Brian White’s willingness to stick his neck out for Apple was one of the reasons he was a darling of the cable news networks. He set Cantor Fitzgerald’s price target at $195 six months ago and hung with it, even in August’s doldrums when the stock traded briefly below $95.

But his loyalty to Apple, he says, is not the reason he left Cantor Fitzgerald for a new firm, Drexel Hamilton.

“Drexel is a boutique investment bank with a rapidly expanding tech franchise and an exciting entrepreneurial work environment,” he told Fortune. “Unlike most firms on Wall Street, Drexel is experiencing explosive growth, aggressively hiring and making big investments in tech research.”

At Drexel, White initiated coverage of Apple with even higher price target: $200 a share.

“The sharp correction in Apple’s stock this summer represents an attractive entry point,” he wrote his new clients Thursday, ticking off the reasons for his belief: “fears surrounding China are overblown, concerns around difficult iPhone comparisons are short-sighted and the appreciation for the implications of this transformational super cycle is surprisingly muted.

“Trading at just 8.2x our CY:16 EPS projection (ex-cash) and well below the 14.7x for the S&P 500 Index, Apple remains one of the most undervalued technology stocks in the world.

“We are initiating coverage of Apple with a BUY rating and a 12-month price target of $200.”

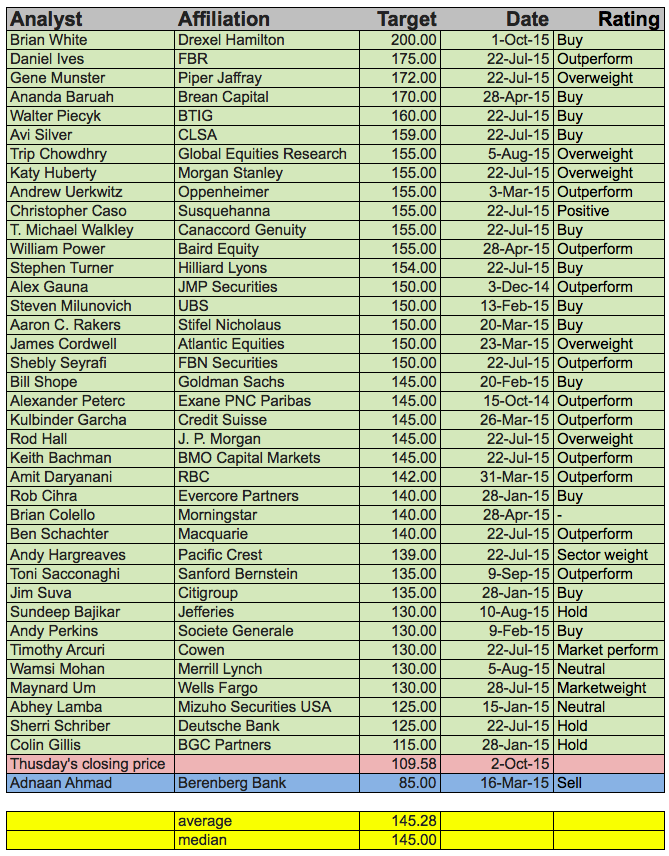

Here, according to my spreadsheet, is where White stands vis a vis his competition. (corrections appreciated).

Follow Philip Elmer-DeWitt on Twitter at @philiped. Read his Apple (AAPL) coverage at fortune.com/ped or subscribe via his RSS feed.