“It’s different this time.”

That, says Hank Smith, co–chief investment officer at The Haverford Trust Co., is what every bear market feels like. “The common theme is fear and panic,” he says, and a feeling that “we have not been here before.”

A series of big losses, repeating in cycles, spooks investors, who then start to panic. Just as conditions seem to be getting better, things fall again.

That’s exactly what happened earlier this month. The Dow had its biggest one-day loss on March 12, 2020, since the 1987 all-time record and dropped into bear market territory, with the S&P 500 following. Though there have since been a few up days—including the best day percentage-wise since 1933—many investors are settling in for an unsettling time.

Understanding a bear market, especially for those who haven’t experienced one before, can be maddening. Investors—including everyone with a 401(k) or IRA—can’t know they’re in one until after it begins. And there’s no telling how long it will last.

For perspective, we turned to Wall Street veterans who lived through the three most recent big bear markets—the 1987 crash, the dotcom crash, and the financial collapse.

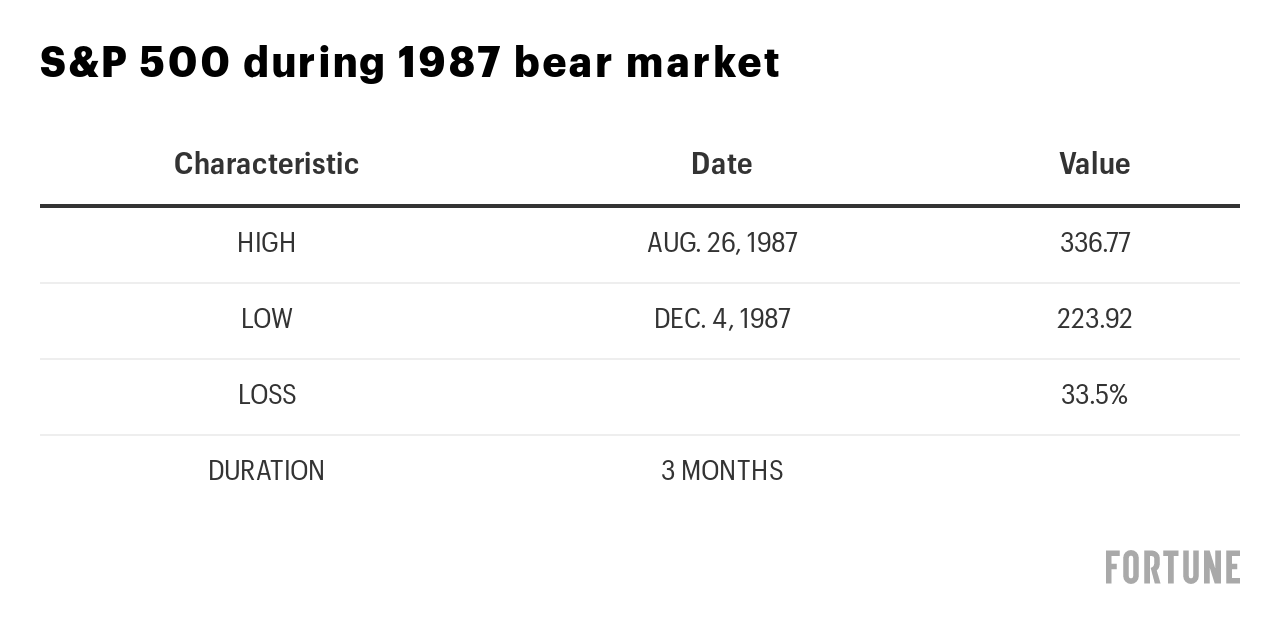

1987 bear market

When people talk of the 1987 crash—Black Monday—it’s typically a reference to one of the biggest one-day percentage market drops ever. On Oct. 19 of that year, the S&P 500 fell by 20.5%, which was a lot easier back then given how much smaller the values were compared with current values over 2,500. Remarkably, that bear market only lasted a relatively short three months.

What comes first to mind for Judith Villarreal, general counsel and chief compliance officer for CoreCap Investments, is something else. At the time, she was working in compliance at a firm that cleared almost all of the market index futures traders in Chicago.

It was a manic day. The company ordinarily guaranteed the finances of the professionals trading on the then exotic futures markets. Business was so furious that one of the owners had to write a $6 million check to the firm the next day to cover all the trades. Employees placing the transactions from traders were all men. Management gave each a razor and a coffee can (to avoid bathroom breaks), and told them to stay in place.

Villarreal had a tiny office across from the kitchen. “Every time someone walked by me, they said, ‘Another hundred points down,’” she recalls.

Some people knew the previous good times wouldn’t last, but that didn’t help when the market orders hit the fan. “The fundamentals didn’t support the prices, and yet everyone was shocked that the markets corrected themselves,” Villarreal says.

“If you’re worried about whether social security is going to be there, and your 401(k) is worth 22% less today than yesterday, and you can’t buy toilet paper, the effects are cumulative and affecting consumers in ways the 1987 crash didn’t,” she adds. “That makes it a wider-spread panic.” But she has advice from then.

“I was very young in ’87,” remembers Villarreal. “What the older professionals were saying was, when the market does this, you should look at it like when Macy’s puts stuff on sale. You have the opportunity to buy good stuff cheap. And that’s eventually what turns the market around.”

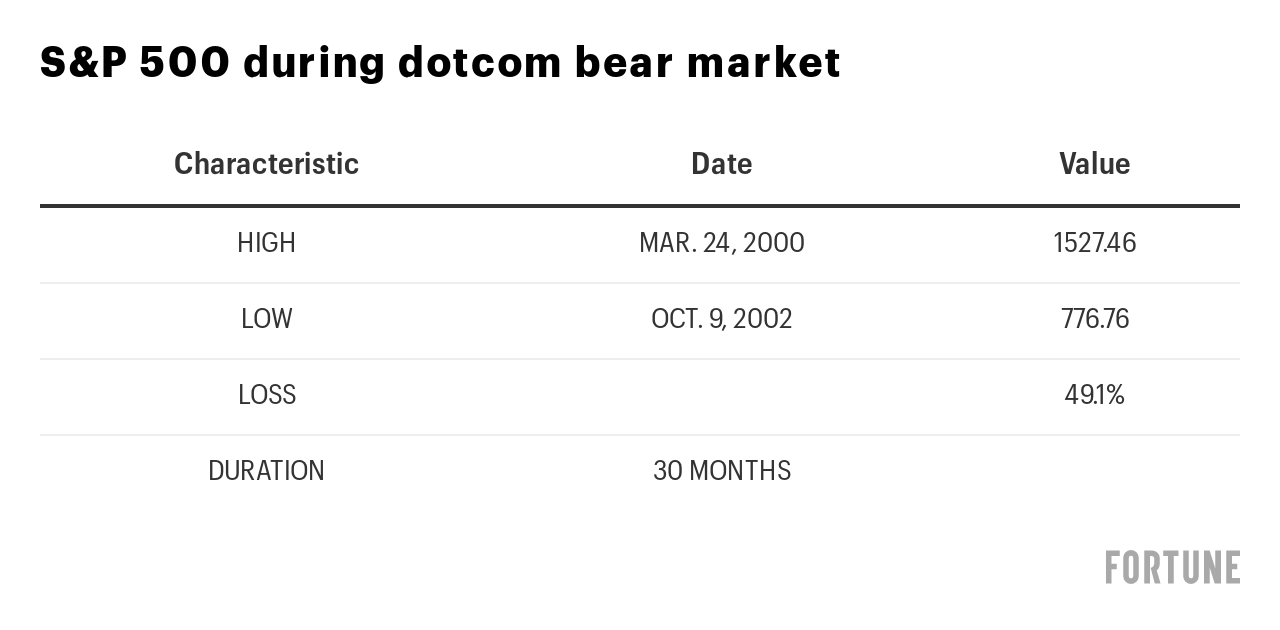

Dotcom bear market

For those who don’t remember dotcom madness, it can be hard to explain. Tech companies, and their investors, swore that business was different than ever before. No need to think of profits. Just get eyeballs—and figure out what to do with them later.

The money tossed around was outrageous.

Stephen Akin, a registered investment adviser who worked for some major brokers back then, and his wife were sailing enthusiasts. On a vacation in St. Thomas, they saw a sweet sailing yacht at the dock. On the back was painted the name, Dot Calm.

“When I saw that boat in St. Thomas, that was the first red flag for me,” Akin says. The owners had cashed out while they could. Most were not so lucky.

“It was amazing how long it went,” Akin says. “When you’re in a rising market like we had in the ’90s, everyone kept thinking it would go and go and go.”

Until it didn’t.

Akin remembers not just the power, but the danger, of leverage and overextension. “[Former Federal Reserve chair Alan] Greenspan’s philosophy thought self-preservation would keep the banks and hedge funds in line, because no one wanted to die.” That rational self-interest would be the corrective safety brake.

“But [too many investors] thought someone would protect them,” explains Akin. “That’s why so many of them got so leveraged out.” It’s wiser to realize that, in investing, you can’t count on a rescue and should assume you’re working without a net.

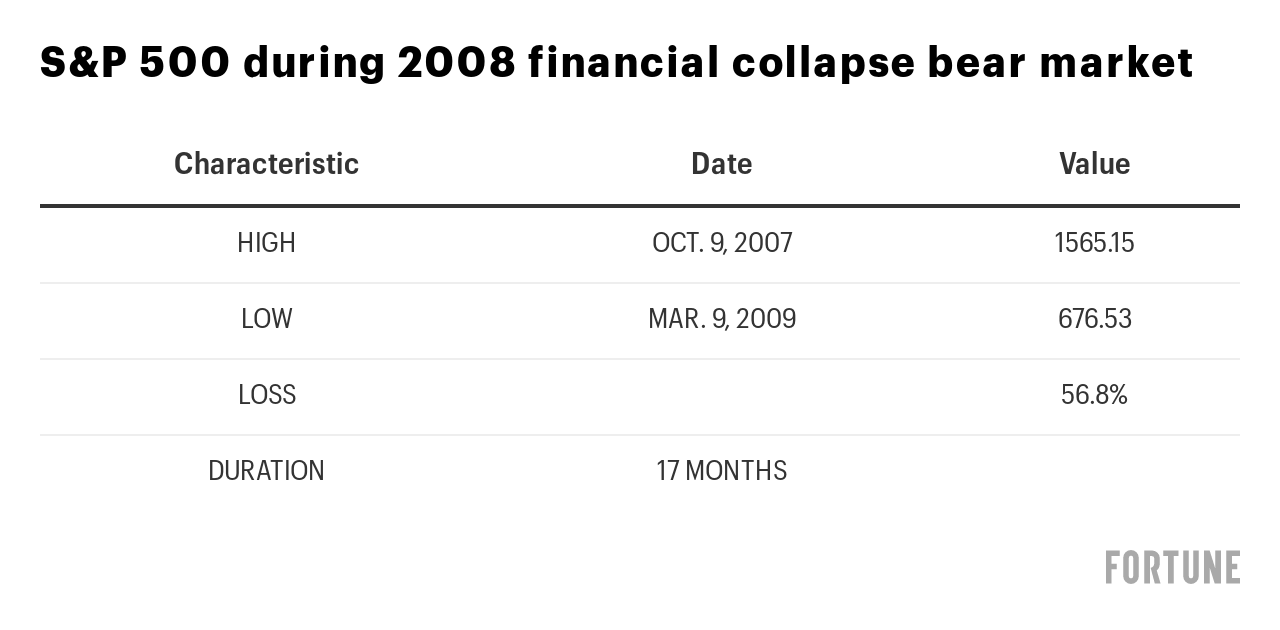

Great recession bear market

Even today, it’s hard to get away from the biggest financial meltdown since the Great Depression. The aftermath has had a long reach even after the bear market turned to the longest bull run ever—one that finally ended Mar. 9, 2020.

“We had a selling climax in January of ’08 that would have bottomed at 80% or 90% of the markets I’d been in,” says Bill Smead, CEO and lead portfolio of Smead Capital Management.

But the time wasn’t normal. “There were two things doing well: energy and China-related activities,” Smead recalls. “People were incredibly bullish about oil because of the emergence of what people thought would be the largest and most successful economy in the world that didn’t exist 20 years before.”

It took a while for investors to realize how much danger was lurking in arcane parts of the financial world. “What exacerbated the final part of [the collapse] was the complete and total fear that came from the idea that because of all the mistakes they made, you couldn’t know what was inside the financial system,” Smead says.

What helped Smead was a book: The Forgotten Man: A New History of the Great Depression by Amity Shlaes. “I felt like I had to go back and understand what had happened in the Depression to be useful to my clients,” Smead recalls. What he got was some distance from the current times and much-needed perspective.

For example, he realized that while 78% of GDP owes to consumer spending, only 20% was really discretionary. “Your electric bill is consumer spending,” Smead notes. “Your housing is consumer spending.” In other words, there was a relative bottom to how low GDP could fall.

Similarly, unemployment happens in sectors, not necessarily everywhere. In the 2008 crash, the heart of the impact came in housing: real estate brokerages, title companies, inspection businesses. “At the peak, it was 4% of all U.S. adult employment,” he says. That was unlike the 1929 crash where “45% of adults were employed in agriculture,” and the crash of banks without deposit insurance destroyed savings and liquidity, forcing many farmers out of business.

Smead realized that he had to look at current market conditions, not those of the previous downturn.

This time, markets are struggling with COVID-19 and the accompanying lack of clarity about when things will turn around. Saudi Arabia and Russia continue to drive down oil prices and push others, like over-leveraged U.S. energy companies, out of business. Again, the triggers are things no one expected.

All people can do is hang in, remember buying opportunities, avoid overextension, look at the conditions governing current markets—and remember that even the worst bear markets eventually turn around.

More must-read stories from Fortune:

—The coronavirus bear market is over already? Not so fast

—Is this your first stock market crash? Some advice for young investors

—Here are two of the biggest losers from the Saudi Arabia oil price war

—Why investors suddenly turned on pot stocks

—Here are some of the most extreme ways companies are combating the coronavirus

—Why it’s so hard to find the next Warby Parker

Subscribe to Fortune’s Bull Sheet for no-nonsense finance news and analysis daily.