This article first appeared in Term Sheet, Fortune’s newsletter on deals and dealmakers. Sign up here.

Obvious Ventures has officially closed its second fund with $191,919,191 million in commitments. (A filing from last month revealed a first close.) The firm’s first fund featured a numeric joke – it had $123,456,789 million in commitments – so it’s only fitting that this one do the same. The fund two total is a palindrome, which is meant to symbolize that its next chapter look just like its first one – same team, same three managing directors, same “world positive” strategy (don’t call it social good!).

Obvious Ventures won’t be adding another partner to help it deploy the larger fund. Rather, the firm may write larger checks, co-founder and managing director James Joaquin says. The company still anticipates that 80% of its deals will be the first “priced” funding round for the startups it backs. The difference is that startups are raising much larger Series A rounds of funding, some as high as $7 million to $10 million.

“The market for convertible debt from angel investors is so robust that we’re seeing companies that have raised several million of convertible debt before they ever get to their first priced round,” Joaquin says. These companies are further along, too, with products, customers, and revenue, justifying a bigger round and valuation. “Our first fund was too small to lead some of those deals,” he says, but now it can.

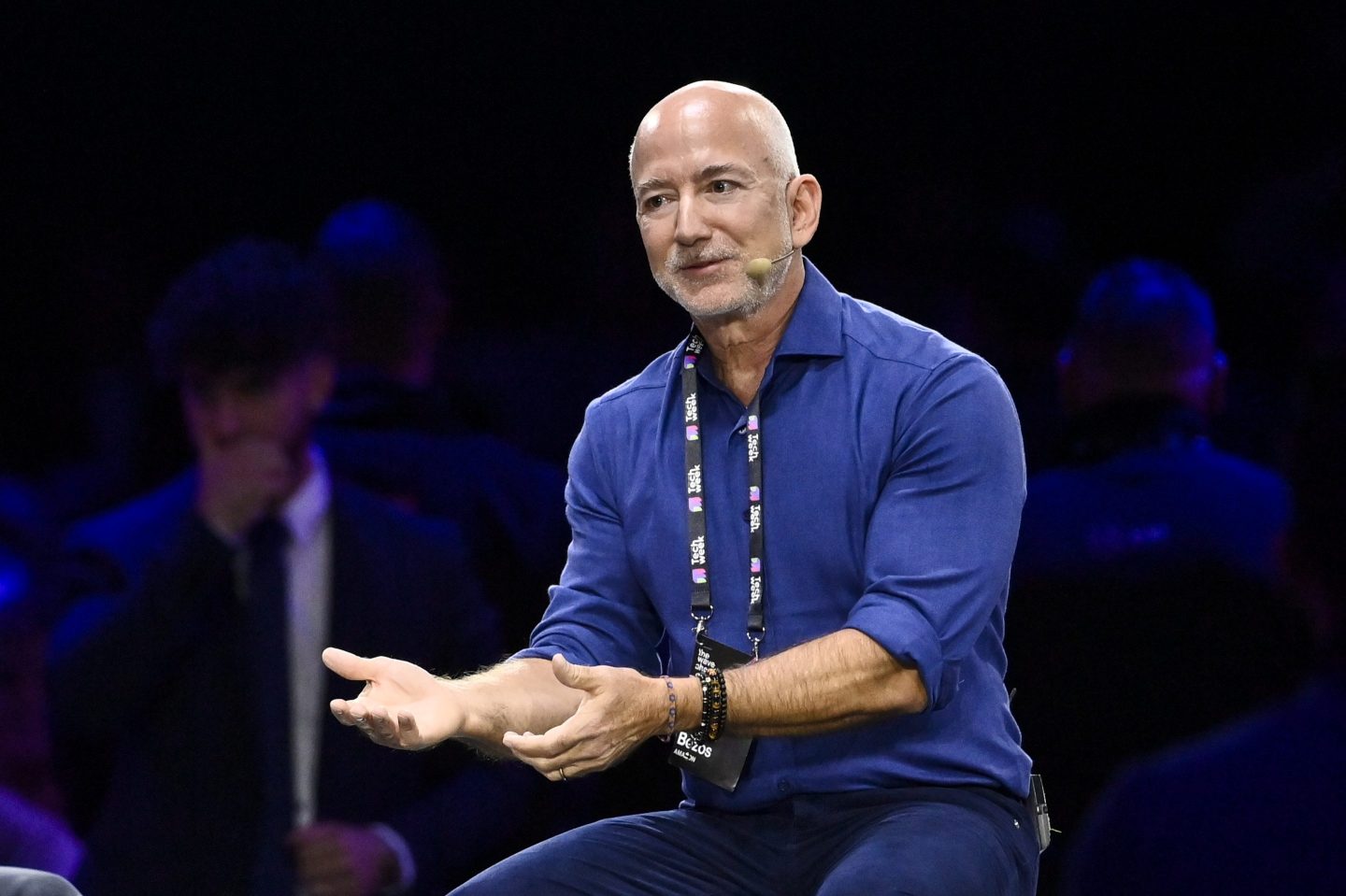

I asked whether it was tricky to get LP checks to line up at such a precise amount, and was told only one LP needs to be in on the joke, making their subscription a very specific number. In Obvious Ventures’ case, that LP its largest: Twitter and Medium co-founder Evan Williams.

Williams represents just over 50% of the second fund with a larger check size compared to fund one, but a slight decrease in the percentage of the overall fund. This fund includes more than a dozen new institutional investors