The rotation trade is all the rage.

And Bank of America certainly isn’t missing out. Coming off a huge year for tech and growth stocks in 2020, the bank is now looking at stocks that are poised to benefit as the world gets back to normal and inflation starts to pick up once more.

Indeed, some market prognosticators are expecting rates (and the 10-year Treasury yield) to rise higher—and faster—than some on the Street expect. “If we go to 2% [10-year yield] by May, you’re going to see growth go through another bout of real pain, and you’re going to see further acceleration into this value trade,” Morgan Stanley’s senior portfolio manager Andrew Slimmon recently told Fortune. “I think the rotation will continue.”

Whether or not rates get to that level in two months, strategists at Bank of America argue that inflation is coming, as they wrote in a Monday report.

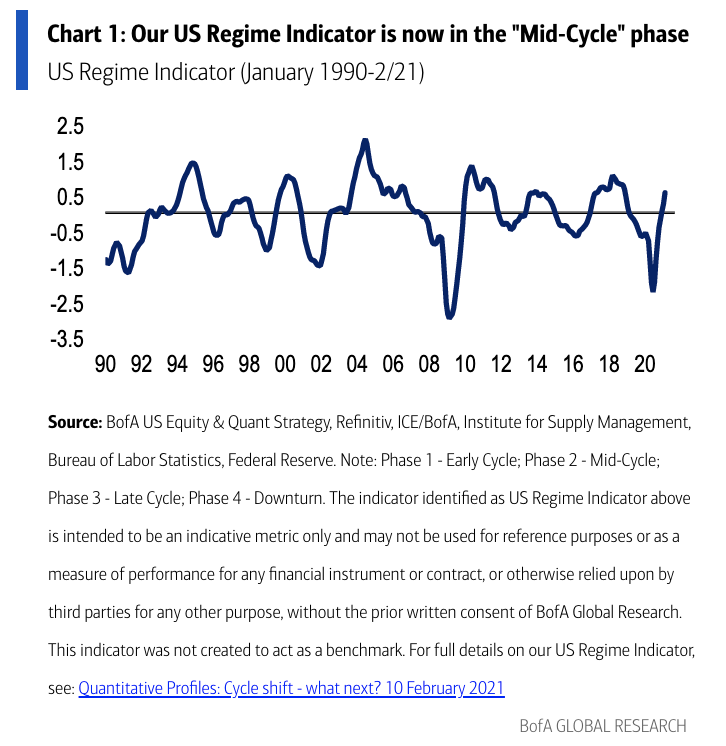

The BofA strategists suggest that the market is now “mid-cycle” where inflation is typically stronger (see BofA’s chart). “In this phase,” the strategists wrote, “small caps and value have typically outperformed large caps and growth—further supported by the profits recovery and economic rebound we expect this year.”

BofA’s reasoning is based not only on rising inflation expectations but also the current political regime. “After years of low inflation and oligopolistic trends within the equity market in which larger companies have continued to take share (contributing to peak income and wealth inequality and suppressing wages in recent decades), this could finally be reversing given pro–small-business sentiment and a focus on social/income equality by the Biden administration, along with potential regulation and anti-monopolistic sentiment in areas like Big Tech,” the strategists wrote.

Though small-caps have done well lately (The Russell 2000 is up 19% so far this year), they are still about 10% cheaper than large-caps based on forward price-to-earnings, BofA wrote. And within small-caps, areas like energy and materials are still trading inexpensively based on historical levels.

7 stocks for the next phase

BofA strategists outlined a group of stocks that “appear poised to benefit from both the recovery (exposed to reopening/services spend or capex) and reflation (inflation beneficiary with pricing power or margin drivers), and where valuation isn’t stretched.” Here are seven of the bank’s picks.

BofA analysts like Comcast, as it should benefit from a return to theme parks and production of shows and films; Disney, with pent-up demand for its theme parks and exposure to the reopening of theaters; Marriott, which should benefit from inflation “as higher room rates and revenues pass through to the company’s fee-based model,” per the BofA analyst; Hess, a preferred oil and gas player to the bank; Principal Financial, which, as a life insurer, is “generally positively correlated to inflation,” the analysts note; Emerson Electric, which should be a “key” beneficiary of a rebound in oil prices; and Broadcom, as it’s poised to benefit from the reopening of enterprise spending and the continued rollout of 5G.

More must-read finance coverage from Fortune:

- Bitcoin? Food? Debt? How most Americans actually plan to spend their stimulus checks

- Companies face calls to bring “dark money” political spending into the light

- Your stimulus check could disappear before you ever see it, thanks to debt collectors

- After its IPO, Coupang eyes South Korea domination

- Everything the new stimulus package includes for college students, from emergency aid to tax-free loan forgiveness