Good morning,

Even the most profitable businesses in the world were rattled by a tumultuous, unprecedented year.

The 2021 Fortune Global 500 list released on Monday— representing more than one-third of the world’s gross domestic product—found the companies’ total revenue fell about 5% to $31.7 trillion this year. Together the 500 companies made $1.6 trillion in profits, which is down 20%. Automakers, energy, industrials, and transportation were sectors that saw at least a 10% decline in revenue from a year ago.

But some fared better than others. Topping the FG500 is Walmart for the eighth consecutive year, with its U.S. e-commerce sales up 79% in 2020 and its Sam’s Club and international businesses booming. The retail corporation’s latest annual revenue is $559.2 billion. Rounding out the top three: State Grid, No. 2, a state-owned electric utility operator based in Beijing, China, and Amazon, No. 3.

Berkshire Hathaway, No. 11, has the highest rank of the financial sector companies, moving up three spots from last year. But the holding company’s revenues fell slightly in 2020 to $245.5 billion, which is down 3.6% from the year prior. Meanwhile, another company in that category, American Express, No. 312, was hit hard during the COVID-19 pandemic. The firm is down 61 spots on this year’s list, compared to 2020. Profits decreased almost 54% last year. But overall credit card spending is beginning to pick up.

I’ve spoken with several CFOs over the past few weeks about the global semiconductor chip shortage amid the pandemic. Some said it may last until next year. Automaker Toyota, No. 9 on the Global 500 list, appears to have hit a stride in navigating the shortage. In an article about the company’s journey, How Toyota kept making cars when the chips were down, my Fortune colleague Eamon Barrett based in Hong Kong writes: “Toyota’s North American production, meanwhile, hummed along at 90% of capacity for the year through June. That prolonged productivity propelled the company to a rare victory: In the second quarter, it was the No. 1 automaker by sales in North America, marking the first time since 1998 that GM hasn’t held the top spot.”

A total of 27 companies made their debut on the FG500, such as Tesla, No. 392, and Netflix, No. 484. There are 23 female CEOs on the list, an all-time high, and six are women of color. There’s so much to explore on the Fortune Global 500 list. I highly recommend this interactive analysis.

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

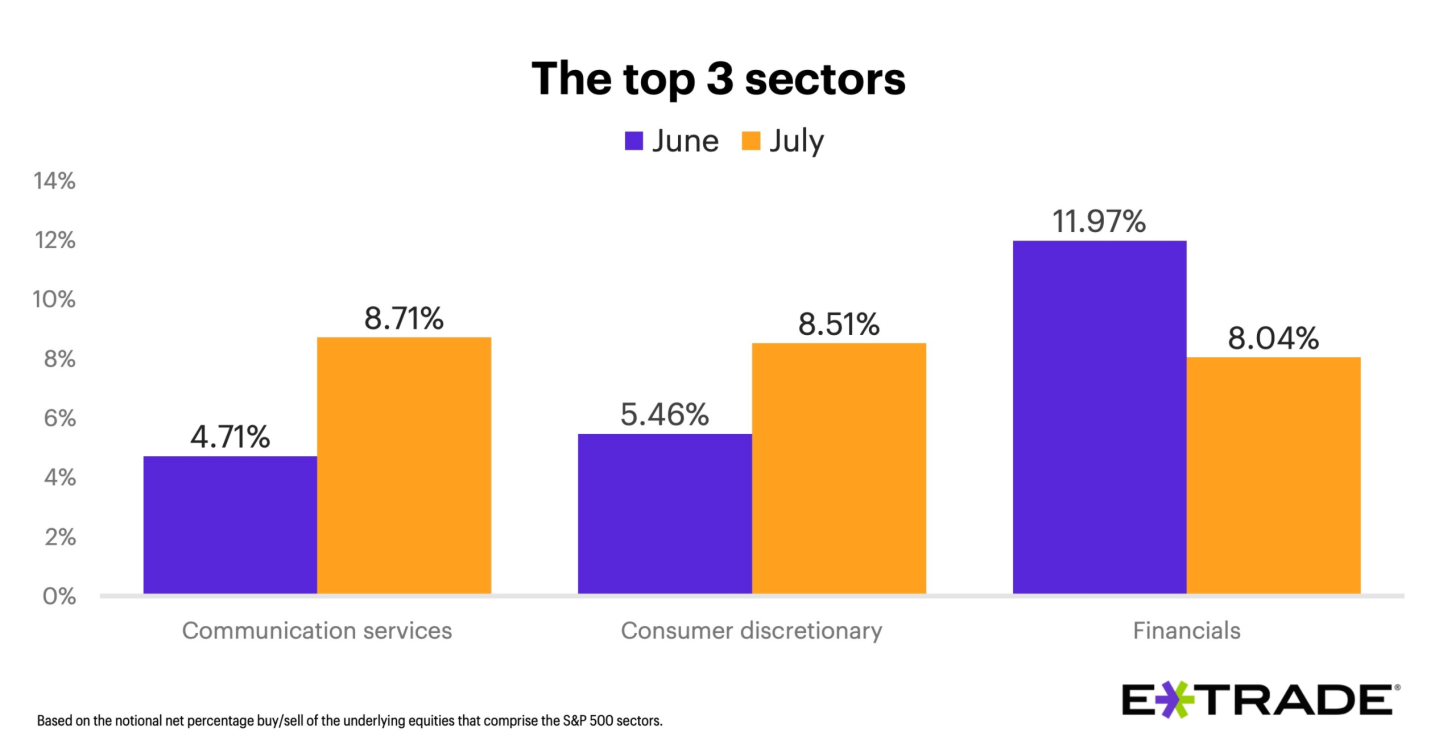

E-Trade released data from its monthly sector rotation study on August 2. The top three sectors for stocks are noted as communication services, consumer discretionary, and financials. Activity increased from June to July, except for financials. The data is based on "customer notional net percentage buy/sell behavior for stocks that comprise the S&P 500 sectors," according to the trading platform.

Courtesy of E-Trade

Going deeper

Black Women’s Equal Pay Day lands on August 3 this year. The date marks the time it took for the average Black woman to have earned the same amount as the average non-Hispanic white man earned in 2020, according to the American Association of University Women (AAUW). "Mothers and most women of color face a wider-than-average gap and need to work even longer to catch up to men’s earnings," AAUW noted in the report. In an article by Fortune reporter Marco Quiroz-Gutierrez, experts provide their perspectives on the pay gap.

Leaderboard

Margaret Vo Schaus, White House nominee for CFO at NASA, was confirmed by the U.S. Senate on July 30. Vo Schaus was nominated for the position on April 23. She is a career member of the senior executive service. Most recently, Vo Schaus served as the director for business operations in the Office of the Under Secretary Research and Engineering at the Department of Defense.

Edward Liu was named CFO at Zocdoc, a digital healthcare platform for in-person or virtual care, on August 2. Liu spent more than 20 years at Morgan Stanley, most recently serving as former co-head of Americas technology banking. He provided counsel to C-suite executives and board members.

Overheard

"It’s a world that we haven’t had to deal with in 40-plus years, and I don’t think you can just take out your regular playbook from the last couple of decades."

—Peter Boockvar, chief investment officer at Bleakley Advisory Group, on a cycle in the U.S. of inflation reaching new heights as growth moves lower, as reported by CNBC.