Think the Chinese are stealing jobs by pricing their currency too low? Think again.

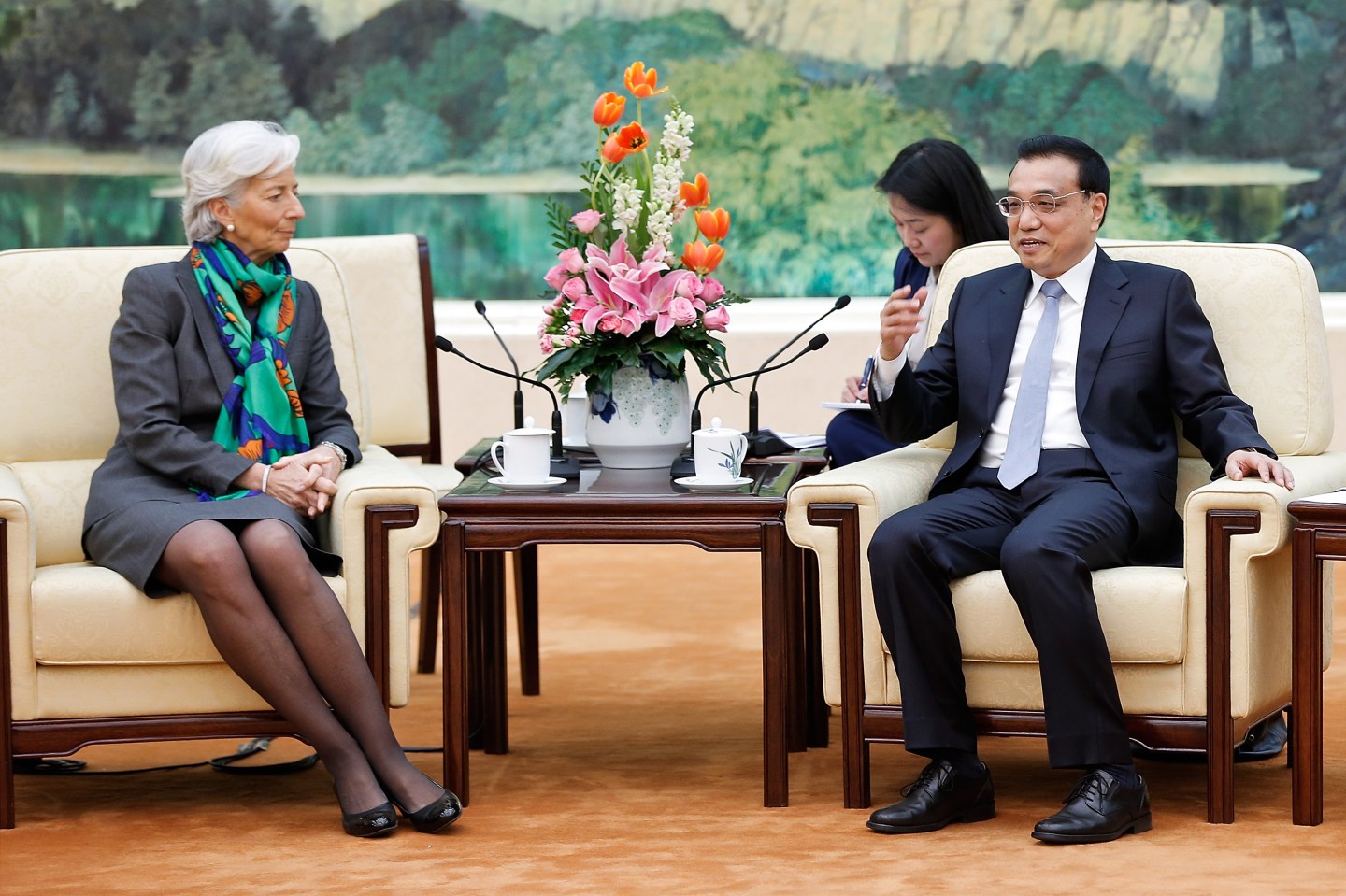

The International Monetary Fund, which has faithfully echoed Washington’s concerns about Beijing keeping the renminbi cheap in order to help its exporters for the last two decades, said Tuesday it no longer thinks the Chinese currency is undervalued.

But before you start thinking that the Fund has caved to pressure from Beijing as part of some inscrutable political deal, it’s worth pointing out that it still isn’t giving China a free pass.

In a statement at the end of a regular assessment of the Chinese economy, the Fund warned that the country’s export surplus is still too high, and that the currency is going to have to appreciate further.

“The still-too-strong external position highlights the need for other policy reforms—which are indeed part of the authorities’ agenda—to reduce excess savings and achieve sustained external balance,” the IMF said. “This will also require that, going forward, the exchange rate adjusts with changes in fundamentals and, for example, appreciates in line with faster productivity growth in China (relative to its trading partners).”

In other words, just because your currency isn’t undervalued doesn’t mean it isn’t still being manipulated. China still operates a very tightly controlled foreign exchange regime, after all, in contrast to the Fund’s orthodoxy that free-floating rates are best. The IMF says Beijing should let the renminbi float within “two to three years.”

“Greater flexibility, with intervention limited to avoiding disorderly market conditions or excessive volatility, will also be key to prevent the exchange rate from moving away from equilibrium in the future,” it said.

While the dollar has soared against the currencies of most of its biggest trading partners in the last year, Beijing has largely refused to let the renminbi depreciate against it. At 6.20 to the dollar, it’s less than 1.5% off the record high it posted at the start of last year.

As you might expect, tying the renminbi to the dollar has led China’s exporters to lose competitiveness on regional and world markets, particularly against local rivals Korea and Japan, whose currencies have both weakened significantly in the same period.

As a result, China’s current account surplus has narrowed sharply, to as little as $7.2 billion in the first quarter of this year, and that’s despite a sharp fall in its bill for imports of key commodities such as oil and iron ore. For comparison, the Eurozone racked up a surplus of over $83 billion in the same period, helped by the European Central Bank’s quantitative easing program that drove the euro to a series of 12-year lows.