The optimistic view from economic forecasters is that the annual GDP growth rate in the second quarter of 2020 will, at best, be -8%. Others predict as bad as -15%. Combined with educated guesses that the first quarter will also see negative growth in retrospect, there’s a good chance the country is already in a recession.

“With the big caveat that we really don’t know, I think it’s reasonable to look for something like 10% to 15% down,” said Scott Brown, chief economist at Raymond James.

“It may be the largest contraction of GDP on record in a specific quarter,” said Gregory Daco, chief U.S. economist at Oxford Economics USA. He expects a 12% contraction.

Forget the expertise and abstruse calculations for a moment. Take a cautious step outside the front door and look at any nearby businesses. Shuttered storefronts, idled workers, the inability to get basic products like toilet paper—all tell the same tale of bad economic times.

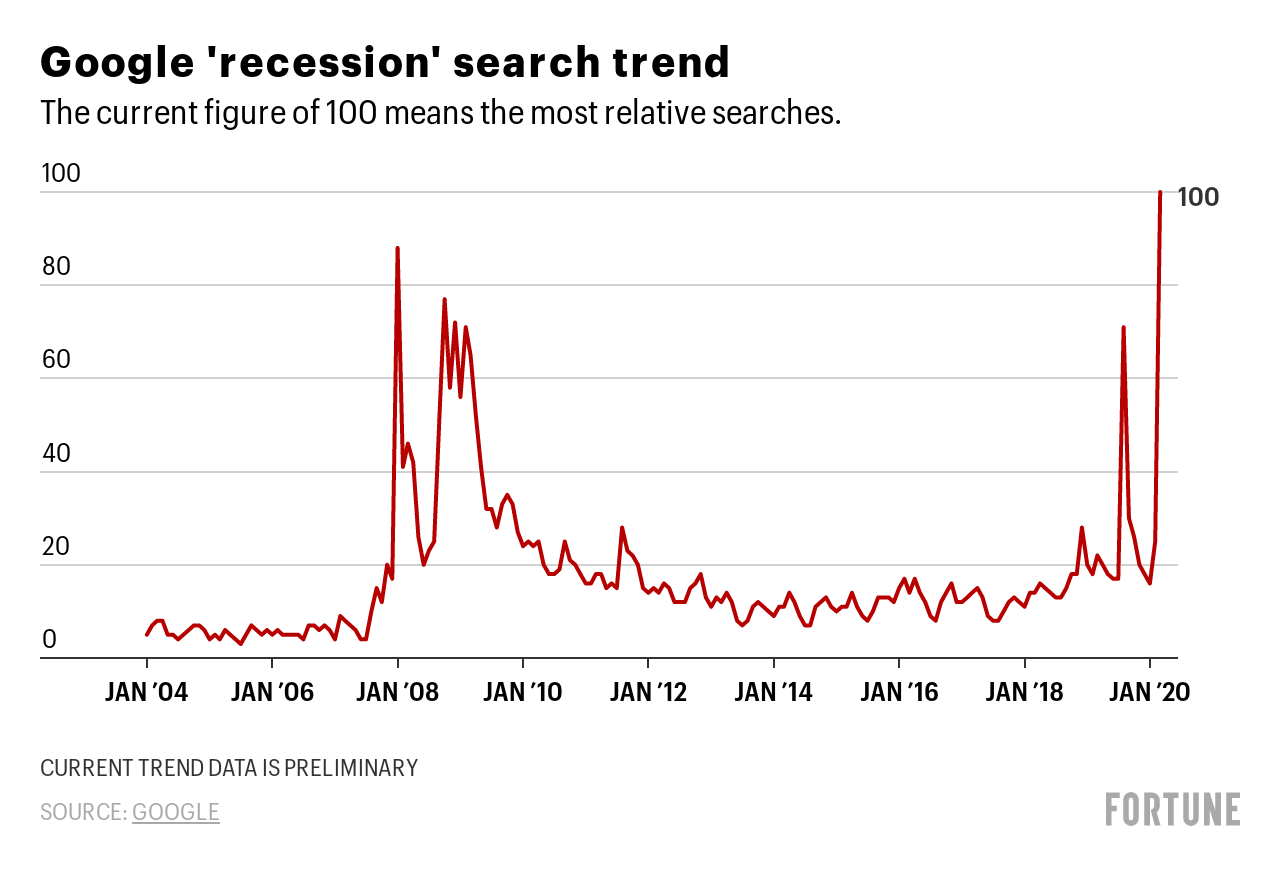

People are rightly worried. In the chart below, Google search trend data on the word “recession” yields the following monthly graph from 2004 to the present.

Some traditional economic measures, like Treasury yields, are mirroring that pessimism. The 10-year bond yield—considered an indicator of investor optimism for the longer term, closed Wednesday at 1.18%. Not great, although better than the low of 0.54% earlier this month—but only after massive liquidity intervention by the Federal Reserve.

Official job numbers for March won’t be out until April 3. Even then, the survey work was done last week. These days, the difference a single day brings can be immense. Today’s weekly unemployment report from the Department of Labor showed claims of 281,000, up from last week’s 211,000. That’s a “sizeable increase” over one week and the largest since 2017, according to Berenberg Capital Markets.

And even that data is already outdated: it doesn’t include yesterday’s news that GM, Ford, and Fiat Chrysler would stop all production in the U.S., Canada, and Mexico for the time being. It all indicates a sizeable and growing hit to the workforce.

Measuring the coming drop

Indeed, getting hard economic data at the moment is difficult. Much of the current data was taken before the more draconian steps that local, state, and national governments have been taking to stop virus transmission.

Normally, models incorporate current data trends and then project forward what path they might take, according to Steven Blitz, chief U.S. economist for TS Lombard. His projection is on the low end at -8.4%. “This is a very different animal because you have an imposed contraction in economic activity because of social distancing,” Blitz said.

While most categories of leisure and service activities are being slashed due to social distancing, there are also offsetting factors, such as increased healthcare spending, government stimulus plans, and reduced imports (which technically increase GDP) that are a result of stymied supply chains and lingering effects of the U.S.-China trade war.

Plus, the negative events all have trickle down effects. People out of work have less to spend in the economy. Companies put off expansions, or even contract operations, which leads to layoffs or reduced hours, which feed into a vicious circle.

Past the second quarter, the estimates spread out, with some experts looking for a rebound beginning in Q3 and really taking off by year’s end. Others look for more losses in the third quarter and say a recovery depends largely on how effectively the federal government moves.

Whatever the final result, the journey is certain to be a bumpy one.

More must-read stories from Fortune:

—This famed economist doesn’t think we’re headed for another Great Recession

—These estimates of how much COVID-19 will hurt the economy are terrifying

—With the markets in turmoil, the ECB readies a bond-buying bazooka

—Here’s where Goldman Sachs predicts the stock market will bottom out—Listen to Leadership Next, a Fortune podcast examining the evolving role of CEO

—WATCH: What’s causing the looming recession

Subscribe to Fortune’s Bull Sheet for no-nonsense finance news and analysis daily.