The flood of Chinese exports around the world helped the economy blow past President Donald Trump’s massive tariff hikes, while Beijing touts successes in AI, EVs, robotics and other emerging technologies.

But that strength masks ongoing weakness among consumers and the property sector.

China’s trade surplus jumped 20% to $1.19 trillion in 2025, marking the world’s largest ever, as shipments surged to the European Union, Africa, Latin America and Southeast Asia.

Exports climbed 5.5% and accounted for a third of economic growth in 2025, the highest level since 1997. Imports were virtually flat, reflecting weak domestic demand and Beijing’s push to become more self-sufficient.

The record trade surplus helped GDP grow 5% last year, matching the government’s target, but the headline figure contrasted with mounting signs of broad weakness.

Growth actually slowed toward the end of the year, with GDP up 4.5% in the fourth quarter on an annual basis versus a 4.8% gain in the third quarter.

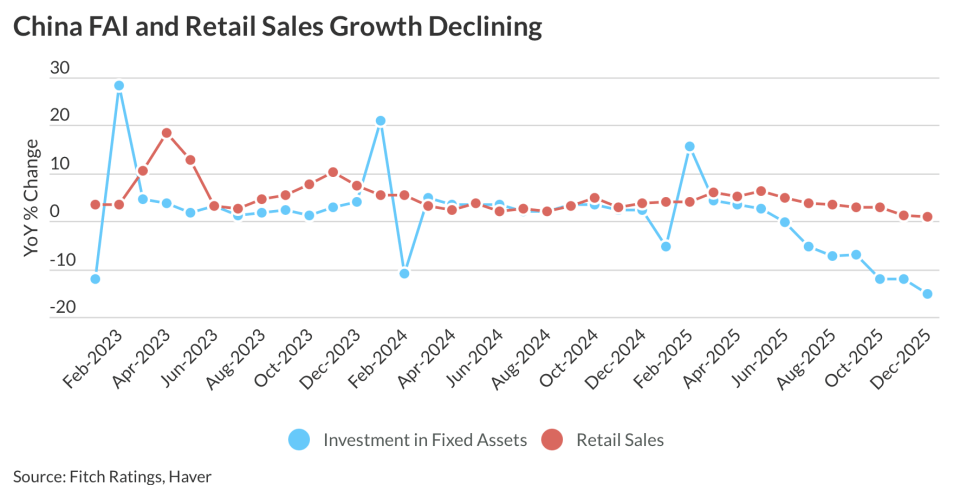

Retail sales in December inched up just 0.9%, down from 2.9% growth in October and 6.4% in May. Investment in fixed assets reversed sharply into an outright decline, collapsing 15% in December after spiking 15.7% in February.

In fact, fixed-asset investment saw its first annual drop in data going back almost three decades. That’s largely due to China’s real estate crash, which sent property investment down 17.2% last year and offset heavy spending on high-tech industries that Beijing is trying to advance.

Fitch Ratings expects China’s economy to run out of steam this year, predicting GDP growth will cool sharply to 4.1% from 5% in 2025.

“We believe domestic demand will remain constrained by sluggish consumer confidence, deflationary pressures, and investment headwinds that have broadened beyond the property-sector correction and are amplified by the local-government debt overhang,” it said in a report on Jan. 22.

But more than four years since China popped a construction bubble, about 80 million unsold or vacant homes continue to weigh on sales, prices, starts and completions.

After tinkering with attempts to revive the property sector, China has signaled it’s pivoting to a new model of development, away from the emphasis on debt-fueled investment.

“This marks the virtual abandonment of an industry that once accounted for about one-quarter of China’s gross domestic product and roughly 15% of the nonfarm workforce,” Jeremy Mark, an Atlantic Council scholar and former IMF official, wrote on Wednesday.

Many other economic problems—such as weak retail spending, deflation, as well as low consumer and business confidence—can be traced back to the free-fall in real estate, which is the main repository of life savings for hundreds of millions of households, he pointed out.

That’s as an estimated 85% of the price gains in real estate have been wiped out since 2021. As result, consumers hoard their money instead of spending it, forcing businesses to trim wages, staff and prices to remain afloat. In response, consumers pull back further.

This feedback loop has kept consumer prices flat and producer prices in negative territory. China’s overcapacity and its support for manufacturers over consumers have also stoked excess supply that drags down prices. An economy-wide price gauge shows China has been suffering from deflation for three straight years, the longest such streak since its transition to a market economy in the late 1970s.

The real estate crash is also rippling through China’s banks and local governments, as efforts to stave off more bankruptcies among developers have created “zombie” firms and mountains of debt, Mark warned.

“Even if the shockwaves from China’s collapsed property bubble eventually recede, the task of rebuilding will be daunting,” he added. “It requires not only replacing a major pillar of Chinese economic dynamism, but also the revitalization of homeowners’ deeply damaged sense of financial security.”

Export-led growth running out of room

Economists have long urged China to rebalance its growth to a consumer-led model and away from an export- and investment-led model. President Xi Jinping’s industrial policies have even been flagged as a greater threat to the global economy than Trump’s trade war.

But last year’s reliance on exports showed that the country’s leadership remains reluctant to make the switch. While Chinese businesses have flexed their muscle as global manufacturing powerhouses, their ability to prop up the rest of the economy is in doubt.

“China’s growth model is becoming increasingly difficult to sustain,” Cornell professor Eswar Prasad wrote in a Financial Times op-ed in December.

Weak growth in employment and wages, plus the property crash and lack of confidence in the government, have weighed on consumption, he added. With little domestic demand, the only option for China’s factories is to export their output.

But Trump’s tariffs have forced exporters to look elsewhere, creating a backlash in other markets that could put up additional trade barriers and limit future growth, Prasad said.

The EU and some other large economies like Indonesia and India have already imposed some targeted tariffs on certain Chinese goods.

“As the second-largest economy in the world, China is simply too big to generate much growth from exports, and continuing to depend on export-led growth risks furthering global trade tensions,” IMF Managing Director Kristalina Georgieva warned in December.