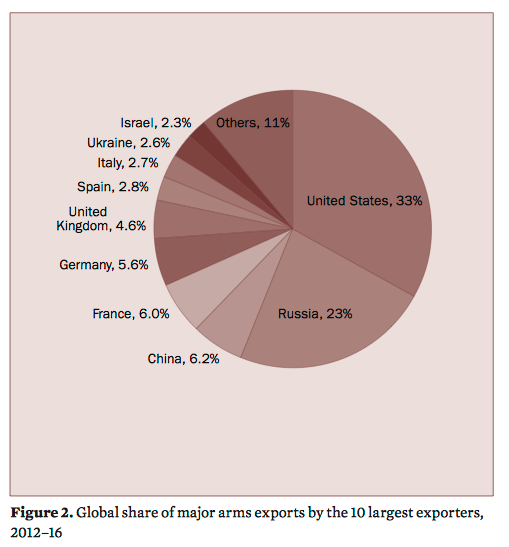

Global trade may be in retreat, but there’s at least one sector that’s still thriving—the weapons business. And the U.S. is still world champion when it comes to arms exports, by a long shot.

According to new data from the Stockholm International Peace Research Institute, the volume of international deals in the five years between 2012-2016 was up 8.4% over the previous five-year period and the highest for any five-year period since the end of the Cold War. U.S. exports rose 21%, with demand for missile defense systems and combat aircraft set to keep demand healthy for the foreseeable future.

Source: SIPRI

While SIPRI didn’t provide dollar figures for the period, it previously estimated that overall U.S. arms sales ran at well over $200 billion in 2015, the most recent year for which it has data. However, that figure includes domestic orders, which have flatlined recently due to caps on military spending. President Donald Trump has sent mixed signals about defense spending since taking office, saying that a strong military was worth a higher budget deficit, but at the same time putting public pressure on individual contractors for sending the Pentagon the check for cost overruns.

Based on the tremendous cost and cost overruns of the Lockheed Martin F-35, I have asked Boeing to price-out a comparable F-18 Super Hornet!

— Donald J. Trump (@realDonaldTrump) December 22, 2016

The figures show a sharp rise in demand for weapons systems across south and east Asia to counter the perceived threat from a resurgent China. They also show a surge in demand across the Middle East, a response to the seemingly never-ending instability caused by the wars in Iraq, Syria, and, most recently, Yemen. Asia and Oceania accounted for 43% of all imports in the period, while the Middle East took 29%.

The U.S. accounted for one-third of all arms exports worldwide, with a client base that no other country approaches. SIPRI said U.S. exports went to over 100 countries. The biggest three recipients were Saudi Arabia (13%), the United Arab Emirates (8.7%) and Turkey (6.3%). The U.S. also did well out of the surge in drug-related violence in Mexico, taking over three-quarters of a market where arms imports nearly tripled in 2012-2016, according to SIPRI.

As might be expected, China looms ever larger in the global arms trade, as it adds military muscle to defend an ever-wider influence on the world economy. China is now the world’s third-largest exporter of arms, after posting a 74% rise in 2012-2016. Exports to Africa, where it has invested heavily in sourcing raw materials to feed and fuel its economy, more than doubled. The other stand-out fact about China’s exports is that its three biggest clients (Pakistan, Bangladesh, and Myanmar) all ring the country that many expect it to be its biggest rival for regional geopolitical hegemony in years to come—India.

In the face of rising Chinese power, India raised its buying of weaponry by 43% in the period, cementing its status as the world’s largest importer.

“With no regional arms control instruments in place, states in Asia continue to expand their arsenals,” said Siemon Wezeman, a senior researcher at SIPRI. “While China is increasingly able to substitute arms imports with indigenous products, India remains dependent on weapons technology from many willing suppliers.”

One other data point from SIPRI that stands out, in the context of the row between the new administration and Europe over defense spending, was a 36% slump in imports by European countries. Austerity hit defense budgets across nearly all Europe in the wake of the financial crisis, but that figure may turn up in the next five years, with nearly 350 F-35s scheduled to be delivered to European countries.