This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning.

It’s looking like a risk-on Friday. From Tokyo to Frankfurt, shares are up across the board, and that’s providing a bit of a lift for U.S. futures. As I type, The DJIA and S&P 500 are well within range of recouping their losses for the week. That’s as the data continues to show the U.S. economy is resurgent, helped by an expanded COVID vaccine push.

Let’s spin the globe, and see where investors are putting their money.

Markets update

Asia

- The major Asia indexes are closing out the week on a high note. The Nikkei is up nearly 1.6%.

- If you’re searching on your smartphone for an Hennes & Mauritz outlet in China, don’t be surprised if you get no results. Reports are flooding in that the popular H&M clothing retailer has been somehow erased from digital searches following an escalating spat over human rights in China’s Xinjiang region.

- The latest in the Suez crisis: At this rate, it’s going to take another week to get the Ever Given unstuck. Which means: at least another week of hilarious internet memes.

Europe

- The European bourses are broadly higher out of the gates with the Stoxx Europe 600 up 0.9% in the first half-hour of trading. Every sector is in the green, including: tech, banks, autos and energy.

- Even with the promising start to Friday, European stocks are down mostly for the week as COVID cases spike, and more pressure falls on Brussels to speed up its vaccine drive.

- Yesterday, the EU revealed that 77 million vaccines made in the EU have been shipped abroad to countries across the Global South, but also the United Kingdom and U.S. of A. For those keeping score, that COVID vaccine export figure amounts to 77 million more than what the United States and Britain have shipped beyond their borders. Reminder: the rich-country-first approach isn’t sound policy to combat a global health crisis.

U.S.

- U.S. futures continue to gain in morning trade. That’s after an afternoon rally pushed all three indexes into the green on Thursday.

- Yields on Treasuries continue to flatline. The 10-year trades around 1.65%.

- Shares in GameStop are up in pre-market trading this morning, after soaring 52% yesterday. Investors cheered the news that a Jefferies analyst upped her price target to $175.

Elsewhere

- Gold is flat, trading around $1,725.

- The dollar is lower after hitting a four-month high yesterday.

- Crude is rebounding, but it’s been just a brutal week. Brent is trading below $63/barrel.

- Bitcoin is that drippy watch in a Dalí painting. We gawk as it loses shape and form, settling around $53K.

***

By the numbers

118.49

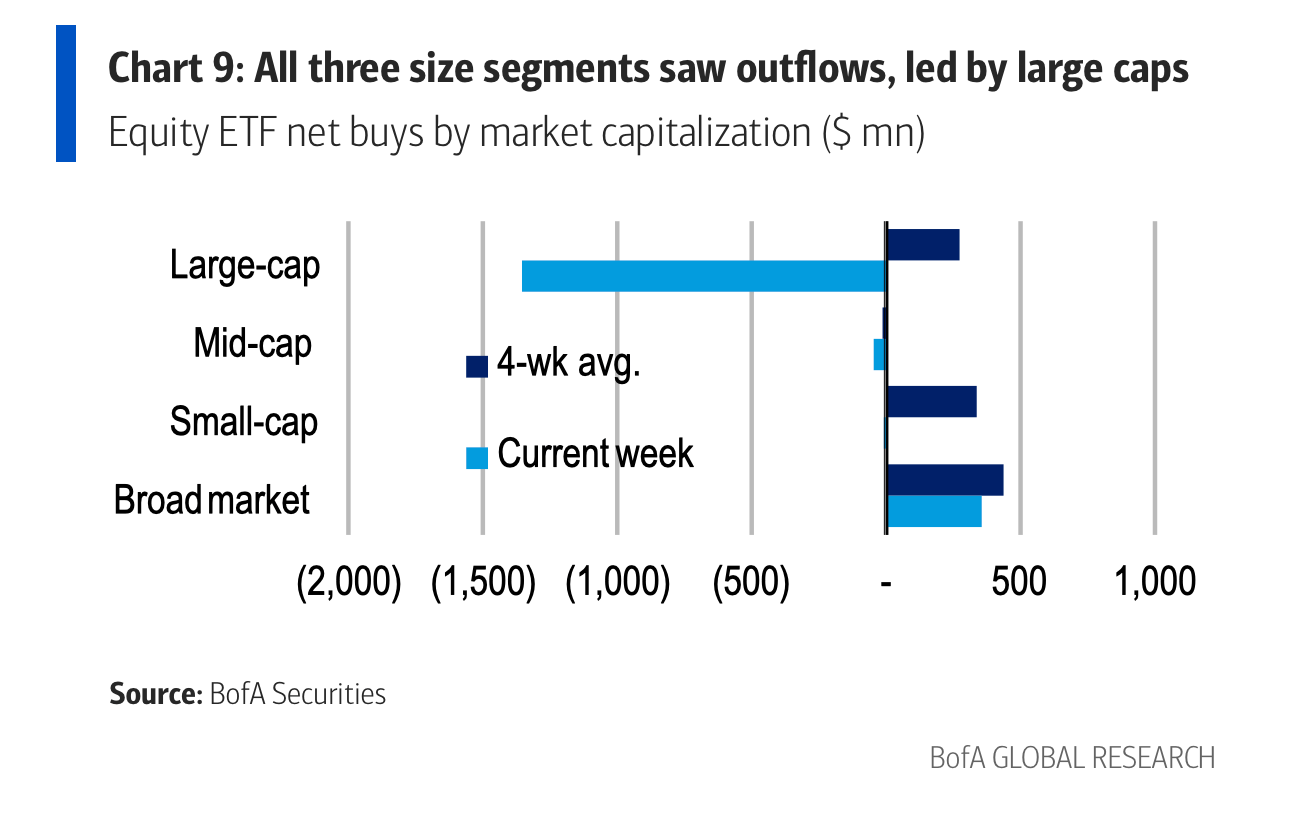

It’s been another tough week for bulls, particularly tech bulls. Over the past five trading sessions, the tech-heavy Nasdaq is down 1.1%, or 118.49 points. Among the FAANGs, Apple, Netflix and Amazon continue to underperform the S&P 500 YTD. In fact, that trio are all solidly in the red for 2021, with Apple down 9%. In fact, AAPL is down 15.8% from its Jan. 26 all-time high. If you take ETF inflows as an indicator, investors are continuing to seek out alternatives to big caps. Were such a trend to persist, it would hurt some of the biggest name in the Nasdaq 100. Here’s the view from BofA’s latest client flow trends report:

Underperform

Congratulations. You’ve decided to go long on a beloved video-game retailer as you believe the brand is ripe for a turnaround in the age of gamer mania. Your bet pays off. Trading is volatile, but you can live with that as your stake is up 875% YTD. Well played! But you still want some clarity from management. In the latest analyst call, earlier this week, the executive team surprises everyone. They bar the customary Q&A portion of the call. That’s after the company had reported, earlier in the day, abysmal top- and bottom-line figures. (And those results were greatly aided by a big fat tax credit). Yes, I’m talking about GameStop. Shares of GME continue to 🚀 up, but that performance is largely unconnected to anything the company is doing right in its business. “Given the continuation of very challenged results for GME,” BofA Securities equity analysts write in an investor note, “change is needed and soon.” They reiterate their underperform rating. Since that report came out on Wednesday, GME shares are up 50%.

52

The markets got a really good dump of data yesterday. Jobless claims fell to a 52-week low—the first time the tally dipped below 700,000 since the start of the pandemic. The markets have been all but ignoring employment data throughout this epic bull rally, but we should admire what we saw yesterday. Those numbers are a clear sign the recovery is well under way.

***

Postscript

This hasn’t been an easy week. The twins’ home-schooling schedule has been really erratic, and that’s messing with everybody’s routine.

Particularly Scilla’s.

She usually snoozes at my feet most of the morning while I bang out the newsletter.

But, with ample time to kill, the girls have been interrupting her beauty sleep to play coiffeur.

Behold, the puppy bun.

She hates it.

***

Have a nice weekend, everyone. I’ll see you back here on Monday… But first, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's read

The mortgage that pays you. Europe's historically low interest rates are creating some odd market distortions. The Wall Street Journal has a great piece about homeowners in Portugal who get a payment each month from their bank. That's what happens when Euribor, the rate that determines what you ultimately pay on a flex-rate mortgage here in Europe, falls below zero.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

"I'm here for the vaccine job!"

It's Friday, so something light...Comedian Jeff Wright—of Late Night with Seth Meyers fame—imagines the COVID-19 vaccines all competing for the big job—the job to vaccinate the public. The 3-minute video is pretty hilarious.