You’d think it wouldn’t be so hard to spark a little inflation.

But in recent years, the Federal Reserve has consistently fallen short of its goal of a 2% annual inflation rate, despite the fact that it has kept interest rates at historically low levels, and has maintained trillions of dollars of government debt and mortgage-backed securities on its balance sheet.

This inability of the Fed to hit its inflation goal has caused many economic commentators to wonder what the central bank will do once the next recession hits. If the U.S. economy does suffer a recession in the near future, it’s unlikely that the federal funds rate will be high enough that the central bank will be able to stimulate the economy with interest rate cuts anywhere near the magnitude it did following recent downturns.

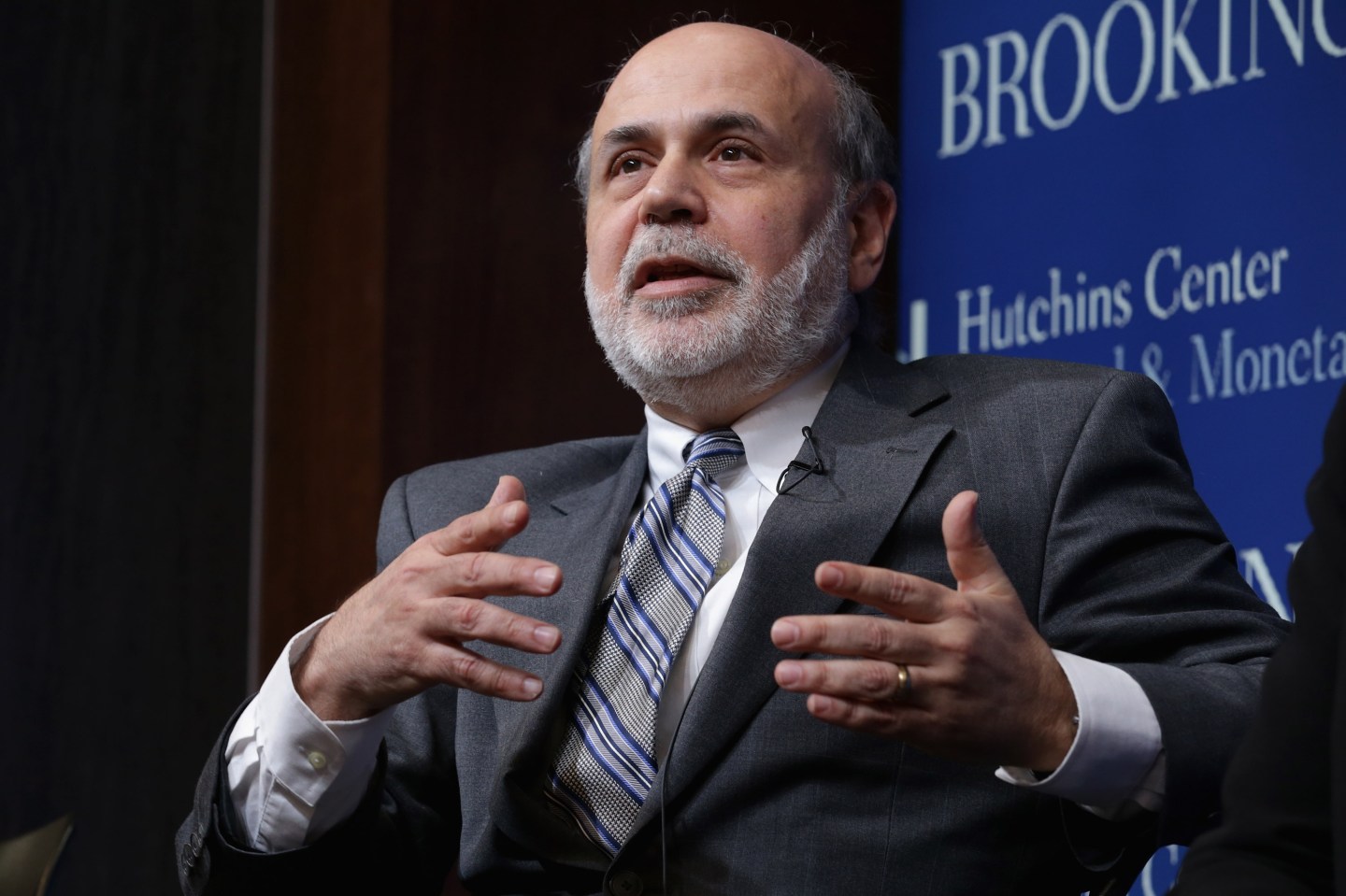

The situation has economists in general, and former Federal Reserve Chairman Ben Bernanke in particular, worried about what to do when the next recession hits. In a blog post Monday, Bernanke took a look at one of the more exciting (and controversial) ideas for future fed policy: helicopter money.

The term was invented by famed conservative economist Milton Friedman, who used the metaphor of dropping money down from a helicopter to illustrate the fact that a determined central bank could cause inflation if it really wanted to, if by no other means than simply handing out free money. “In theory at least, helicopter money could prove a valuable tool,” Bernanke writes. “In particular, it has the attractive feature that it should work even when more conventional monetary policies are ineffective and the initial level of government debt is high.”

Bernanke famously used the same “helicopter” analogy in a 2002 speech, which critics say gave then-Fed Chair Alan Greenspan the intellectual cover to pursue the loose monetary policies that led to the housing bubble and, ultimately, the 2008 financial crisis.

Fast forward to the present and many people are understandably concerned about giving the central bank the power to just print dollars and hand that money out, as opposed to conducting monetary policy through the banking system as it does now. Many accounts in the media wrongly equate the Fed’s program of quantitative easing (QE), with “printing money,” even though it is really creating bank reserves and using them to buy government debt and mortgage-backed securities from large banks; this stimulates the economy only if the resulting lowering of interest rates encourages banks to lend out more money. One reason the U.S. economy has remained sluggish despite the Fed’s extraordinary actions to address the financial crisis is that its QE program failed to spur a dramatic increase in bank lending.

Helicopter money, however, could finance government spending—or a tax cut—without relying on the banks increasing their lending, and without increasing government debt. But it is difficult to imagine a scenario in which the Federal Reserve could institute a “helicopter drop” of money without coordination with Congress. Sure, the Fed could credit the Treasury Department with extra dollars, but Congress would have to decide how to spend it. The first concern economists who study central banks have with such a program is that this sort of coordination with Congress could undermine the independence of the Federal Reserve, and turn the central bank into an institution that is run by elected officials.

Bernanke shares these concerns but the former Fed Chair does foresee a scenario in which the Fed finances tax cuts or government spending. He writes:

A possible arrangement, set up in advance, might work as follows: Ask Congress to create, by statute, a special Treasury account at the Fed, and to give the Fed . . . the sole authority to “fill” the account, perhaps up to some prespecified limit. At almost all times, the account would be empty; the Fed would use its authority to add funds to the account only when the [Fed] assessed that a [helicopter drop] of specified size was needed to achieve the Fed’s employment and inflation goals.Should the Fed act, under this proposal, the next step would be for the Congress and the Administration—through the usual, but possibly expedited, legislative process—to determine how to spend the funds (for example, on a tax rebate or on public works). Importantly, the Congress and Administration would have the option to leave the funds unspent. If the funds were not used within a specified time, the Fed would be empowered to withdraw them.