Weaker than expected demand for the latest iPhone models has prompted Apple to cut production 30%, a new report claims.

The article by Japanese news service Nikkei, which cited unnamed sources in Apple’s supply chain, spooked investors on Tuesday. The giant’s shares (AAPL) closed down 2.5% to $102.71.

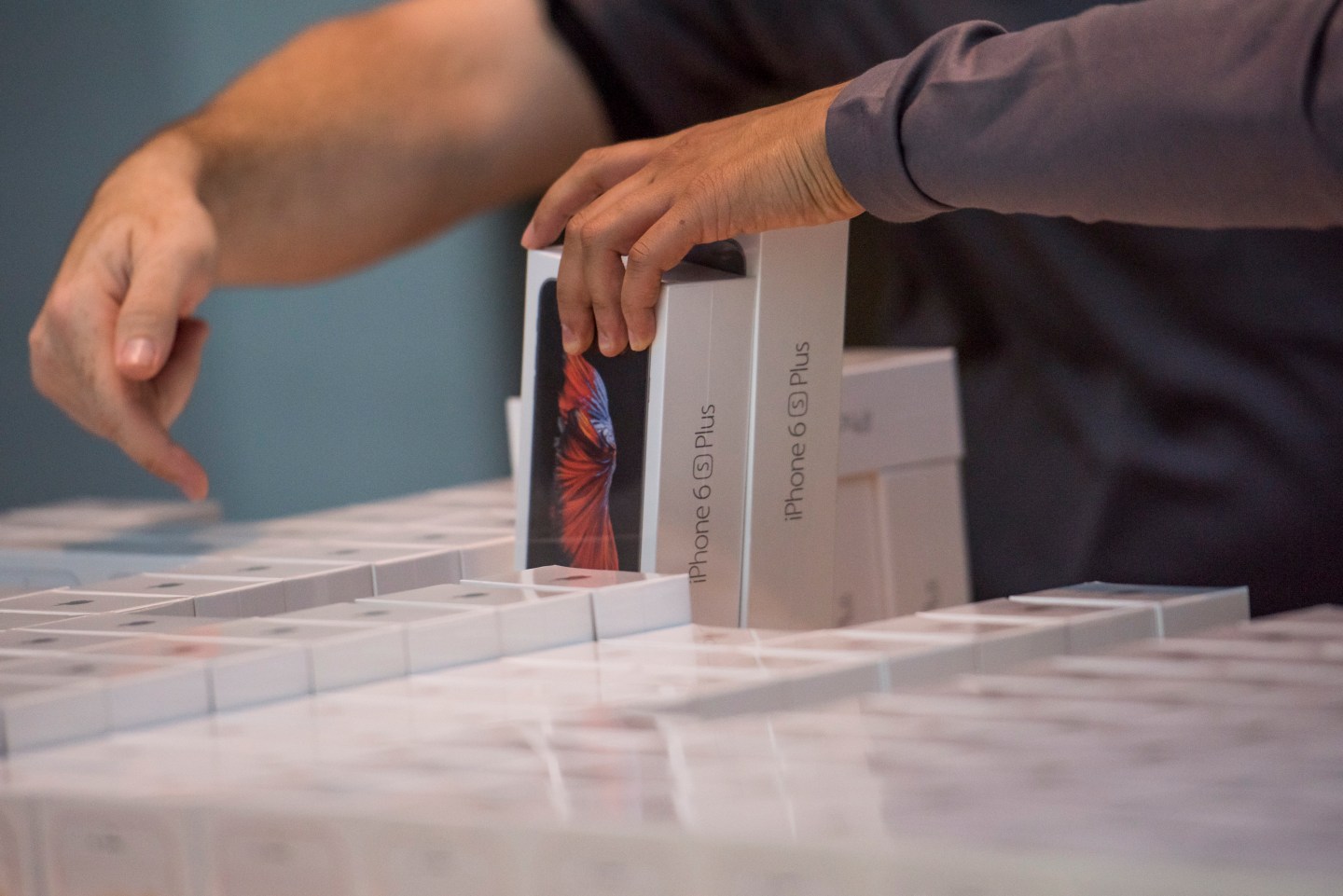

The report said Apple has reduced its planned iPhone 6s and iPhone 6s Plus production for the quarter ending in March. However, Apple is expected to maintain its order target next quarter, the report claims.

In the last six months, Apple’s shares are down 18.8% over concerns about slowing iPhone demand.

According to the Nikkei’s sources, Apple had anticipated higher demand for the iPhone 6s and iPhone 6s Plus. More specifically, the sources say that Apple’s iPhone supplies are mounting in key markets, including its two biggest, the U.S. and China.

The iPhone is critical to Apple’s business. In its last-reported quarter ending in September, Apple’s iPhone revenue topped $32.2 billion, over half of its total $51.5 billion in revenue. Meanwhile, Apple’s iPad business has been in free fall and Mac sales have been relatively static for several quarters.

SIGN UP: Get Data Sheet, Fortune’s daily newsletter about the business of technology.

In a note to investors on Monday, Daniel Ives, an analyst at FBR & Co., said that Apple investors have faced “a miserable, dark period over the past few months.” He added that a “white knuckle period” is likely to continue into the early part of 2016 as iPhone 6s demand remains “less than stellar.”

Worries on the Street may have been exacerbated by nearly constant talk of iPhone 6s issues. Last month, several analysts, including those at Morgan Stanley, JP Morgan, and Barclays, said that Apple had reduced component orders on its latest handsets. That report came after analysts predicted a year-over-year iPhone shipment decline of 15% in the quarter ending in March. If the Nikkei report is true, it may be even worse.

Still, there may be another side to the story that investors aren’t considering. For one, it’s entirely possible that the Nikkei report is mistaken. Apple CEO Tim Cook said last year that he had “never seen one” estimate on Apple’s iPhone supply chain orders that were “even close to accurate.” Indeed, on several occasions, Cook has said on several occasions that the iPhone 6s line is performing above his expectations.

WATCH: For more on iPhone sales, check out the following Fortune video:

Last month, Morgan Stanley lowered its Apple price target 12% to $143 from $162 in large part over Wall Street’s concerns about the iPhone. Morgan Stanley analyst Katy Huberty noted that while she was cutting Apple’s price target, she anticipated the company’s iPhone market share in 2016 to reach record levels.

Perhaps more importantly, she shed some light on why production cuts may not necessarily be a bad thing. On a call with investors, Huberty said that while it’s possible Apple’s decision to cut component orders is due to weaker-than-expected demand, it may instead be the result of adequate inventory. It’s possible Apple’s supply chain has done a fine job of building more than enough iPhones, and the company has simply decided to wind things down for a period so it’s not overwhelmed with stock. In that scenario, demand would not be an issue.

MORE:About Those Rumors of Apple Supply Chain Cuts

For now, only Apple knows for sure what’s going on, and a spokeswoman declined to comment about the Nikkei report. Still, despite the bearish response to yet another troubling Apple report, several analysts, including Ives and Huberty, don’t believe the roof is caving in.

“The reality is that this interim product cycle should still help Apple hit roughly 220 million+ iPhone unit sales for 2016, a still commendable achievement for a “S” product cycle, and thus help lead to the drumroll for a robust 250–255 [million] iPhone unit sales number in 2017 on the heels of a much anticipated iPhone 7 cycle,” Ives wrote.

In other words, don’t worry about it.