The pandemic is a watershed moment for clean technologies. After a quarter century in which politicians have found it easier to sign climate agreements than keep them, governments in Asia, Europe, and North America are turning to clean technologies to power their post-COVID economic rebounds. But if governments are serious about rebuilding the global economy with sustainability in mind, they cannot simply throw money at the problem. We need ways to mobilize all parts of the economy to rapidly commercialize new clean technologies and get them into widespread use.

Momentum is gathering on climate action as realization grows in government that sustainable technologies can drive job growth and emissions reductions. President-elect Biden, who has already dubbed himself the “climate-change president,” is proposing $1.7 trillion in spending on priorities like transit, clean power, smart agriculture, and building retrofits that would employ millions. Not to be outdone on the pithy turns of phrase, U.K. Prime Minister Boris Johnson has called for a “green industrial revolution” to create 250,000 jobs. He plans to phase out the sale of gas-powered vehicles within a decade and will invest £12 billion ($16.1 billion) on projects including expanding hydrogen, nuclear, and offshore wind-power generation and carbon-capture technologies.

Meanwhile in Canada, Justin Trudeau’s government unveiled $100 billion Canadian ($77 billion) to build a greener economy, just days after tabling legislation that legally mandates the country to reach net zero emissions by 2050.

This renewed urgency is a welcome departure from the cycle of fanfare followed by slow progress that followed the climate agreements at Kyoto, Rio, and Paris. But there’s a wrinkle: According to the International Energy Agency, more than a third of future emissions cuts will come from technologies that are only at the prototype stage right now. With the climate emergency becoming more pressing by the day, it’s vital that these technologies get out of the R&D lab and into production as quickly as possible.

The good news is that even before governments opened the funding floodgates, cleantech was growing strongly and set to become a $2.5 trillion market by 2022, according to Canada’s Smart Prosperity Institute. Venture capitalists are sensing opportunities and have invested $16.3 billion in the sector in 2019, compared with just $418 million in 2013, according to PwC.

What are needed now are strategies to capitalize on this growth by bringing together the public sector, businesses, tech ventures, researchers, investors, and regulators to speed the commercialization of new clean technologies. In this effort, bigger businesses have a particularly vital role to play. With their deep pockets and broad reach, corporations can help fund development of technologies and accelerate their entry into the market by adopting them across their footprints. Corporations already spend hundreds of millions a year on climate initiatives. For instance, Google recently announced it has become carbon neutral and Amazon has set up a $2 billion fund to invest in climate initiatives.

New efforts are now emerging that bring a range of partners, including big businesses, to the table to help accelerate the growth of cleantech ventures. Third Derivative, a new accelerator focused specifically on clean energy, recently accepted its first cohort of 50 startups from more than a dozen countries. The companies run the gamut of sustainable technologies and include Summit Nanotech, which is creating a clean process for extracting lithium for use in batteries, and Gricd, a manufacturer of IoT monitoring systems to reduce wastage of chilled food and medicines. One of Third Derivative’s major advantages is its large stable of corporate partners that include BP, Microsoft, Wells Fargo, Shell, and AT&T.

MaRS, where we are executives, is launching Mission from MaRS, an initiative to identify the most promising clean-technology ventures in Canada that can rapidly cut greenhouse-gas emissions. The program will assess ventures from across the country. After the selected companies are announced in May, they will be paired with a curated team of investors, regulators, potential customers, and corporate investors including HSBC and RBC banks. The selected companies will also receive a validated assessment of their potential to reduce carbon emissions, which can be an important sales tool.

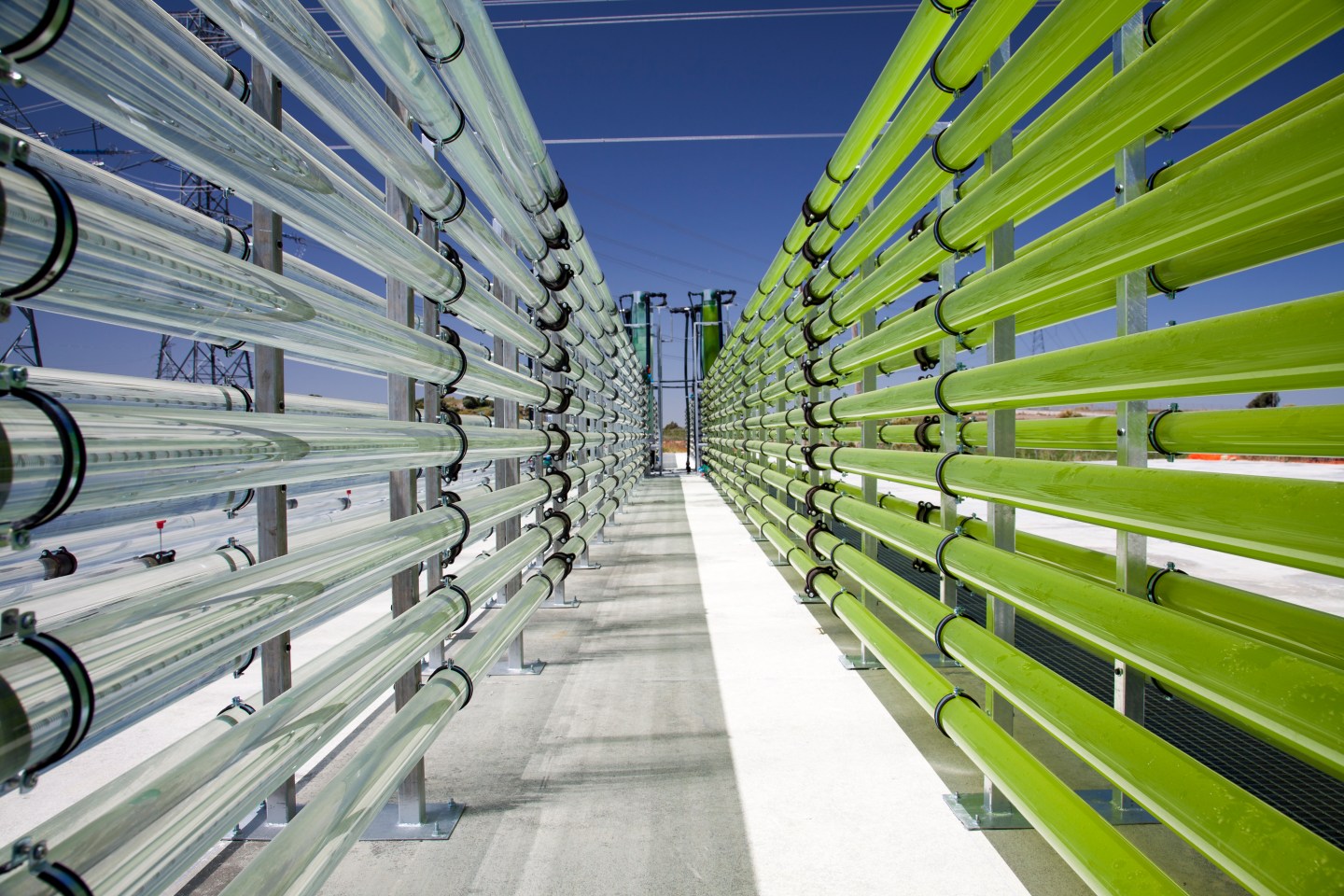

Programs like these are needed because cleantech companies face a unique set of challenges. These businesses are solving some of the toughest issues we face using tools like precision engineering, advanced analytics, and artificial intelligence. These endeavors are far more complex than, say, building a smartphone app: Perfecting a system for storing clean energy, or extracting carbon dioxide from the air, or routing transit more efficiently takes years and can be capital intensive. These ventures have enormous potential to create a sustainable economy and generate shared prosperity, but they require patient capital and extensive support systems to accelerate their growth.

As governments commit billions to building back better, it is essential this money is spent wisely. Policies like R&D tax credits, export support, and funds to support early-stage startups are vital, but we must look beyond these to assemble end-to-end support systems to clear the path for rapid development of clean technologies and accelerate their mass adoption in the market. As devastating as the pandemic has been, it has given us a once-in-a-generation opportunity to realign the economy and change course on climate change. We must not waste it.

Yung Wu is the CEO of MaRS Discovery District, an innovation hub based in Toronto. Ray Newal is the managing director, Ecosystems, for MaRS.