Coinbase, the U.S’s largest cryptocurrency exchange, reported $1.24 billion in revenue for the third quarter that ended Sept. 30, falling short of the $1.57 billion forecast by analysts and the $2 billion recorded in the second quarter of 2021.

In its letter to shareholders on Tuesday, Coinbase blamed the disappointing results on “softer crypto market conditions, driven by low volatility and declining crypto asset prices,” which resulted in fewer users and lower trading volumes and transaction fees.

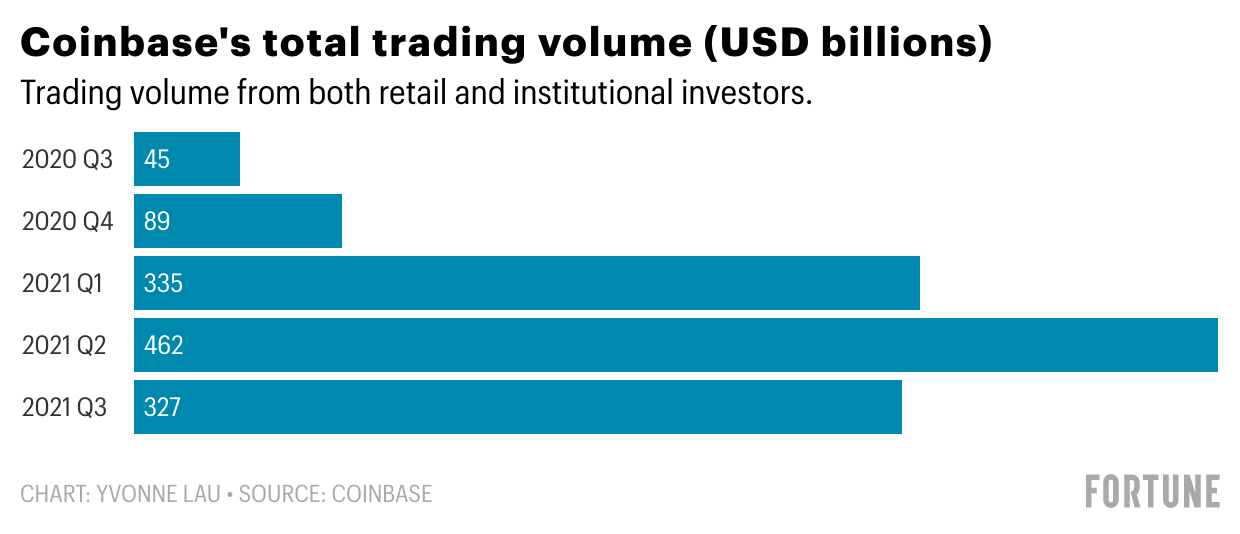

Coinbase users traded less amid the dip in the price of cryptocurrencies this summer. The platform’s transaction revenue dropped to $1.09 billion in the third quarter, down from $1.93 billion the previous quarter. Coinbase’s monthly transacting users also fell to 7.4 million from 8.8 million in second quarter, though the figure beat the 6.85 million that analysts were expecting.

Investors dumped the stock on Tuesday—shares of Coinbase fell 12% in extended trading after its earnings report—but the company is forecasting a fourth-quarter recovery, and there are plenty of signs that such a comeback could materialize.

Since the start of Coinbase’s fourth quarter, which began in October, the market cap of cryptocurrencies globally has surged from $1.9 trillion to $2.8 trillion as of Wednesday afternoon Hong Kong time. On Tuesday, the total crypto market cap reached a record $3 trillion, with the top two coins Bitcoin and Ether rallying to record highs of $67,591.86 and $4,789.45, respectively.

October was highly “active for cryptocurrency trading—not unexpected given heavy news flow and token appreciation,” wrote J.P. Morgan analysts this week, ahead of Coinbase’s earnings.

The record October rally of the dog-inspired Shiba Inu coin, which trades as SHIB, bodes well for Coinbase. The altcoin shot up 777% in the 30 days ended Oct. 29 (though its market cap has plunged 93% since to $2.6 billion). The exchange added the onetime “meme” coin in mid-September, making it one of the few publicly listed platforms where traders can buy and sell the asset. (Robinhood has so far resisted demands from the coin’s fans, the so-called SHIB Army, to add the asset.)

Altcoins like SHIB, Solana, and Binance Coin contribute to the majority of Coinbase’s trading volume—59% in the third quarter, up from 50% a year ago. (Bitcoin and Ethereum trading make up 19% and 22% of the volume, respectively.)

As SHIB and the broader cryptocurrency market ticked higher last month, traders sought out Coinbase. On Oct. 28, Coinbase became the most downloaded app on the U.S. Apple App Store with 2 million iOS downloads (and 2 million Android downloads), according to mobile app data provider Sensor Tower, beating out viral video platform TikTok and rival Crypto.com.

In its shareholder letter, Coinbase said that it was already seeing “higher levels of activity among retail traders [in October].” The company is also diversifying its services. It recently introduced an upgraded version of Coinbase Prime, its brokerage for institutional customers, and it has plans to launch Coinbase NFT, a peer-to-peer non-fungible token marketplace.

Coinbase is “not a quarter-to-quarter investment,” the company said, “but rather a long-term investment in the growth of the cryptoeconomy.”

More must-read business news and analysis from Fortune:

- From Delta to Southwest, the airlines in the best—and worst—shape going into a chaotic holiday season

- How a risky bet on the Shiba Inu coin made this warehouse manager a millionaire

- Patagonia doesn’t use the word ‘sustainable.’ Here’s why

- Will monthly child tax credit payments continue in 2022? Their future rests on Biden’s Build Back Better bill

- ‘I’m afraid we’re going to have a food crisis’: The energy crunch has made fertilizer too expensive to produce, says Yara CEO

Subscribe to Fortune Daily to get essential business stories delivered straight to your inbox each morning.