Apple Pay launched in the U.K. Tuesday, the first time that Apple Inc.’s (AAPL) much-touted mobile payments system has been seen outside the U.S..

Now, you might be thinking that the curmudgeonly, Olde Worlde Brits might not go for all the hype and ballyhoo that attends the typical Apple launch. But you’d be mistaken. Albion was positively submerged in a wave of hyperbole:

Quite impressed with this #ApplePay

— Morry (@weemorry) July 14, 2015

Well, ok, some of the tech-savvy crew were a little more, um, free and easy with expressing their joy, but it still couldn’t get them over their essential Britishness:

Just bought lunch using #ApplePay on the #AppleWatch – feeling like a bad ass (looked like an ass)

— Jack Gillespie (@jgillespie) July 14, 2015

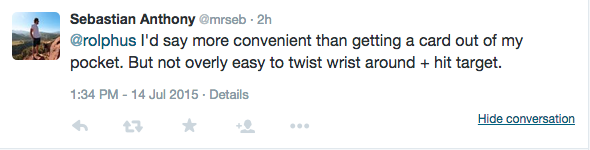

The #Firstworldproblem came to a head in London’s subway system, where the ticket readers are on the passenger’s right…

There was more than a little peevishness among those who don’t have a spare $500 at the fact that Apple has only enabled ApplePay for the iPhone 6, 6 Plus and Apple Watch.

So disapointed to have only an iPhone5S and no #iPhone6 to try #ApplePay today pic.twitter.com/aRX9F6UTGC

— Vanessa Bourdillon (@VanessaBourdill) July 14, 2015

After the sheer thrill of the novelty, the next biggest pleasure the launch afforded the average Brit was the opportunity to indulge his favorite pastime: moaning about his bank. Barclays plc (BCS), which has its own rival contactless payment system, Lloyds Banking Group plc (LYG) and HSBC plc (HSBC), which ducked out of being one of Apple’s ‘launch partners’ at short notice, were called out in no uncertain terms.

Come on #Barclays and #Lloyds, why have you not supported #ApplePay on UK launch. Not good enough. #lookforanotherbank

— Jason Murphy (@thejmurphster) July 14, 2015

Surprised @HSBC_UK was an #ApplePay UK launch partner as they’ve never been at the vanguard of anything. Normal service has been resumed.

— Andy Long (@ndylng) July 14, 2015

I wonder if Taylor Swift has an @HSBC_UK account and fancies writing a letter? #ApplePay

— Adam Burroughs (@adburroughs) July 14, 2015

(Barclays was shamed into saying that it would after all support ApplePay “in the future” by lunchtime in London.)

But yes, overall, it’s fair to say that the response to ApplePay was a bit lukewarm…

Currently, tweets using #ApplePay are 14% positive, 74% neutral, and 12% negative.

— sentiBotr (@sentiBotr) July 14, 2015

…although it wasn’t clear how many of the negative tweets were about the banks, rather than the app itself.

One of the reasons for that might be that Near Field Communication is already a pretty well-established technology in the U.K.: over 100 million pounds ($160 million) a month is spent through contactless payments, up threefold over a year ago, with an average of some 370 transactions a minute, according to the U.K. Cards Association.

Apple isn’t even the first smartphone maker to offer the service: mobile network operator EE’s Cash on Tap service, which works with Android phones made by Samsung, Sony and HTC, is already accepted at 300,000 points across the country (Apple boasted 250,000 today).

https://twitter.com/JDPrognosis/status/620933982461501440

What EE doesn’t have, of course, is an army of retailers from McDonald’s (MCD) to Whole Foods Inc. (WFM) desperate to cover themselves in a little Cupertino stardust.

We’ve introduced Apple Pay in every restaurant, so paying for your McDonald’s is now a handy touch away. #ApplePay pic.twitter.com/8qYeWufBg4

— McDonald's UK (@McDonaldsUK) July 14, 2015

On the plus side, nor does it have a bunch of wiseguys trying to confuse hapless sales assistants first thing in the morning…

#ApplePay isn't all it's cracked up to be https://t.co/xeQ14Nf7b5

— Harry Seaton (@harryseaton) July 14, 2015