Our mission to help you navigate the new normal is fueled by subscribers. To enjoy unlimited access to our journalism, subscribe today.

Does the stock market know something the pollsters don’t?

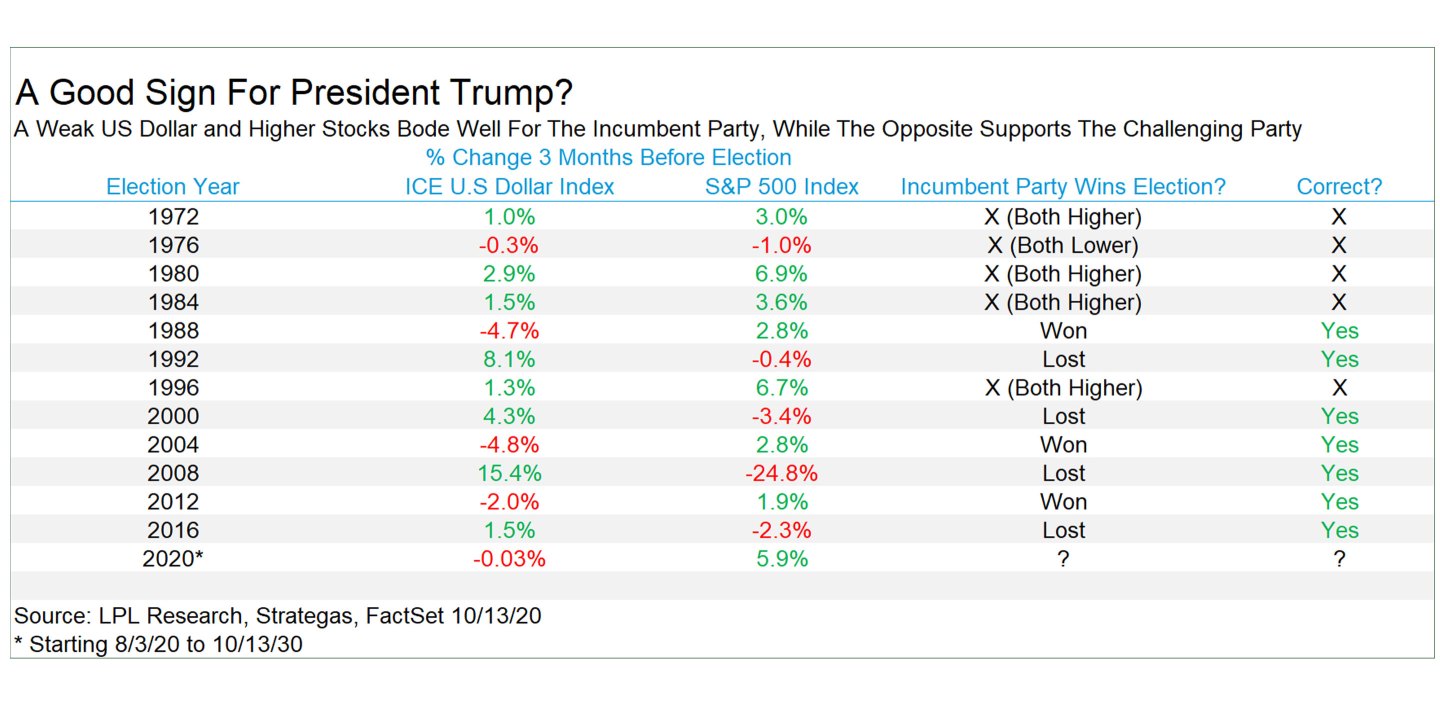

That’s the takeaway from Ryan Detrick, chief market strategist for LPL Financial, who has been closely monitoring both the overall stock market’s moves as well as the U.S. dollar.

As he wrote Friday, “We’ve noted before that stock market gains ahead of the election historically support the incumbent party, while if stocks are lower it tends to support new leadership in the White House.” Detrick adds that the dollar is another indicator worth watching. “In fact, when stocks are up and the U.S. dollar is lower ahead of the election, or if stocks are lower and the U.S. dollar is higher before an election, the results have accurately predicted the last seven times those scenarios took place. Given stocks are up and the U.S. dollar is slightly lower, this could be one clue the upcoming election will be much closer than many are expecting.”

Indeed, despite a commanding lead in national polls, there are indications that support for Trump is somehow being undercounted. As Fortune’s Jeremy Kahn wrote this week, an A.I. tool that correctly predicted Brexit is showing a tight race. Expert.ai, explains Kahn, “uses an A.I. technique called ‘sentiment analysis’ to understand the emotions being expressed in social media posts. The company’s analysis puts Democratic candidate Joseph Biden ahead of President Donald Trump, 50.2% to 47.3%, a margin that is much narrower than the double-digit lead that Biden has over Trump in most national opinion polls.”

Other favorite Wall Street election indicators show a mixed bag. Fortune’s Rey Mashayekhi wrote that FiveThirtyEight’s Nate Silver considers the ISM Manufacturing Index to be the best metric for predicting elections. On that front, “if the ISM averages above 50 during that time (signaling an expanding manufacturing sector), that tends to bode well for the incumbent party, while an ISM average of below 50 (reflecting a contracting manufacturing sector) usually corresponds with a new party taking control of the White House.” With the index at 50.3 through the first nine months of the year, that’s another piece of data that suggests this election is still way too close to call.

More must-read finance coverage from Fortune:

- What Wall Street needs from the 2020 election

- How J.P. Morgan is proceeding with extreme caution—and still making plenty of money

- “A tale of two Americas”: How the pandemic is widening the financial health gap

- A disputed election could cost the U.S. its “AAA” credit rating

- As earnings season kicks off, only 48% of companies have resumed giving investors guidance