More Americans filed for unemployment benefits last week than in any other week in American history. Just under 3.3 million Americans filed for unemployment benefits the week ending March 21, more than four times as much as the one-week U.S. record set in 1982, according to the U.S. Department of Labor.

Many states weren’t prepared fiscally for a recession-level increase in jobless claims, let alone this current historic swell in unemployment claims. A total of 22 states do not have the recommended unemployment trust reserves, according to a Department of Labor report published in February.

“This is going to be something people are going to remember. We’ve never seen a number like this…It is not like a run-of-the-mill recession,” says Dan White, head of fiscal policy research at Moody’s Analytics. Similar to the 2007–09 recession, White says, many states will need to borrow money from the federal government to cover the unemployment benefits tab. Although this time they’ll likely come asking for money sooner.

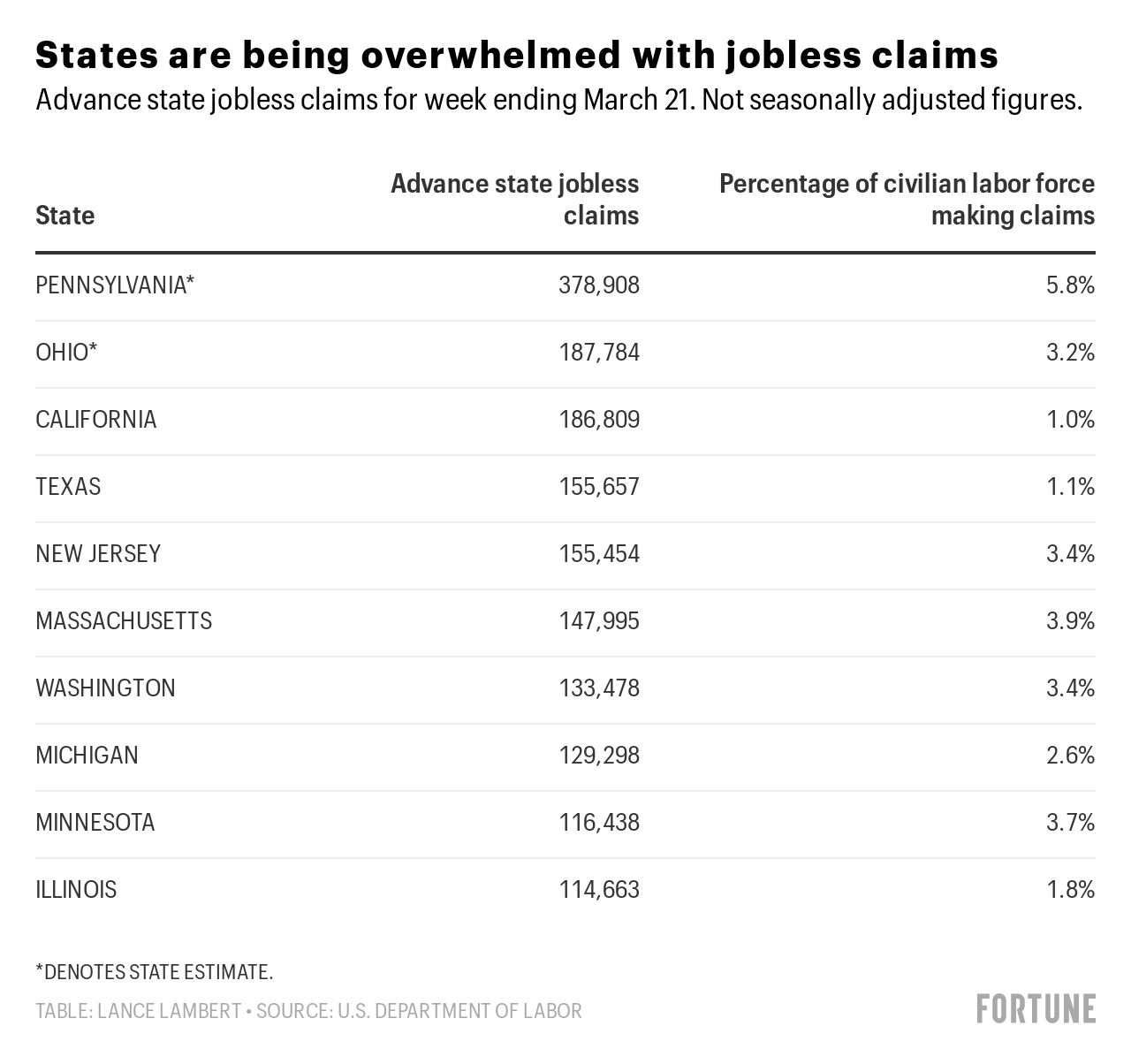

The states with the most jobless claims are the very ones that, the Department of Labor said last month, lacked the reserves for a recession. California, New York, and Texas—three of the four largest states—have the worst unemployment trust fund solvency situation. States like California without the required trust funds aren’t eligible for interest-free federal government loans to cover unemployment benefits.

On March 17 Pennsylvania became one of the first states to order all but “life-sustaining” businesses to close. That explains why Pennsylvania reported the most jobless claims for that week. Pennsylvania is also among the states deemed to lack the adequate unemployment reserves, making it all the more likely the state will be among the first to seek loans from the federal government.

And states might need to brace for more unemployment claims than previously expected. Earlier this week, Moody’s Analytics projected the U.S. will lose an estimated 5 million to 6 million jobs in March, including 2.7 million lost jobs during the week ending March 21. But given that last week’s claims are 600,000 more than expected, Moody’s is now revising its March job loss figure to go even higher.

More must-read stories from Fortune:

—How small-business owners and the self-employed can take advantage of the coronavirus stimulus package

—Everything you need to know about the coronavirus stimulus checks

—The quickest way to boost the economy isn’t even being considered. Why?

—How does America pay for the coronavirus relief bill? With two shiny coins

—Will the “Great Cessation” be worse than the Great Recession?

—Listen to Leadership Next, a Fortune podcast examining the evolving role of CEOs

—WATCH: The U.S. tax deadline has been moved from April 15 to July 15

Subscribe to Fortune’s Bull Sheet for no-nonsense finance news and analysis daily.