Becky Quick is an anchor on CNBC’s Squawk Box.

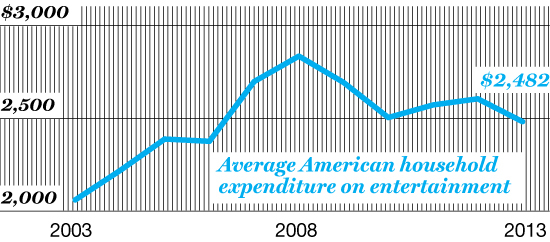

It may be the best gauge of how Americans are feeling about the economy: how much we are spending to entertain ourselves. And right now we’re apparently feeling a little under the weather. Last year the average American household spent just $2,482 keeping itself amused, the lowest level since 2006. Lately even the clowns from the Greatest Show on Earth are having trouble cheering us up.

“Our core customer is Middle America, the Wal-Mart customer, the Target customer,” says Kenneth Feld, the CEO of Feld Entertainment. His company operates everything from the Ringling Bros. and Barnum & Bailey circus to Disney on Ice and Monster Jam racing events. “We’re seeing them struggle,” adds Feld, who uses a massive database to monitor his patrons. In some cases, he noticed even the company’s most loyal customers opting not to splurge on events this year. “It’s tough out there, and there’s a mentality to be more frugal.”

Smart companies, though, adapt to tougher times. Feld Entertainment now monitors ticket sales in markets around the country on an hourly basis. If seats aren’t selling, it starts discounting, offering special prices to select customers. It’s all part of a dynamic pricing model (developed by Ticketmaster) to charge for seats more appropriately and efficiently, much like airline seats.

What Feld learned in the process is that while most of his customers may be struggling, plenty of folks are feeling a bit more flush, and are willing to cough up additional money for better seats or better access. Think of it as yet another example of the inequality gap in America. The middle class, it seems, has its own 1%. The trick is to bifurcate the market.

To wit: This year when Marvel Universe Live, a comic-themed action show featuring superheroes like Spider-Man and the Hulk, came to New York, Feld discovered through the dynamic pricing model that he could charge as much as $400 for seats in the front row at Brooklyn’s Barclays Center. That was up from the maximum price of $150 a year earlier. The low-end cost for tickets dropped, however: Nosebleed seats went for just $15, instead of $30 a year earlier. The strategy helped fill more seats and boost revenues.

Feld has also learned that some customers will pay handily if they feel they are getting exclusive access or unique experiences. At an ice-skating show in Raleigh, N.C., the company sold out of a special dining package in which guests dine rinkside during the show, at tables decked out in white linen tablecloths. Those seats go for roughly $100 apiece, vs. just $12 for the cheapest seats in the arena. “Those go like hotcakes,” says Jeff Meyer, senior vice president of marketing and sales at Feld. “We can’t put enough of those seats down there.”

Feld isn’t the only company using bells and whistles to win a larger share of its customers’ entertainment dollars. It’s the same strategy the Miami Dolphins will use at their new stadium. Instead of focusing just on luxury boxes, the Dolphins’ owners will also offer a premium middle-tier option—a limited number of comfortable seats right on the 40-yard line, with access to the field and a fancy club on the ground floor. Black-car service with a separate lane to cut down on traffic waits will also be available. “If you create scarcity, you provide pricing power,” says Tom Garfinkel, president and CEO of the Dolphins and Sun Life Stadium.

It’s a reality that entertainment companies are recognizing, as cash-strapped consumers become choosier when it comes to where they spend their shrinking discretionary income. And investors in the sector need to sit up and take careful note, because it’s attention to that kind of detail that might make the difference between an entertainment company that delights its backers and one with a performance that falls flat.

This story is from the October 6, 2014 issue of Fortune.