Above illustration by Sinelab

Even before Jeffrey Sevigny stepped to the podium, it was clear that something momentous had occurred in the world of Alzheimer’s research. Before Biogen’s senior medical director for clinical development could click on the first slide of his PowerPoint deck, tens of billions of biotech investment dollars had already been wagered on what his presentation would say.

The day before Sevigny’s March 20 talk at the International Conference on Alzheimer’s and Parkinson’s Diseases, analysts at Credit Suisse Group—following buoyant reports by Barclays, Citigroup, and RBC Capital—projected that Biogen’s stock would soar to $500 a share, up from the $400 target they had estimated less than two months earlier. Shares of the Cambridge, Mass., drugmaker, then trading at $428, were already up 41% from early December, when the company teased investors with findings about its investigative Alzheimer’s drug, aducanumab, the details of which Sevigny would share fully at the conference. The three-month stock run-up had added a staggering $29 billion to Biogen’s market capitalization.

In a sense, the news had happened. And yet, for an anticlimax, Sevigny’s report to the roughly 2,500 scientists, investors, and biotech reporters crowding into the Acropolis convention center in Nice, France, was thrilling. Attendees, it seems, couldn’t help themselves from buzzing, as they snapped photos of Sevigny’s slides with their smartphones and kept Twitter ablaze with commentary and a kindling of data.

The reason was obvious: For the first time ever, a drug appeared both to significantly remove the brain plaques associated with Alzheimer’s disease and to slow the terrifying cognitive decline suffered by patients. But, then, so was the awkwardness of the moment—a collective whisper that reminded the crowd to squelch the thrill if they could.

This was Alzheimer’s, after all—the pathology that ate promising drugs and spit them out, the disease for which pharmaceutical science had the worst batting average of all. Of the 244 compounds that drug companies had tested against the disease in clinical trials from 2002 to 2012, just one had received FDA approval, according to a study last year by researchers at the Cleveland Clinic. (Fourteen are still in clinical testing.) That translates to a 0.4% success rate, compared with 19% for cancer drugs. Only five Alzheimer’s drugs have ever been approved, of which four remain on the market. All are aimed at treating symptoms of the disease, such as memory loss, rather than the illness itself—and none is considered by experts to be particularly effective. Of the top 10 causes of death in America — Alzheimer’s is now No. 6 — it is the only one for which there is no way to prevent it, cure it, or even slow its progression.

The outlook has been even worse for drugs like “adu” (as Fortune will abbreviate it), Biogen’s experimental antibody, that go after beta-amyloid—bits of broken protein that clump together to form, presumably, neuron-choking plaques in the brain—leading some to wonder whether we’ve been chasing the wrong target. More than 70 anti-amyloid agents—including high-profile drugs from Eli Lilly, Roche, and a combined effort by Elan, Pfizer, and Johnson & Johnson—had been tested in clinical trials. None had been successful. “We’ve seen them before, and we’ve seen them fail,” says Morningstar analyst Karen Andersen, who was determined not to get too excited before seeing the Biogen data.

As if all that wasn’t enough to temper excitement, there was this: Biogen’s study on adu was a so-called Phase 1b, whose aim was merely to find an appropriate dose of the drug and, to a preliminary degree, assess its safety. The trial, which itself was not yet complete, involved a mere 166 patients, nowhere near enough to draw any definitive conclusions. What’s more, those who received higher doses of the agent and who saw the biggest responses were also at greater risk of developing a potentially serious complication: swelling in their brains.

Still, by the time trading on the Nasdaq exchange was done on March 20, Biogen shares were at $476, not far from Credit Suisse’s lofty target. Within days of the Nice conference, Goldman Sachs analysts pegged future peak annual sales of adu—which even in the best-case scenario was years away from approval—at $8.4 billion. Others on Wall Street put the figure much higher.

And though the Alzheimer’s research community was perhaps not as breathless as some investors, many were more excited than they’d ever been about a drug trial. Of the 25 academic and industry researchers interviewed for this story, few did not note Biogen’s study results with enthusiasm. “If the treatment’s clinical benefit is confirmed, it would be a game changer in the scientific fight against Alzheimer’s,” says Eric Reiman, executive director of the Banner Alzheimer’s Institute. Says Brian Basckai, a professor of neurology at Harvard Medical School who has studied the effect of adu in mice: “This is the most successful clinical trial in Alzheimer’s disease ever.”

“There’s a little bit of a mania going on,” says P. Murali Doraiswamy, director of Duke’s neurocognitive disorders program, who is also impressed with the Biogen findings. Or as one prominent biotech blogger described the mood: “euphoria.”

Even industry competitors seem energized and impressed. Michael Ehlers, chief science officer for Pfizer’s neuroscience division, described the data as one of the field’s biggest breakthroughs in years. To hear many tell it, Biogen’s drug has been validation for the whole Alzheimer’s research community. Finally, many say, after years of failure and false starts, we’re at a turning point.

The story of how we got here, though, isn’t a tale of one company, but rather of two: The first is Biogen, the cash-flush newcomer that bet big on a single drug (discovered by another biotech firm); the second is the 139-year-old Eli Lilly, which has spent 26 years and untold sums chasing an elusive goal, largely in its own research labs. Theirs is the pharmaceutical version of the tortoise and the hare — but with a twist. For now, it seems, the hare is winning.

A death sentence that progressively steals one’s memory and independence, Alzheimer’s is a devastating illness, one that currently afflicts 5.3 million Americans. That number is expected to balloon to some 8 million by 2025 as baby boomers age and live longer. By 2050 the figure is on track to nearly triple, even as the broader population is expected to grow by roughly 25%.

Alzheimer’s, importantly, is also the nation’s most expensive affliction. The cost of caring for patients—much of which is shouldered by Medicare and Medicaid—was $214 billion in 2014. The Alzheimer’s Association projects that figure will reach $1.1 trillion by 2050 if current trends continue.

Such numbers have long tempted many drugmakers, who see this overwhelming medical challenge as a massive untapped opportunity. Lilly understood the potential but had only a vague idea of how it hoped to go after it when it hired Patrick May, a postdoctoral fellow at the University of Southern California, to do research on the disease in 1989.

More than a century ago Alois Alzheimer, a German psychiatrist, had become intrigued by the peculiar mental state of his patient Auguste Deter, a 51-year-old woman who appeared to be prematurely losing her mind. At the time, senility was considered a natural part of aging, but Deter, who in occasional bouts of clarity told the doctor, “I have lost myself,” seemed unusually young for such a fate. When she died in 1906, Alzheimer autopsied her brain: It had shrunk considerably, and its tissue, when stained, was speckled with distinctive markings in and around the neurons. These deposits—later characterized as amyloid plaques and neurofibrillary tangles, or tau—are considered the hallmarks of Alzheimer’s.

Despite this headstart, the pharmaceutical industry did not take the disease seriously until seven decades later, when researchers began to understand that Alzheimer’s was not a rare condition but rather the primary source of dementia population-wide.

Rich with cash from its depression drug Prozac, Lilly threw some research dollars at the disease, and by 1995 it had a molecule, called xanomeline, that the company believed could restore memory in dementia patients. Lilly’s marketing department was so excited by the prospect that it persuaded management to buy Alois Alzheimer’s boyhood home in Bavaria, an ivy-covered cottage in Marktbreit, Germany, which the team hoped to showcase with the launch of the medicine. But then it failed in clinical testing.

Strangely, the early drug candidates didn’t focus on the two abnormal brain deposits that Dr. Alzheimer himself had seen in his patient: amyloid and tau. While four decades of research have not yet established the role that either plays in the development of the disease, there is a prevailing theory. Called the amyloid hypothesis, it contends that things begin to go wrong in Alzheimer’s patients when beta-amyloid, a protein that normally cycles through the brain, starts to build up there—either because too much is being produced or because not enough is being cleared from the organ. That amyloid aggregates and forms plaques around the neurons, gumming up the synapses and inhibiting cellular work. This, in turn, triggers problems with tau, a protein in neurons involved in basic cellular function. As these plaques and “tangles” of tau proliferate in the brain, neurons die and more and more mental activity is snuffed out.

Patrick May was one of the field’s first proponents of the idea. Early on, his team alighted upon a compound they called LY-411575, which tested so well in mice May was sure it would one day be enshrined in medical textbooks. But when tested in dogs, it filled their gastrointestinal tract with mucus. No go. One by one, he’d find himself hopeful about an amyloid-targeting molecule only to have it go bad in animal models or flame out in human testing.

Eventually, though, came semagacestat. Making it through a gauntlet of early testing, it was Lilly’s first real shot at an Alzheimer’s medication. Aside from a skin rash, there appeared to be no negative side effects. And in 2008, nearly two decades after May began working at Lilly, his group launched the company’s first, massive Phase 3 Alzheimer’s trial. Phase 3 studies are typically the largest and most expensive stage of human drug testing, and this one involved 2,600 participants in 31 countries who would be studied for 21 months.

A couple of years into the trial, Lilly received a call from the study’s independent safety monitor. There was a problem: Participants who were receiving the drug were scoring worse on cognitive tests than those on placebo. Semagacestat appeared to be hastening their decline. The trial was over.

“We were stunned,” says Eric Siemers, the medical director of Lilly’s Alzheimer’s program at the time. “If it just hadn’t worked, we were ready for that possibility, but this no one expected at all. Tears were shed.”

May, who had lost his wife unexpectedly several months before this news, says the only consolation was that she wasn’t there to see what his 21 years of work had amounted to. “It was devastating,” he says. “Just devastating.”

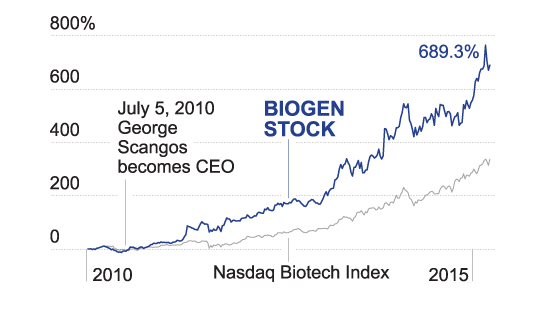

Such was the promise of Alzheimer’s drug development when George Scangos arrived at Biogen in July 2010. A biologist who, as a postdoctoral fellow, had landed on the front page of the New York Times for helping engineer the first transgenic mouse, Scangos had been a professor before joining the ranks of the biotech world in the late ’80s.

The challenges facing Biogen then were more managerial than academic, however. The company he inherited was spread wide and thin, with scientists working across five therapeutic areas, as if it were a drugmaker four times its size. “We had too many people telling two people what to do and going to meetings all day,” he says.

The country’s oldest independent biotech had made its name with a handful of groundbreaking multiple sclerosis medications. It made sense for Scangos to continue to invest in that. Far less sensible, he thought, was trying to compete in the oncology and cardiovascular categories, where a number of competitors were well ahead, so he quickly shuttered those programs. A harder question was what to do with the biotech’s fledgling Alzheimer’s effort, which focused on a single anti-amyloid antibody, aducanumab, from a Swiss firm called Neurimmune.

Alzheimer’s was not exactly natural territory for Biogen. The disease, which had stumped far bigger and better-resourced pharma companies for years, had never figured prominently in its playbook. And at least four drugmakers, including Lilly and Pfizer, were actively working on antibodies that, as with Biogen’s, targeted amyloid protein. Biogen could quite conceivably be fifth to cross the finish line.

The sheer likelihood was that it would end up as just another company investing bucketfuls in a product—the average drug for the central nervous system consumes $1.5 billion and takes 15 years to develop — that would ultimately fail to make it to market. Still haunting the field was the memory of a disastrous trial by Elan from 2001, when the Irish company (since acquired by OTC drugmaker Perrigo), injected patients with a form of beta-amyloid on the theory that it would stir an immune response against the plaque. Hopes were dashed when 6% of clinical trial participants developed meningoencephalitis, a serious inflammation of the brain and spinal cord.

Already there was a rift among researchers—those who wanted to focus on beta-amyloid protein (“the BAPtists”) and those who believed tau was a worthier target (“the tauists”) —and each new amyloid drug failure only widened the schism. Increasingly, scientific critics complained that Alzheimer’s research was off track, and that decades of effort and billions of dollars had been wasted aiming at the wrong bull’s eye.

Scangos had studied Alzheimer’s for a brief time when he was at Bayer 14 years earlier. “It would have been foolish of me to think I understood it in depth,” he now says, “but you still have to make some bets.”

That’s where Al Sandrock came in. A bearish man with a shock of black hair and a whiff of mad scientist about him, Sandrock was head of Biogen’s neurology R&D, and he was itching to tell his new boss about adu. The antibody had been derived from genetic information expressed in immune cells of elderly donors in Switzerland who were especially healthy and mentally quick. The hunch was that the same thing that kept these individuals sharp into old age might also help keep the minds of Alzheimer’s patients from failing.

Biogen scientists had been laboring to develop similar compounds in the lab to no avail. “We’d been trying to do it with old-fashioned techniques—starting with immunizing mice — and we were having a heck of a time,” Sandrock recalls. “Meanwhile, my friend Roger in Zurich is fishing them right out of patients with exactly the characteristics we were looking for!”

Indeed, the antibody seemed to have remarkable properties. It bound wonderfully to amyloid plaque, and when it was tested in older mice, the plaque was greatly reduced. Biogen licensed the antibody from Neurimmune, buying worldwide rights to develop and commercialize it in exchange for royalties.

That it had originated in humans posed interesting challenges: to test the antibody in animal models, Biogen would have to murinize, or “mousify,” it. The industry typically goes the other way, humanizing antibodies that were engineered in mice.

Few of Sandrock’s colleagues shared his enthusiasm for the molecule, however, with many thinking that the company’s foray into the Alzheimer’s field was pure folly. For one thing, an antibody was considered a dubious approach—too large to even penetrate the blood-brain barrier, which was essential if it was to reach its target.

What mattered, though, wasn’t that colleagues doubted adu, but rather that Scangos believed in Sandrock. “Part of being a CEO is assessing the people you have,” says Scangos. “You have to make bets on who is talented, who is telling the truth, who is being straightforward, and who has a nose for good science and good medicine.”

Over the next few years Biogen watched the four anti-amyloid antibodies of its rivals fail or be halted in clinical development. Even Sandrock, a true believer, felt the pressure. “I was getting hammered by many of my colleagues outside and certainly inside that the amyloid hypothesis was wrong,” he says.

His boss, however, wasn’t fazed in the least. “People overgeneralize negative data,” says Scangos. When something doesn’t work, he says, “the question to ask is, ‘Why doesn’t it work?’ ”

That was what the Biogen team asked with regard to adu’s competitors. The evidence suggested three different answers, they thought. First, some were testing their drugs on patients who didn’t necessarily have Alzheimer’s disease to begin with. Second, it wasn’t clear that some rival agents were actually hitting their targets—which was to say, the amyloid protein. And third, the companies were testing their drugs too late: The patients were too far gone.

One of the smarter decisions Scangos made when he arrived at Biogen was to hire Ajay Verma. Verma, an energetic neurologist who previously had stints at Novartis and Merck and speaks in sweeping evolutionary terms about brain disease, is described by colleagues as the company’s “Q” — the resourceful inventor in James Bond films. (Officially his title is vice president of experimental medicine.) It was his team’s job to figure out how best to test adu.

His first task was making sure the patients in the trial had Alzheimer’s — something that was surprisingly hard to do. Until very recently it was possible to know for certain that someone had the disease only through an autopsy (the same way it was done in 1906 for Auguste Deter). To diagnose it in living patients, physicians had to watch closely for worsening dementia, relying primarily on the accounts of friends and families or the results of somewhat crude mental tests. Such assessments often swept people with other forms of dementia into the net.

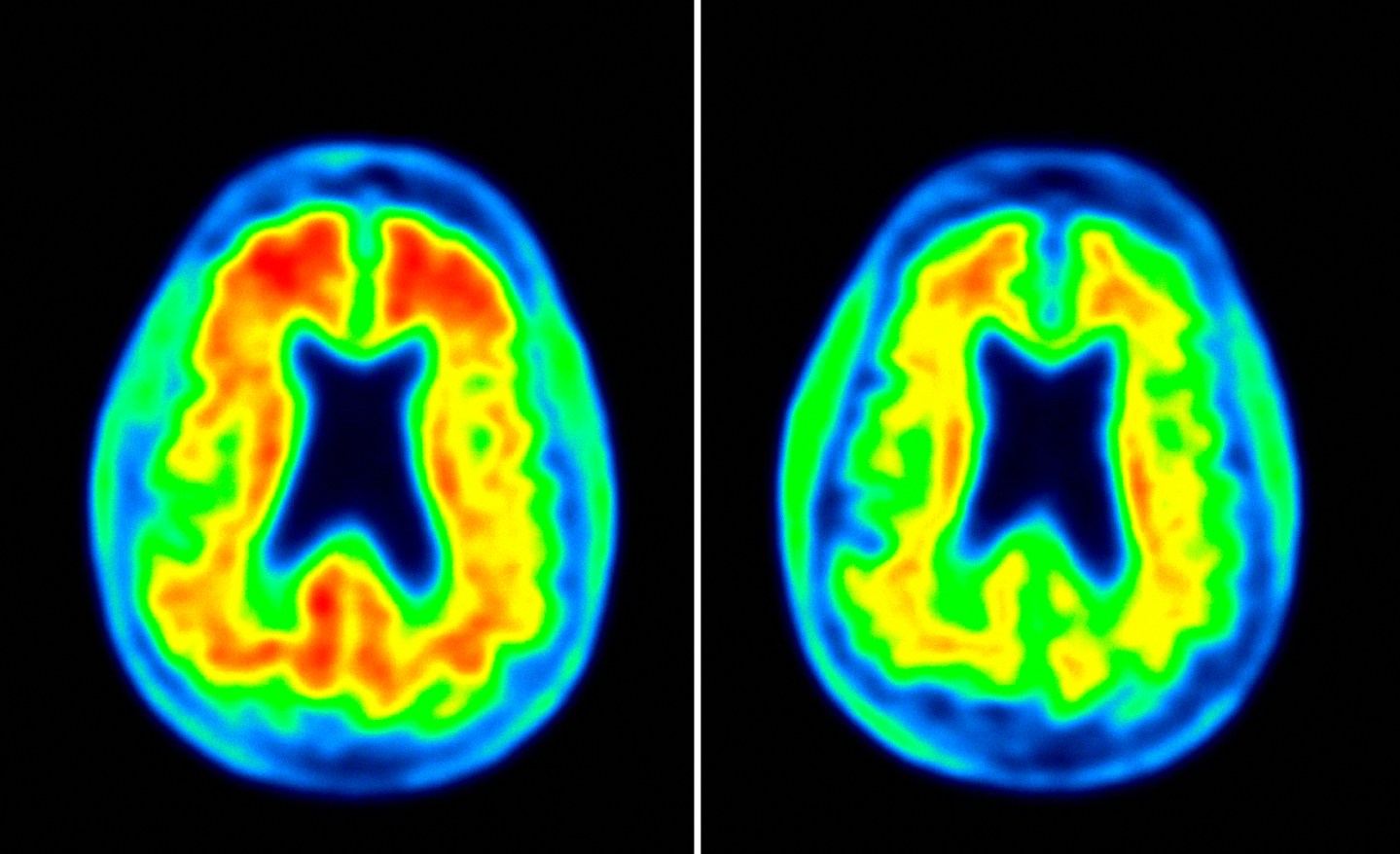

Verma, however, brought an important emerging technology into Biogen’s patient-screening process — imaging equipment that allowed clinicians to pinpoint amyloid (and more recently tau) deposits in the brain and to visualize the disease’s progression. The importance of this was much greater than it sounded. Of the patients who applied to join Biogen’s Phase 1 adu trial, an astounding 40% didn’t have the disease, despite showing signs of early dementia.

It may sound obvious, but an anti-amyloid drug, as a rule, won’t work on patients without amyloid deposits in their brains. That, indeed, was a factor that plagued the trial of yet another failed Lilly drug, solanezumab. Lilly found — after the fact, unfortunately — that in a large Phase 3 trial of “sola,” as many as 25% of participants didn’t have amyloid plaques in the brain.

The second task, of course, was to make sure the drug was hitting the right target. Again, the answer involved the same imaging technique above, which, ironically, relied on a radioactive tracer owned by Lilly.

Biogen’s innovation was to pay for all this crazily expensive imaging in a Phase 1 trial, an early-stage study that is typically used to determine the proper dose of an experimental agent. In its adu trial, 166 patient volunteers underwent a battery of procedures — from multiple MRIs and glucose brain PET scans to lumbar punctures.

But the real game changer was deciding what patient population to go after. Again, the insight derived from, among other things, the failed trials of Lilly — and that was to give the amyloid-clearing drugs to patients in the very earliest stages of disease, before too much damage had been done.

Amyloid, it turns out, begins accumulating in the brains of Alzheimer’s patients some 15 years before they ever show symptoms. To the field as a whole, this discovery was the equivalent of a lightning bolt: Maybe the drugs weren’t working because they were being given too late.

That’s why Biogen’s adu trial generated so much excitement. It showed that patients with mild—and even incipient (or “prodromal”) — Alzheimer’s could benefit from early therapy. Though the trial wasn’t designed to measure it, the drug appeared to slow the decline in Alzheimer’s patients’ recall and mental agility. After a year of treatment, trial volunteers who received the drug performed strikingly better on cognitive tests than the placebo group, though such results should be taken with a dose of caution given that the sample size was very small (and the tests themselves can be squishy). Nevertheless, the fact that this apparent clinical change was accompanied by rock-solid evidence of a biological change—a significant reduction in amyloid plaque — gave the finding some credibility.

That’s certainly how the Biogen team saw it, even if they couldn’t quite believe it themselves. “Candidly, we were surprised,” says Doug Williams, who joined Biogen as head of R&D in 2011. “I kept waiting for something to not fit, but every piece of data hung together — it was dose-response and time dependent, the placebo looked like it should have looked. It worked on all the measures.”

Outside the company, many drug executives also felt a revelatory excitement. Biogen’s early findings, if borne out, offered a rare financial jackpot. If anti-Alzheimer’s drugs were ultimately proven to be effective as preventive meds — and patients took them early and often in the same way that millions take statins to stave off heart disease — the business model could be extraordinarily profitable. The National Institute on Aging (NIA) is now funding a handful of prevention studies to test the theory.

Duke’s Doraiswamy says this has reenergized the field. “You may need to give treatment for four to six years, or preventative treatment for 10 years,” he says. “Clearly it’s an incredibly lucrative opportunity.”

Last December, three months before Biogen’s dramatic presentation in Nice, the company announced it was jumping adu from Phase 1 testing to Phase 3 — an expensive trial with lots of patients. But even if the strong results are replicated (and there are no additional complications), Biogen won’t be able to get a drug on the market until at least 2018, analysts speculate. (Perhaps reflecting that reality, the stock price has pulled back; at presstime in late April it was trading at $423.)

Which means the race between the tortoise and the hare is hardly over. Lilly has already embarked on its third Phase 3 trial with sola — this time only in prescreened patients with mild Alzheimer’s disease. The NIA is also evaluating the Lilly drug, which seemed to show a slight cognitive benefit in some patients, in one of its studies. It, too, could emerge in 2018.

Moreover, both companies have plenty of other Alzheimer’s drugs in their pipelines. Says Biogen’s Williams: “We’re quadrupling down.”

Experts say that if they’re approved, there may be room for all of them in the marketplace. Increasing evidence shows that Alzheimer’s is a complex disease that is heavily influenced by the individual biology of each patient. As with cancer, it is likely that treating Alzheimer’s in most patients will require a combination of therapies. In the end, perhaps, the tortoise and the hare may be celebrating together at the finish line.

This story is from the May 1, 2015 issue of Fortune magazine.