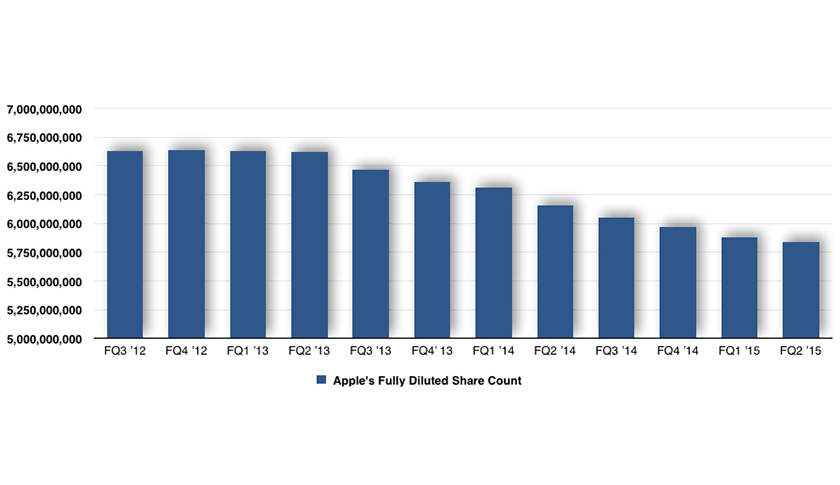

See the downward slope in the attached bar chart, posted Saturday by the Braeburn Group’s Robert Paul Leitao?

It shows what’s happened to Apple’s fully diluted share count over the past three years.

Since Apple hit a split-adjusted high of 6.637 billion shares outstanding in 2012, the company has repurchased 12.09% of its fully diluted shares.

“In a way,” writes Leitao, “the massive share repurchase program works as a leveraged buyout for the benefit of long-term shareholders.”

Apple is leveraging its cash assets to repurchase shares. This boosts the value of the remaining shares and the shares are continuing to be repurchased at a significant discount to future share value. With $60 billion remaining on repurchases under the expanded $140 billion repurchase program, today’s share price presents an excellent opportunity for management to repurchase more shares at what may soon prove to be an attractive discounted price.

Leitao is bullish on Apple. He thinks Wall Street still doesn’t get what’s going on. The company’s revenue is up nearly 25% over the past three quarters. EPS is up 39% over the same period, in part, as he shows, because S is still shrinking.

Link: Wall Street Discounts Apple’s Revenue and Earnings Trend.

Follow Philip Elmer-DeWitt on Twitter at @philiped. Read his Apple (AAPL) coverage at fortune.com/ped or subscribe via his RSS feed.