It’s been a rough couple of months for Facebook, erm, Meta, that is.

At the end of September, the Wall Street Journal published the “Facebook Files”: a damning investigation, covering tens of thousands of pages of leaked documents spanning presentations, research reports, and employee communication that revealed a myriad of examples of how Facebook harmed users, and exactly what the company knew about it.

Later, the whistleblower and former employee who leaked those documents, Frances Haugen, gave testimony before the Senate. She reportedly thought the Journal could have done more with the information and shared those redacted documents with 17 other outlets. Stories about disturbing content, its CEO choosing growth over safety, its platform contributing to violence in Ethiopia and vaccine misinformation, to name a few, have been rolling out ever since (Here is a list of stories stemming from what are now being called the Facebook Papers). Meta has said it’s since become subject to “government investigations” over the allegations, according to its latest earnings disclosure.

In the heat of it all, Facebook announced it would be changing its name to Meta to emulate its focus on investing in virtual reality. The name swap ignited insults from competitors and plenty of critical memes and comments across social media.

While the deeply concerning allegations did hit shares of Meta Platforms (currently still trading under the ticker FB until early December), the stock price has been surprisingly resilient given all the noise. Shares were trading at more than $335 the afternoon of Nov. 4, up nearly 25% from the beginning of this year, though they are down more than $58—or more than 15%—from the beginning of September.

So what gives? Here are a handful of factors that may be contributing to its durability:

Wall Street is bullish on the company’s future

Wall Street analysts think some of Meta’s more immediate challenges may be short-term. There’s the Facebook Papers, of course, but some other challenges to its bottom line, too. Recently Apple updated its iOS, and it’s started making Facebook ads less effective, cutting into Meta’s margins. UBS analyst John Hodulik anticipates the company will improve its tools and systems in response to the update, and that it may end up faring better than competitors on this front.

As for the high-profile Facebook Papers, analysts don’t seem all that concerned. Wells Fargo Securities analyst Brian Fitzgerald said that, while a negative, public relations risks have already gone down. “We view material political or business fallout as unlikely,” he wrote.

Investors have short memories

As my colleagues Nicolas Rapp and Declan Harty observe, investors haven’t dwelled too long on bad news about Meta in the past.

“Take the 2018 revelation that Cambridge Analytica, a data firm, had obtained millions of users’ Facebook data to create voter profiles—one of the company’s biggest scandals ever,” they note. “Shares were rocked by the news, falling 15.1% over the following two weeks. Facebook shares cratered some 27% over the course of 2018. Six months into 2019, though, and the stock was back in the green—trading above $190 for the first time ever.”

The rebrand may be helping its poor PR outlook

Some investors think that Facebook’s name change will improve its public image, which hasn’t always been great over the past year. The brand swap may emphasize some of Meta’s other lines of business that aren’t Facebook—like Instagram, WhatsApp, or Oculus—and help it re-craft a new identity. It also may serve as “somewhat” of a distraction from the negative attention of late, according to Bank of America analyst Justin Post. Indeed, bad press may be the chief reason the company changed its name at the time it did, one early investor noted.

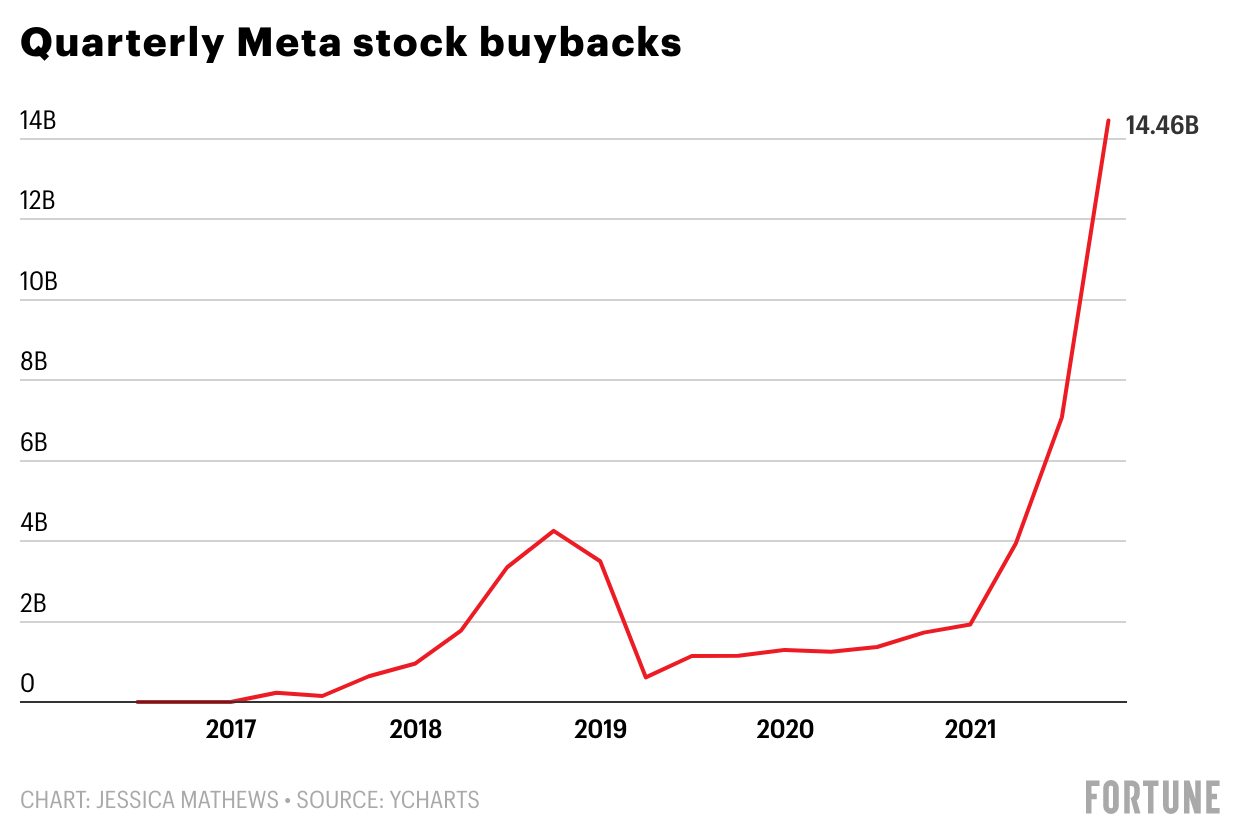

Meta is buying back shares

Meta has been purchasing back a lot of its shares this year. In the past quarter alone, it bought $14.4 billion in shares, according to the company’s earnings report. Stock buybacks reduce the amount of outstanding shares on the market, and therefore increase the ownership value of the remaining shares.

Mark Zuckerburg personally holds a big stake in the company

While it’s not going to keep a stock price from swinging, it may help that Meta’s CEO holds more than one out of 10 of the company’s outstanding shares. Either personally or through the Chan Zuckerberg Initiative, Zuckerberg owns more than 395 million shares of Meta—or a little less than 17% of the company’s outstanding shares, according to the company’s most recent proxy statement from April. (He holds nearly 58% of voting power.)

Whatever the reason for its resilience after everything that has come to light, Meta’s stock price doesn’t make much sense to me. But hey, it wouldn’t be the first time.

WEEKLY CHART

JARGON, EXPLAINED

“Meta” stems from metaverse, which is a concept from science fiction. It refers to a universe that exists in the digital world that people can access via virtual reality. It’s often depicted as “a fully immersive online realm that looks similar to the real world but is computer generated,” writes my colleague Jonathan Vanian. Read more about that here.

NEWLY LISTED

I know, I know. I’m adding another section? Yes. Yes I am. I compile the IPO and SPAC section of Lucinda Shen’s Term Sheet newsletter, so I’m already keeping tabs on some of the more exciting public offerings coming down the runway each day. I thought it may be worth giving you a heads-up. Here are some of the companies on the docket:

- Wool shoe company Allbirds went public this week and is now trading under the ticker BIRD on Nasdaq.

- Personal finance content hub NerdWallet went public yesterday and is now trading under the ticker NRDS on Nasdaq.

- Electric scooter company Bird listed on the NYSE this week under BRDS (I bet they’re not too happy with Allbirds) after merging with a SPAC.

- Expense software company Expensify is planning to list next week. Pre-IPO shares are on Robinhood.

- Storage cloud company Backblaze is planning to list next week. Pre-IPO shares are on Robinhood.

- Retail brokerage TradeStation Group said it would go public via a SPAC merger.

DON’T MISS THIS

There’s a lot going on in the world of investing. Burger King launched a crypto program. Robinhood is letting companies allocate shares to friends and family on its IPO platform. The Fed will finally start tapering its bond purchases. And guess what? GameStop and AMC started spiking…again.

Have an investing query you’d like to see addressed? Send me your thoughts and feedback below. Thanks for reading.

Jessica Mathews

Twitter: @jessicakmathews

Email: jessica.mathews@fortune.com

More finance coverage from Fortune:

- 4 things to know about stimulus checks in 2022 and beyond

- GameStop report from SEC sheds new light on meme stock mania—conspiracies and all

- How high Goldman Sachs predicts home prices will go in 2022

- Mortgage rates may spike 30% next year, according to a new forecast

- These markets are expected to be the hottest for real estate in 2022

Welcome to The Dividend, Fortune’s new weekly investing column, available exclusively to subscribers. Each week we’ll dig into an area of the market that’s making headlines and help you figure out what deserves a place in your portfolio—and what doesn’t.