Now, this is counter-intuitive.

On the day that prices for crude oil hit their highest level in 18 months, some people are warning that they may collapse back to somewhere near their multi-year lows before long.

Hans van Cleef, senior energy economist for Dutch bank ABN Amro, told Bloomberg Tuesday that “oil pries could easily go back to the low $30s”, unless OPEC and other big producers such as Russia extend their current deal on output restraint. “The downside risk has become much bigger than previously.”

Admittedly, that is a minority view right now. Most industry professionals see crude prices collared between $50 and $60 a barrel, a range that both state and private producers have indicated they can live with.

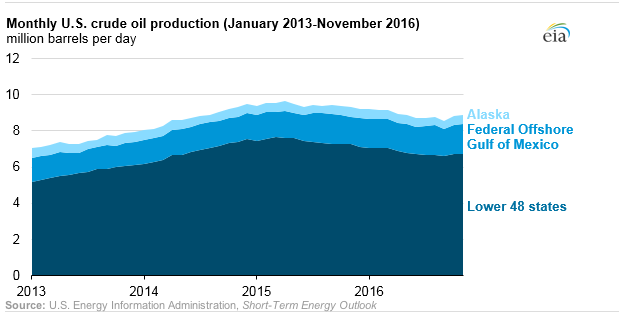

For your biggest clue, look no further than U.S. data on oil production and gasoline stocks. Oil production rose for the second month in a row, according to government data released Tuesday, confirming suspicions that U.S. shale producers would immediately respond to any rise in price. That frustrates OPEC’s goal of trying to bring supply and demand in the global market back into balance.

The second part of the equation is just as eye-catching. After falling through most of 2016, U.S. inventories of gasoline are now back at record highs of 259.1 million barrels, because refineries are making gasoline faster than U.S. drivers can burn it, and faster than foreign customers can take it off their hands. If all the refineries in the country stopped work tomorrow, there would still be enough gas to drive America for a full month.

Obviously, the U.S. isn’t the only country that matters when it comes to balancing the world oil market. But it is still the biggest source of demand, and the only major producer consciously working against the artificial restriction on supply.

The other factor that appears to be worrying some analysts is that hedge funds and other traders have accumulated an enormous long position on oil, expecting to rise further as the glut of the last two years dries up. According to Reuters oil analyst John Kemp, hedge funds now own 903 million barrels of oil – nearly 10 days of global oil supply – through the futures and options markets.

Hedge funds, of course, are not end consumers of oil. Ultimately, they will sell every barrel that they’ve bought (before it arrives in a harbor and starts costing them real money to store). Even more importantly, hedge funds now own 9.5 barrels of oil for every barrel other speculators have sold short – the highest ratio since 2014. That’s the kind of one-way market that happens when groupthink takes over.

That’s not to say the hedgies are wrong. Spring – the driving season in America and the other developed markets of the northern hemisphere – will soon be arriving. With the U.S. and, latterly, the Eurozone economy doing well, demand should pick up and change people’s view of the supply-demand balance.

But if the U.S. continues to raise output, and the rising number of drilling rigs suggests very much that it will, then the U.S. will once again be taking market share at the expense of OPEC – the original reason that Saudi Arabia triggered the price war in 2014. No-one except the Saudis (who took the most barrels off the market in November) knows where the tolerance for such ‘free-riding’ ends. But end somewhere, it most definitely does. And an awful lot of money is now riding on it not being soon.