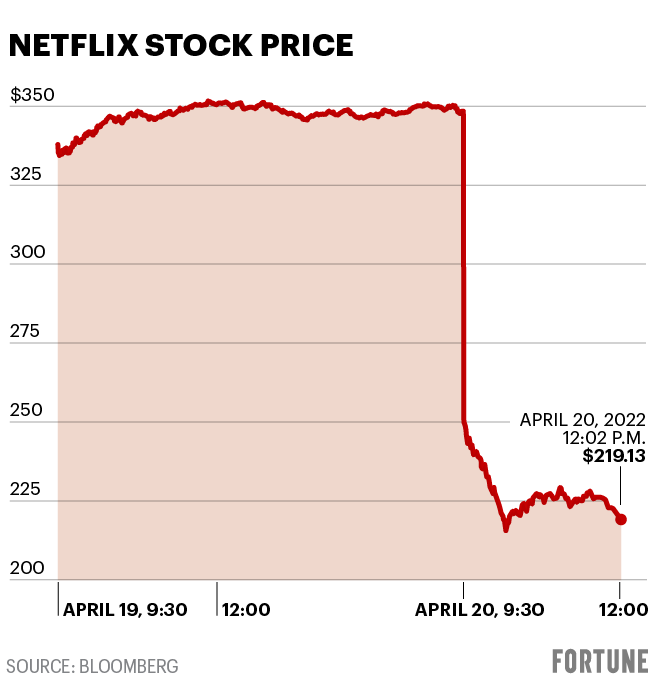

Netflix’s bad Tuesday is extending into Wednesday.

The streaming service’s stock nosedived $132 in early trading—nearly a 38% drop. That’s the steepest decline the company has seen in nearly a decade

The drop follows the company’s earnings report, where it announced it had lost 200,000 subscribers in the first three months of the year and expects to lose 2 million more around the world this quarter.

The spillover from the investor disappointment has also affected other streaming providers, including Disney and Warner Bros. Discovery.

The first quarter “reflected the perfect storm of domestic market saturation, competition for content, competition for subscribers, inflation, and an ill-timed price increase,” said Wedbush analyst Michael Pachter. “Compounding the effects of all these factors was Russia’s invasion of Ukraine, and the corresponding global sanctions imposed on Russia.”

Netflix hit record highs during the pandemic as people rushed to the service to devour series like Tiger King and The Crown. The company is hoping the May 27 premiere of Stranger Things 4 will help retain some subscribers, but analysts are wary due to market saturation and the volume of new content on competitive services, which are often cheaper.

Netflix has announced it is open to exploring a commercial-supported option, which Pachter says could provide a bump to the stock, but isn’t a guarantee.

“Should Netflix roll out an ad-supported tier, the stock will likely respond favorably, but we expect management to test the concept for at least several quarters before announcing a major change,” he said. “We would remain on the sidelines until there is evidence that Netflix is a growth company once more.”

Never miss a story: Follow your favorite topics and authors to get a personalized email with the journalism that matters most to you.