FORTUNE Analytics brings readers business insights from exclusive data such as the Fortune survey featured in this article. It will launch as a premium newsletter in the coming weeks. Sign up for the debut.

It’s been a while since news broke in 2016 that Wells Fargo had created millions of fraudulent accounts without customer consent. But the fallout isn’t over: On Tuesday, Wells Fargo reported a 53% drop in year-over-year fourth quarter profit, which was pulled down by a variety of legal fees, including those associated with the scandal.

And the bank’s reputation is still taking a hit.

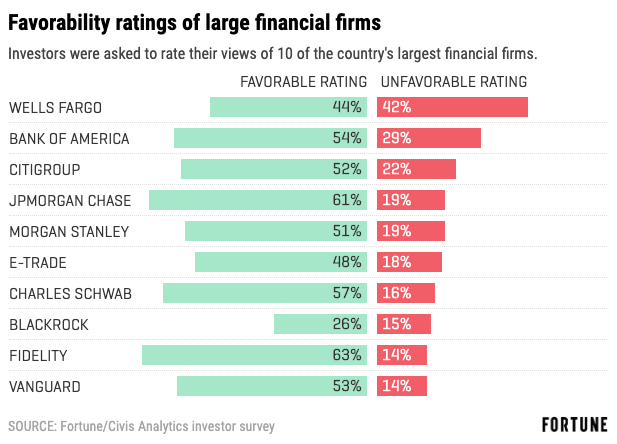

Wells Fargo is the most disliked large financial firm in America among investors, according to a Fortune/Civis Analytics survey* of more than 1,300 investors. The bank has the highest percentage of investors viewing it unfavorably (42%), well above the second and third most unfavorable financial firms, Bank of America (29%) and Citigroup (22%). The good news for Wells Fargo is that 44% of investors rated it favorably.

After the fake accounts scandal, the bank was fined $185 million by regulators. In the fall of 2017, then-Wells Fargo CEO Tim Sloan spoke at a Senate Banking Committee, where he was told by Senator Elizabeth Warren that he should be fired as a result of the “scam.”

Then in 2018, the bank was fined $2.1 billion by the Justice Department for bad mortgage practices, including allegedly misstating borrowers’ incomes, leading up to the 2008 financial crisis. Later that same year, Wells Fargo agreed to pay $575 million to all 50 states over its sales practices, including opening bogus accounts. And Democratic presidential candidates like Warren continue to use Wells Fargo as a punching bag along the campaign trail.

“Wells Fargo’s new marketing efforts are fine and in the right direction, but so far haven’t gone far enough to change perceptions,” says Tim Calkins, a professor of marketing at the Kellogg School of Management at Northwestern University. This month marks one year since Wells Fargo launched the marketing campaign “Re-Established” to rebuild its brand. “This is clearly bad news for Wells Fargo. Perception is so important for financial firms: Their business is all about trust.”

Wells Fargo declined Fortune’s request for comment.

*The Fortune/Civis Analytics survey was conducted among a national sample of 1,315 investors during December 19-20, 2019. We asked these investors to rate their favorable and unfavorable views of 10 of the country’s largest financial firms. We included a mix of banks, online brokerages, and other financial services companies. The national sample of investors has been weighted for age, race, sex, education, and geography.

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.