Singapore’s Straits Times Index hasn’t had a year like this in over a decade. As 2024 comes to a close, the index is poised to be Southeast Asia’s best-performing stock market index.

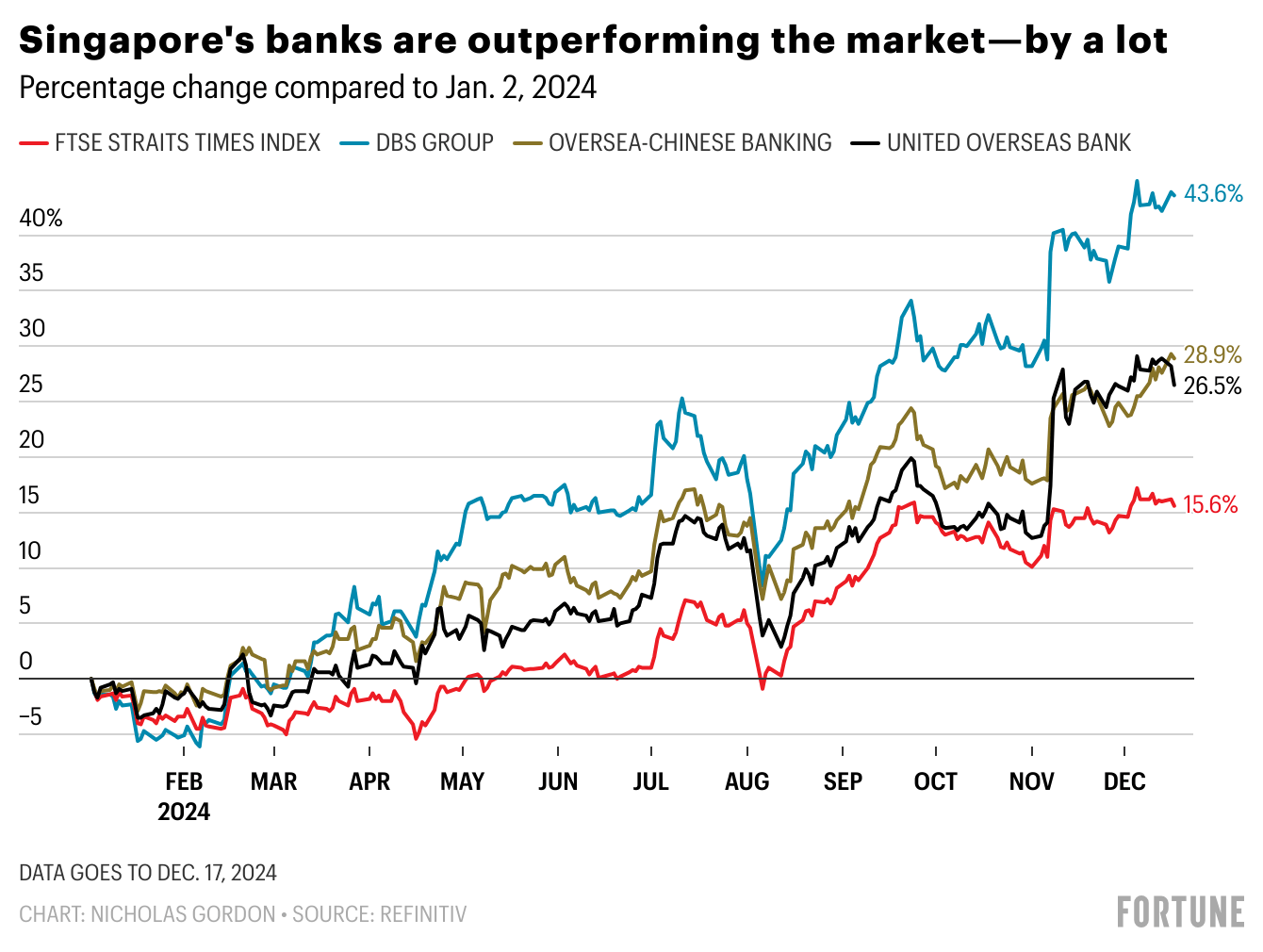

The STI, which tracks the 30 largest companies by market value traded on Singapore’s stock exchange, is up 15% for the year. The index also touched 3842 in the first week of December marking a 17-year-high, and close to its all-time high of 3906 in 2007. Like most markets, the STI has slipped following the U.S. Federal Reserves’ comments after delivering a 25 basis point rate cut on Dec. 18.

The Singaporean index took the lead in the final months of the year, with its rally only picking up steam in September.

Malaysia’s Kuala Lumpur Composite index, which tracks the country’s 30 largest companies, led the region’s markets. At the start of July, the KLCI was up 10% for the year; the STI was only up around 7%. (Malaysia’s index is posting a 9.6% increase for the whole year).

The STI’s rally, however, is really a story about Singapore’s Big Three banks: DBS, United Overseas Bank (UOB), and Oversea-Chinese Banking Corporation (OCBC), No. 10, 11, and 12 respectively on the Southeast Asia 500, Fortune’s list of the largest companies in the region by revenue.

Shares of DBS, the region’s largest bank, are up 41.6% so far this year and shares of OCBC and UOB are up 26.9% and 25.8% respectively.

If the Big Three banks are excluded from the STI, the index would have posted just “single-digit increases,” writes UOB Kay Hian analyst Adrian Loh in a Dec. 9 research note.

DBS, OCBC and UOB combined make up more than half of the STI’s weight, says Michael Makdad, a senior equity analyst at Morningstar.

Nominations are now open:

Fortune is now accepting nominations for the 2025 Southeast Asia 500—the definitive ranking of the region’s largest companies. Start your nomination here.

By comparison, other large companies on the STI haven’t fared as well. Shares in Wilmar International—the largest company by 2023 revenue on the STI—are down 15% for the year.

Singapore Airlines, the country’s flag carrier and constitutent of the STI, is down 2.75% in 2024, as the airline warns that earnings could be pressured by competition and rising costs. Singapore Airlines, No. 18 on the Southeast Asia 500, is the fifth-largest company by revenue on the STI.

Singapore banks’ performance

“The main driver was that the U.S. Federal Reserve started to cut interest rates more slowly than the market had assumed going into the year, helping the local banks avoid severe narrowing in net interest margins,” Makdad says.

The analyst also points to better-than-expected growth in wealth management fees and a surprise share buyback announcement from DBS as reasons for investor optimism.

Singapore’s banking CEOs are also optimistic heading into 2025—even if a second Trump administration could bring some uncertainties.

Outgoing DBS CEO Piyush Gupta, at a recent earnings call, suggested that Trump’s policies could lead to renewed U.S. inflation, which in turn might keep interest rates high. The banking head noted that a “higher interest rate environment is generally better for DBS.”

OCBC, too, also believes that new Trump policies might be good for the bank. Greater pressure on China might encourage more Chinese companies to invest in Southeast Asia through Singapore, whether to avoid tariffs or to search for new markets. Increased flows from China “must benefit a bank like us,” CEO Helen Wong told analysts on Nov. 8.

UOB chief financial officer Lee Wai Fai, on a recent earnings call, said the bank is closely watching developments in the U.S. He noted that some “proposed actions” could be inflationary, which will slow the rate of interest rate cuts—which will benefit for the bank’s margins.

Analysts are more mixed on how Singapore’s banking shares will perform. Loh, from UOB Kay Hian, is optimistic on DBS and OCBC, anticipating that the banks will generate healthy levels of cash flow even if Singapore falls into recession next year.

Makdad, however, is less certain. In his view, the strong performance of Singapore’s banking sector “raises the bar for 2025.” That may leave Singapore’s banking shares less room to grow: “They’re now all near our estimate of their intrinsic value,” Makdad says.