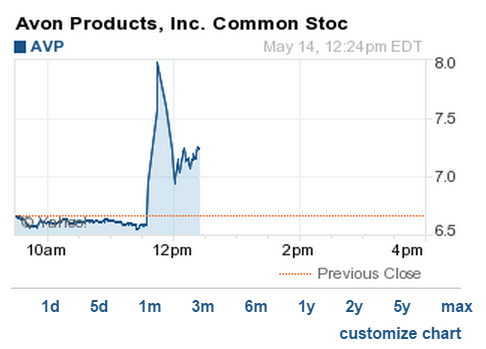

Avon Products (AVP) stock spiked earlier this morning on an SEC filing that a London-based investment firm called PTG Capital had offered to acquire the company for $18.75 per share.

You see that part where it went right back down again? That’s because while PTG Capital sounds rich and important, there doesn’t seem to be any actual evidence that it exists. Ditto for its listed law firm, Texas-based Trose & Cox LLC.

Neither “firm” has a working website, listed phone number nor employees on LinkedIn. There are phone numbers listed for each on the filing, but the former goes to a voicemail and the latter goes to an executive business center. It’s also worth noting that PTG refers to itself twice in the filing as TPG, which actually is a real private equity firm (but not one that offered to acquire Avon).

So was this simply a ploy to boost Avon Products stock to make a quick buck?

If so, it is unclear how the perpetrator would have gotten the document into the SEC’s system. All corporate filers, including Avon Products, file electronically via a platform called EDGAR. In order to do so, however, they must use both privately-held confirmation codes and passwords. If someone was in there improperly, it must be someone who at some point had access to Avon information. One big caveat, however, is that third-parties can file certain documents that get added to a company’s page — such as a hedge fund manager launching a proxy fight — without the company’s ascent. If that it how the phony Avon letter was entered, one must wonder if new restrictions will be put in place going forward.

An SEC spokeswoman declined to comment.

As for Avon, the New York-based company has not yet responded to a request for comment, but a source says that it has not received the “PTG” offer.

Avon has been the subject of much speculation about whether it would put itself, or some units like its struggling North American business, up for sale. The $18.75 per share bid was all the more stunning for the fact that shares have been trading as low as $6.64 and have not been near the purported offer’s level in a year and a half.

The beauty company has been grappling with an exodus of its sales representatives in the United States, stiff competition in the once promising Latin American market, and a consumer pullback in Russia. At its peak in 2004, Avon was worth $21 billion. Before news of the purported offer, its market cap was $2.8 billion.

UPDATE: Avon spokeswoman Cheryl Heinonen says that the company has not received a takeover bid from PTG Capital, nor can the company verify PTG’s existence. It also is worth noting that the offer letter still appears on the SEC’s website.