PayPal yesterday announced plans to acquire Xoom Corp. (XOOM), a San Francisco-based digital money transfer services, for approximately $890 million. The $25 per share deal represented nearly a 21% premium over where Xoom stock closed trading on Tuesday, and a 56.25% premium over where Xoom priced its initial public offering back in early 2013.

Xoom is not one of the so-called unicorns, that ever-expanding group of privately-held companies that have been valued by their venture capitalists at $1 billion or more. But its experience may be instructive when thinking about the idea of a tech startup bubble, particularly in terms of investor risk and reward.

VC firm Andreessen Horowitz recently published a data-driven refutation of the bubble-mongers, with a heavy emphasis on differences between today’s environment and the dotcom bubble. As I wrote previously, a lot of it is persuasive.

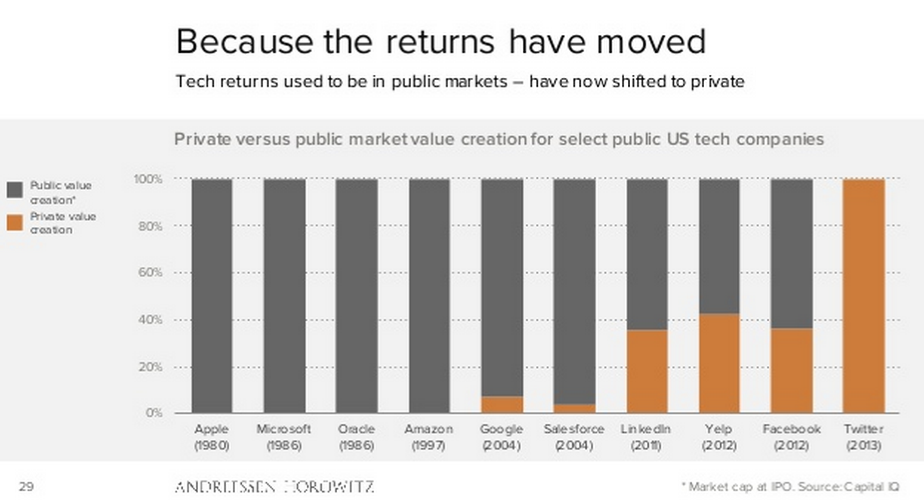

But for the purposes of this post, I want to focus on a particular slide about how the increase in later-stage private funding (“quasi-IPOs”) has allegedly shifted value appreciation from the public to private markets. Here it is:

I understand the argument, and even made a similar one in a magazine column last summer. In short: The longer a growing company remains private, the more wealth is created for a small number of investors. Historically that would the VCs and company employees, but the “quasi IPO” has slightly expanded that pot to also include hedge funds, mutual funds and sovereign wealth funds. By going public, you allow a much broader group of investors to benefit from the company’s growth. That’s why my magazine column was titled: “Dear tech CEOs, go public for the good of the country.”

My quibble with Andreessen Horowitz’s slide, however, is that VCs don’t usually sell their shares at IPO. Instead, they usually hold on for at least the first 90 days (per lock-up agreements), and often for a significant amount of time after that (in the case of small biotech floats, the VCs often buy more shares at the IPO price). As such, the “public” value creation cited by Andreessen Horowitz for a company like Google (GOOG), for example, is belied by the fact that Google’s venture capital backers — namely, Kleiner Perkins and Sequoia Capital — held onto most of their shares for years after its IPO.

“We made a lot of money during the dotcom bubble once VC portfolio companies went public, because they were often small floats and the VCs held onto the stock as the prices soared” explains a longtime investor in venture capital funds. “We’re seeing similar valuation increases today but, because the companies haven’t gone public, VCs are basically taking on extra risk for the same reward.”

All of which brings us back to Xoom. Among the company’s current shareholders is Sequoia Capital, which last reported a 14.72% ownership stake. Had Sequoia cashed out all of its Xoom shares at IPO, it would have returned nearly $52 million fewer dollars. That difference is not accounted for in the Andreessen Horowitz slide. It’s also worth noting that Sequoia would have received around the same value appreciation had it sold just after its post-IPO lockup expired (it peaked in July 2013).

For an even more stark example, take a look at Palo Alto Networks (PANW), where the value of Sequoia’s remaining stock today is $734 million higher than it was at the time of IPO.

To be clear, none of this is arguing for or against a tech bubble. It’s only to point out that the advent of unicorns does not necessarily mean that the private markets are going to be better off for their existence.

Get Term Sheet, our daily newsletter on deals and deal-makers.