking firms Morgan Stanley and Barclays Capital.

Overheard

There's an "emergence of a new leadership style rooted in empathy, intelligence, and integrity—hybrid leadership."

—Betsy Leatherman, the global president of consulting services at Leadership Circle, outlines in a Fortune opinion piece the findings of research on global business leaders about their assessments of what defines capable leadership.