This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.

Good morning, Bull Sheeters.

After successive record closes, stocks are trading sideways on Friday. One of the stand-outs is the travel sector, helped by bullish news from aviation giant Airbus. Don’t look now, but the Stoxx Europe 600 Travel & Leisure is up more than 21% YTD.

Meanwhile, bond yields are fairly subdued, helped by yet more dovish comments from the Fed’s Jerome Powell.

Even with the lackluster start to trading on Friday, equities stand a good chance of closing out the week higher.

Let’s spin the globe, and see what’s moving markets.

Markets update

Asia

- The major Asia indexes are closing out the week on a rough note. The Hang Seng is off nearly 1.2%.

- The U.S. blacklist of Chinese firms continues to grow with a host of Chinese supercomputing firms added to the those for whom American companies are forbidden to work with.

Europe

- The European bourses are trading sideways with the Stoxx Europe 600 flat, flat, flat out of the gates, before nudging up.

- Shares in Airbus were up 2.3% this morning after reporting an upswing in the delivery of new planes last month, a sign the aviation industry is getting back on track. Travel and leisure stocks are one of the top-performing sectors today.

- Another beleaguered industry—autos—is on the road to recovery, too. Germany’s BMW and Daimler’s Mercedes-Benz unit have reported double-digit sales growth thanks to strong China sales.

U.S.

- U.S. futures are up a touch, looking to finish the week in the green. That’s after the S&P 500 hit a fresh all-time high on Thursday, helped by Fed Chairman Jerome Powell’s latest dovish comments on inflation.

- Yields on Treasuries continue to flatline. The 10-year trades around 1.65%, barely changed over the past two weeks.

- Shares in Amazon are up 0.4% in pre-market trading this morning as it appears a crucial unionization vote in Bessemer, Alabama will go down in defeat.

Elsewhere

- Gold is down, trading around $1,750.

- The dollar is up.

- Crude is lower, with Brent trading below $63/barrel.

- Bitcoin has been stuck in a range most of the week, settling right around $58,000.

***

By the numbers

$5 trillion

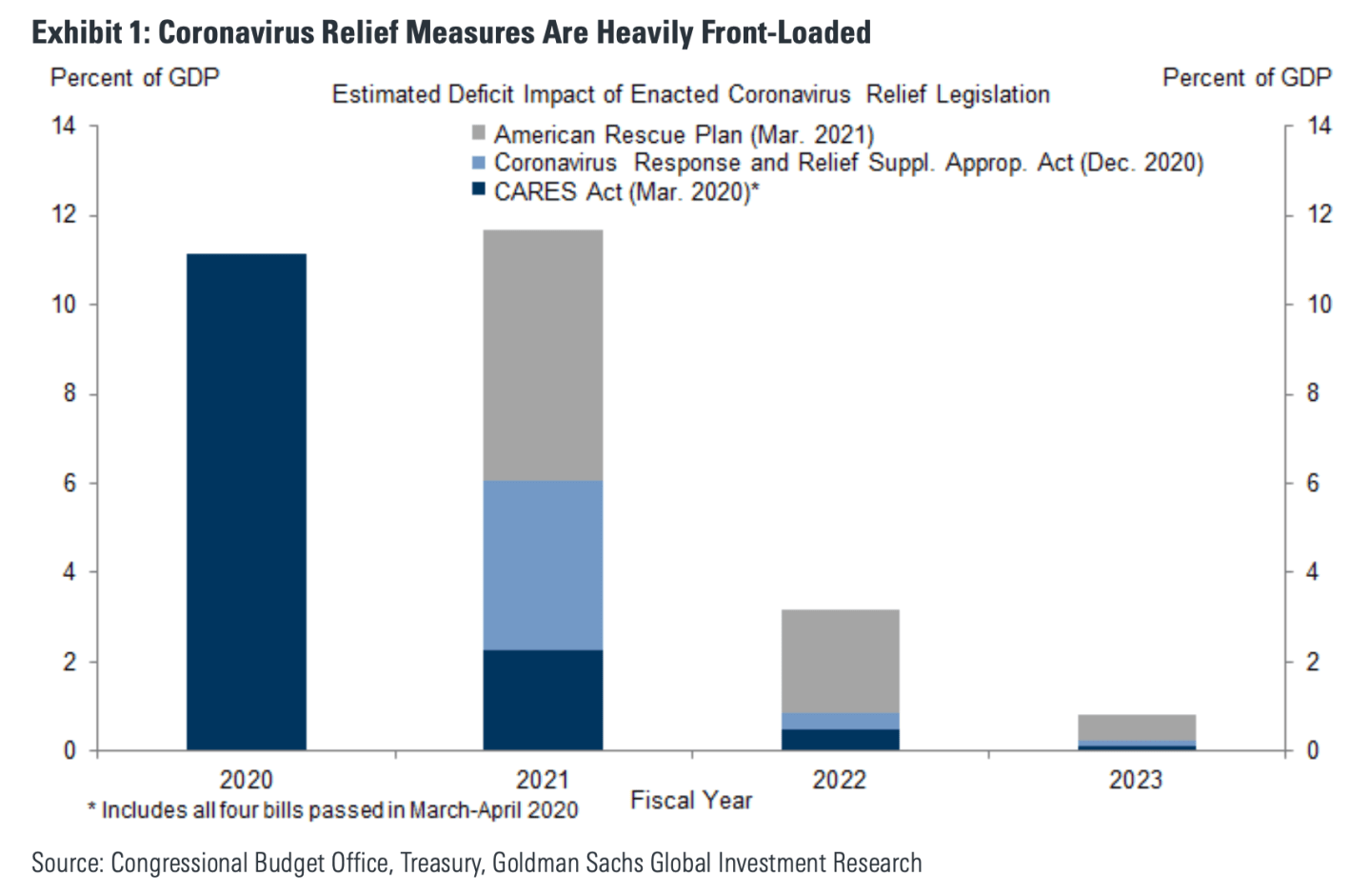

…give or take a few billion. In the span of the past twelve months, Congress has enacted a half-dozen laws that succeeded in dumping more than $5 trillion worth of helicopter money on the American economy. That equates to roughly 25% of U.S. GDP. A reminder: the goodies took the form of pandemic funding for states and cities, stimulus checks for American families and extended unemployment benefits for laid-off workers. All that taxpayer money will provide rocket fuel for historic U.S. economic growth this year, and part of next year. But, by design, the economic benefits will peter out fairly quickly after that. Goldman Sachs economist Blake Taylor, for one, thinks there’s a good chance we haven’t seen the last of these fiscal spending packages, in part because the likes of the CARES Act and American Rescue Plan were so front-loaded. Yes, we’ll see an infrastructure spending bill or two. But, beyond that, he sees a case for Congress to go back to the drawing board to craft new spending plans, particularly if the economy recovers in, as the Fed’s Jerome Powell says, an “uneven” fashion. Alas, any pitch for further stimulus spending will trigger a showdown in Congress. But the point is Congress and the Fed are committed to easy money policies, and that will be a big factor in American economic expansion in the years to come.

Zzzzzz 😴😴😴

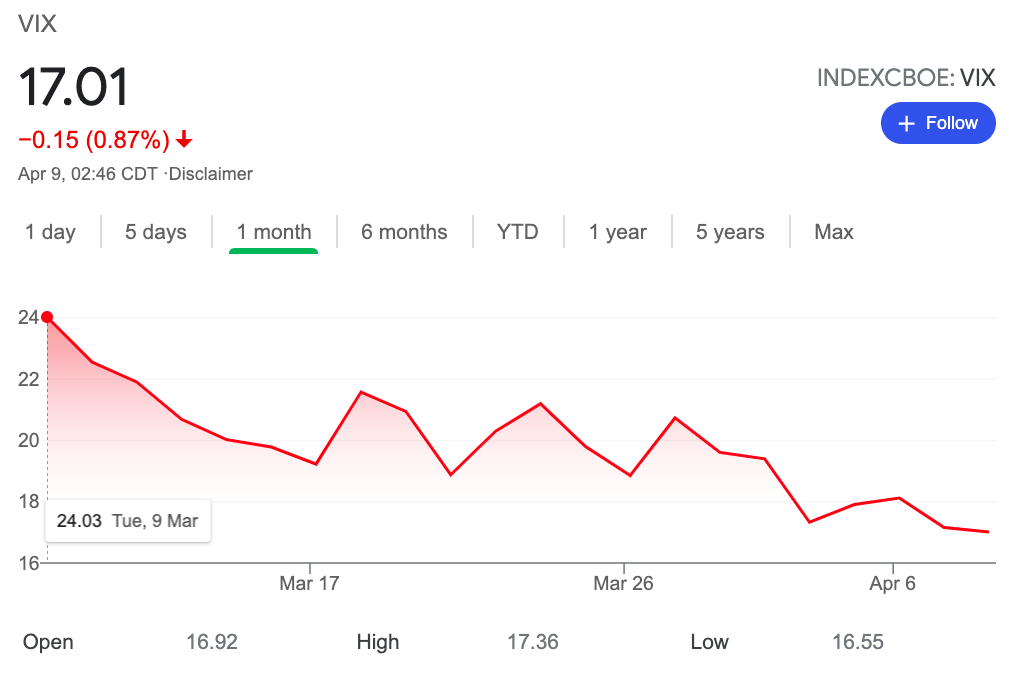

We haven’t talked much about the VIX lately, and that’s probably a good thing. The Cboe Volatility Index spikes during times of heightened markets uncertainty. What’s going on these days? The opposite. The VIX has been a big snooze in recent weeks, dipping below 20, and staying there for the past two weeks. Alas, there are some in the markets who are convinced the lull won’t last. They see storm clouds on the horizon in the form of inflation, tax hikes and worries about vaccination rates and any hit that may have on the global economy. As such, a massive VIX options trade appeared on traders’ screens earlier this week, a bet that volatility would return to the markets by this summer. What happened to the VIX after that? It continued to flatline.

Outperforming (yours truly)

I was talking to my nephew over Easter, and the conversation turned to Bull Sheet, and GameStop. Turns out he put some YOLO dough into GME… and, he’s up big. 🚀🚀🚀 My dinosaur brain of course couldn’t comprehend this investing strategy, and I told him so. I think I used the F-word—”fundamentals”—a few times in laying out an argument for why he should put in a sell order, pronto. I’m sure he didn’t listen. Since then, I’ve been watching GME like a hawk. My nephew is up like 75-80%, even after yet another volatile week. Maybe I’m in the wrong. Maybe I should get him to write a guest post for Bull Sheet, because I can’t figure out the attraction of these meme stonks.

***

Have a nice weekend, everyone. I’ll see you back here on Monday… But first, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

A boom-time indicator. The benchmark S&P has hit a series of all-time highs. The economy is rebounding. Jobs are coming back. Sounds like a good time to buy stocks. Right? Before you do, read Shawn Tully's piece on the famed CAPE stock-price indicator, which foretells ups and downs in the market.

Mark your calendars. At the end of next week, my colleagues and I will be brining you the latest Fortune Quarterly Investment Guide. It's a special feature for Fortune subscribers that's loaded with investment tips and analysis. You can check out past issues here.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

Quote of the day

There is a lot of soul searching now at the SEC because the floodgates were wide open over the last nine months and now the new administration wants to normalize the process a little bit.

That's Ari Edelman, a SPAC attorney, telling the Wall Street Journal that Washington will become a much more active sheriff in policing blank-check IPOs. Yesterday, an SEC official warned companies to dial down the—erm—misleading statements that often accompany these new offers.