This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Happy Friday, Bull Sheeters. Asian and European stocks, as well as U.S. futures, are trading sideways as investors weigh what the conflicting economic data and mounting COVID-19 case load means for the economic recovery… And, Netflix bulls, you may want to avert your eyes.

Let’s check in on the action.

Markets update

Asia

- The major indexes are mixed, with the Hang Seng leading the way, up 0.5%.

- In their business dealings with China, U.S. corporate giants such as Walt Disney and Apple have become mere pawns of the Chinese Communist Party. The accusation of a disgruntled shareholder? Nope, that was Attorney General William Barr in a withering speech yesterday.

- COVID-19 cases have raged past 1 million in India with more than 25,000 deaths, forcing the once-booming economic power to reimpose lockdown measures.

Europe

- The European bourses were mixed at the open with Germany’s DAX up 0.3%, before slipping.

- Euro stock- and bond bulls beware: EU leaders convene a two-day make-or-break summit today to decide on the €750 billion coronavirus bailout package. Dutch PM Mark Rutte, part of the “frugal four,” told reporters this morning that chances for a deal this weekend are less than 50%.

- An EU court yesterday threw out a U.S.-EU data-sharing deal on Thursday, plunging the “$7.1 trillion transatlantic economic relationship,” as the U.S. Commerce Department calls it, into disarray.

U.S.

- The major averages all fell yesterday on divergent economic data and a record spike in coronavirus cases. The jobless claims, meanwhile, were worse than expected, dousing any enthusiasm from strong retail figures.

- Netflix shares are down 7%, off bigger declines, in pre-market trading after it delivered a weak subscriber forecast for the current quarter yesterday and announced a shakeup in the C-suite.

- Morgan Stanley shares climbed 2.5% after reporting record top- and bottom-line results yesterday, fueled by knockout trading revenues. On cue, Northman Trader’s Sven Henrich quipped: “So the Fed made the banks a bunch of dough. Imagine that.”

Elsewhere

- Gold is flat.

- As is the dollar.

- Crude is down as America’s problems containing the coronavirus contagion muddles the demand outlook. Goldman Sachs now calls a year-end $45 price tag on Brent.

By the Numbers

17 straight. For the seventeenth consecutive time, weekly jobless claims came in yesterday above 1 million. The past few weeks have been among the most worrying as the claims number has more or less plateaued. Yesterday’s official number was 1.3 million, almost exactly as rough as the week prior. Economists had been forecasting 1.25 million. The number was bad enough to wipe out any momentum from yesterday’s impressive retail sales figure, sending markets into the red. With coronaviurus spiking across the country, the hopes for a quick recovery in the labor market, or in the U.S. economy, are fading fast. “Absent a vaccine, the need for ongoing physical distancing will prevent a full recovery,” Michael Pearce, senior U.S. economist at Capital Economics was quoted in CNBC was quoted as saying. The Thursday number is increasingly becoming the number to watch to gauge the health of the U.S. labor market. The monthly jobs report, courtesy of the U.S. Bureau of Labor Statistics, is rife with errors.

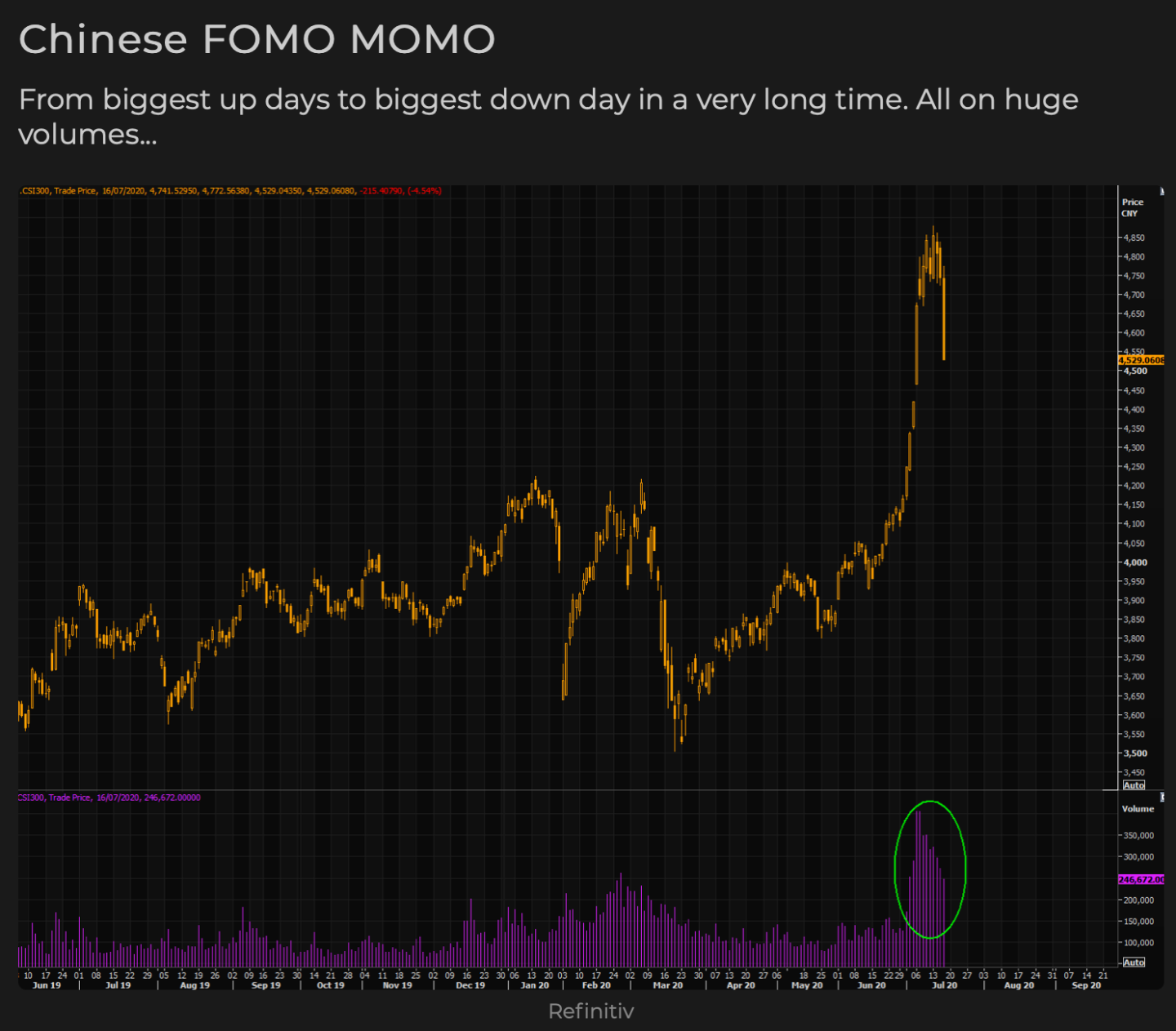

-5%. Last week we were marveling at the Shanghai Composite’s bull run. It had climbed 17.8% between June 15 and July 10, beating even the Nasdaq over that period. Since I wrote that, it’s down 5%. Much of the decline started when the state-run China Economic Times warned last week about the dangers of a “crazy” bull market. Now investment professionals are drawing the same conclusion. “We downgraded China about a week ago, for the very simple reason … it is expensive on an absolute basis, it’s rallied very much to outperform the rest of the region,” Herald van der Linde, head of Asia Pacific equity strategy at HSBC, told CNBC yesterday. Citing Refinitiv data, Market Ear points out that the surge up and and the slump down have both been on huge volumes.

$35 billion. Looking for a decent metric on the true health of the U.S. economy? Follow the billions the banks are pulling from the “P” column on their P&L to cover loan losses—this is the swelling number of business proprietors, home owners and consumers on the brink of default. In the past three days, the big U.S. banks have detailed they’ve set aside $35 billion for Q2. That’s on top of the $24 billion set aside in Q1, according to Bloomberg. The banks are preparing for the worst. So far, provisions from the CARES Act have kept millions of Americans and American businesses solvent. If Congress and the White House fail to agree to an extension in the coming weeks, the banks fear, the insolvencies will skyrocket.

***

Have a nice weekend, everyone.

A programming note: in a few hours, I’ll be driving down South for a week’s vacation. Bull Sheet will be in the capable hands of Rey Mashayekhi next week. I’ll be reading along from Magna Grecia.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Today's reads

PPP goes crypto. The Department of Justice charged a Texas man with fraud for securing $1 million in federal paycheck protection bailout money and allegedly investing the proceeds in bitcoin. The man got the dough for his "Texas Barbecue" business, which is little more than a website with no employees.

Quarterly Investment Guide. Fortune's crack team of finance reporters have been working on the new investors' quarterly. This edition will be dedicated to real estate. Fortune subscribers get first crack at their findings, analysis and rich data beginning today at 6 a.m. ET (noon, Rome time). Here's the link.

Some of these stories require a subscription to access. There is a discount offer for our loyal readers if you use this link to sign up. Thank you for supporting our journalism.

Market candy

79%

According to a new academic study, removing passengers from the middle row of a commercial airplane will reduce the COVID risk by 79%—and [not calculated] boost passenger satisfaction by a few million percent. So, all U.S. carriers are keeping the middle row clear, right? Wrong. As Fortune's Jeff John Roberts notes, "Delta, JetBlue and Southwest have chosen to keep middle seats empty, while United and Spirit are filling them."