Despite a bout of volatility on Monday, stocks overall have continued to hit new highs.

Markets were undeterred by a tumultuous election, chaos in the Capitol, and roaring coronavirus cases, to name just a few news events from the past few months. But now some on the Street see a correction in the cards moving into February.

With the S&P 500, Dow, and Nasdaq all swinging in the red (and back again) in trading on Monday, “The kind of craziness we’re seeing right now is not atypical of the kind of craziness you tend to see when we’re ready for a little bit of a downturn,” Randy Frederick, vice president of trading and derivatives at Charles Schwab, tells Fortune.

Indeed, Stephen Suttmeier, a technical research strategist for Bank of America, sees “tactical risk” from a variety of factors including “a lack of bullish confirmation of the rally into early 2021 from the percentage of [S&P 500] stocks above 10-day and 50-day moving averages,” and signs of “upside exhaustion” that, coupled with “bearish February seasonality,” could increase the “risk for an interruption of the equity rally,” Suttmeier wrote in a Monday report.

Others like CFRA’s Sam Stovall point out “the breadth picture suggests that these latest highs are not well-supported and that a pause or pullback may be impending,” he wrote in a Monday note. And “on any pullback, support is established at 3695 and 3633” points for the S&P 500, he suggests. Meanwhile Schwab’s Frederick points out that put/call options ratios are heavily leaning to the call-side, meaning “people are, for lack of a better term, irrationally bullish right now and really of the mindset the market is only going to go up,” he suggests.

February ‘weakness’

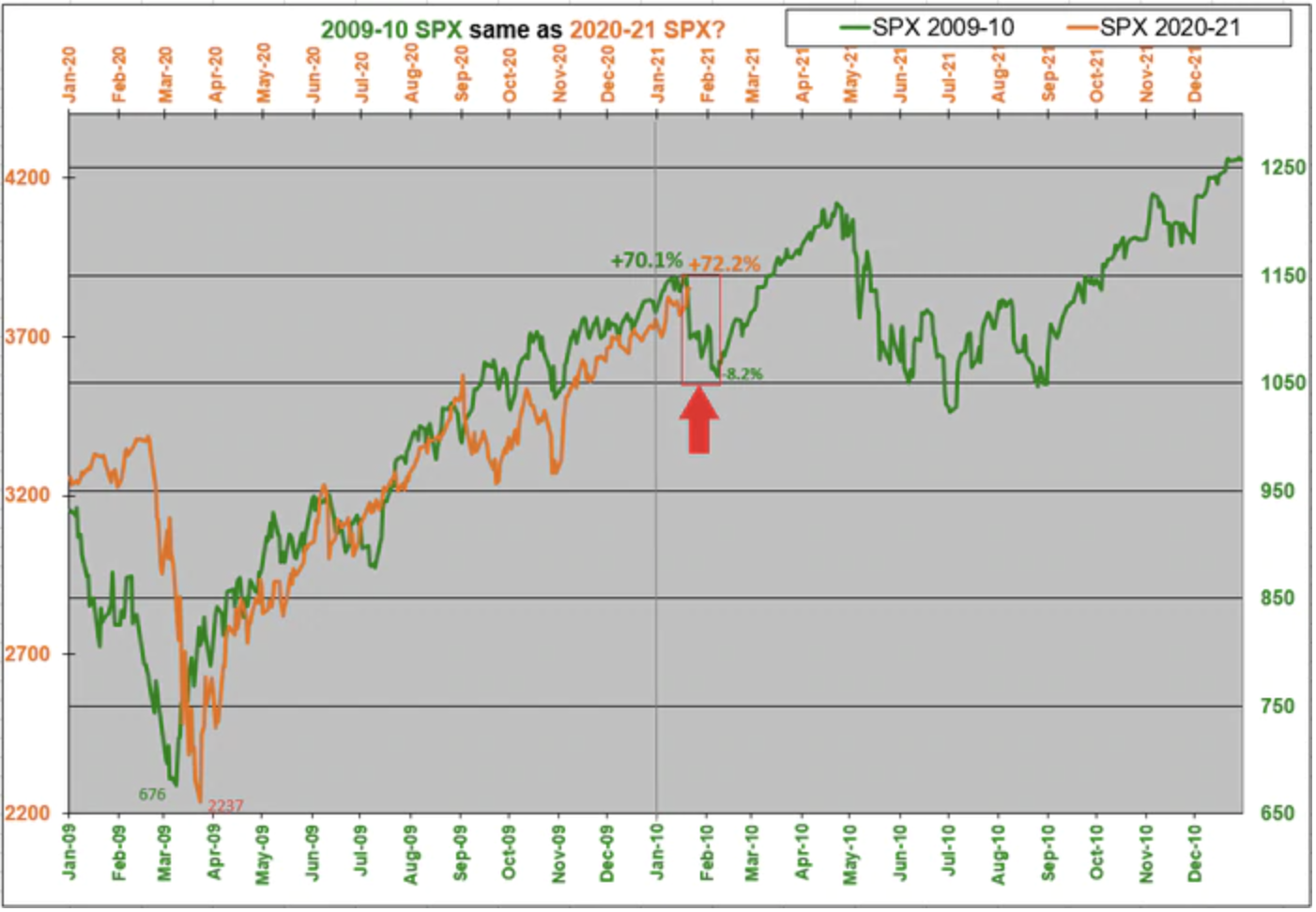

A possible February correction also lines up with a few key historical patterns, including the rather uncanny way the S&P 500 has been tracking the 2009 rally since last year, and the historical performance of markets following the inauguration of a new president.

The former has been an interesting storyline for the S&P 500 in 2020 and, seemingly, in 2021 so far. “Assuming we follow something even loosely to that, it wouldn’t be surprising at all to me to see February be somewhat of a weak month,” Schwab’s Frederick says (see Schwab’s chart).

Indeed, “If we get a pullback, I’d say anything in the 5% to 10% range, then I would say, ‘Okay we’re still on that roadmap,'” he says. “I kind of see it as the make-or-break moment of whether that roadmap continues to work or doesn’t.”

Meanwhile, those like LPL’s Ryan Detrick point out that it’s normal for markets to show some weakness (even into March) following the inauguration of a new president, via data going back to 1950.

And BofA’s Suttmeier points out February in general can be “a bearish month for the [S&P 500] in terms of seasonality back to 1928.”

Of course with the market’s remarkable resilience in 2020 and the consistent all-time highs, there’s no guarantee stocks will be knocked too far off course from their trajectory. And analysts argue Congress passing another stimulus package to follow the $900 billion deal in December could add more juice to the rally—likely creating more stimulus-check-sized investments in the market.

Buy the correction?

If investors do get a breather, however, some strategists think it could provide a nice buying opportunity.

BofA’s Suttmeier argues “the risk (or potential) is for a buyable correction within a larger bullish trend for equities.”

Suttmeier and others like Frederick believe the S&P 500 will end the year higher (Frederick is predicting 10% to 15% up). And with the government and Fed remaining accommodative from a fiscal and monetary standpoint, “Frankly, [that] is why we’ll continue to see markets go higher,” says Frederick.

“When we get a pullback,” he adds, “we will see buyers.”