Good morning. And an early Happy Thanksgiving to our American readers.

Like much of the U.S., we’ll be off the rest of the week to eat, drink, and be thankful. (I’m especially grateful for my Fortune colleagues; they’re aces all around.)

We’ll be back on Monday. Today’s tech news below. —Andrew Nusca

P.S. I asked a popular chatbot which pie was best to celebrate the holiday, and it responded with “apple pie.” Just in case you were wondering where AI’s allegiances lie.

Want to send thoughts or suggestions to Fortune Tech? Drop a line here.

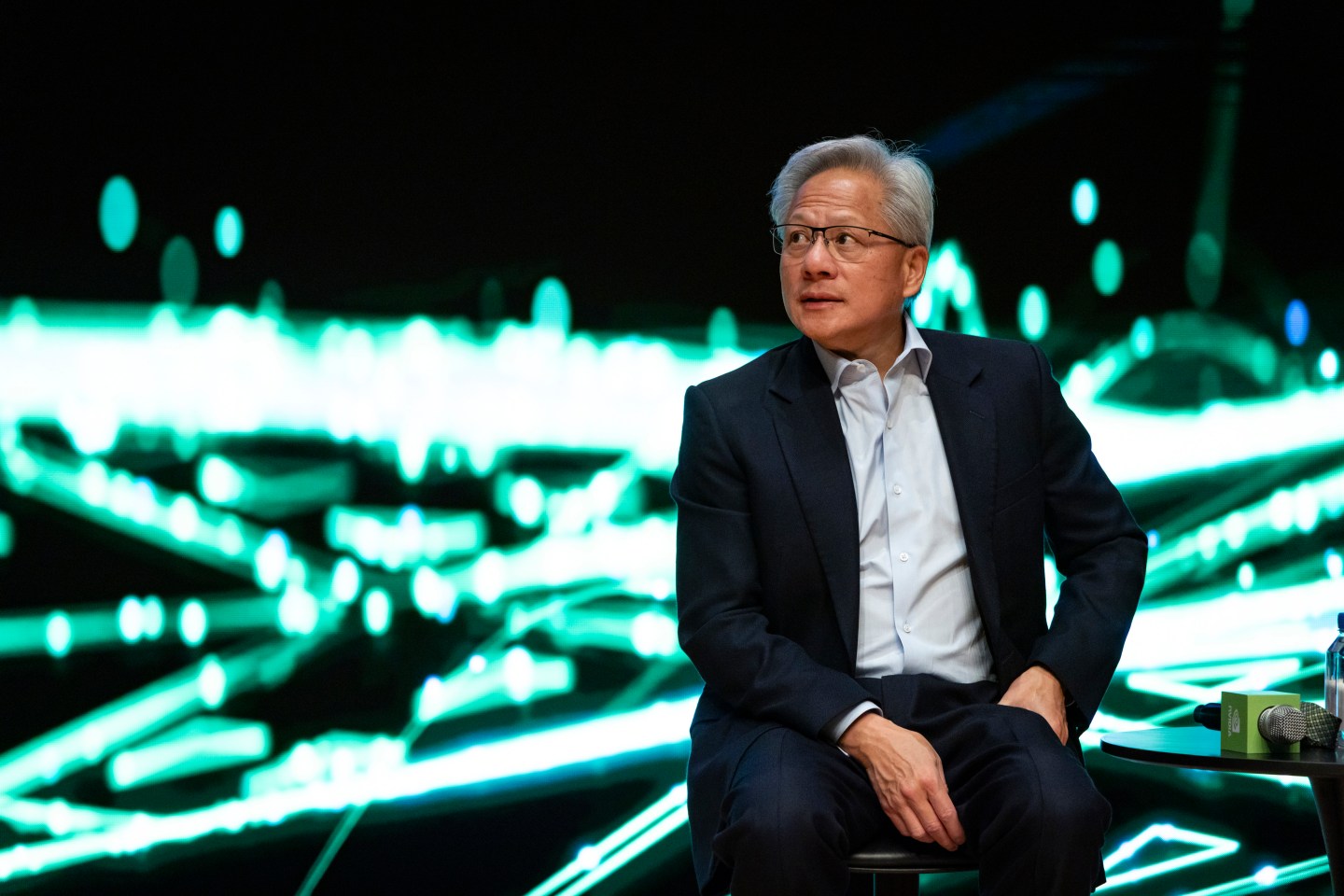

Nvidia: We’re ‘a generation ahead’ of Google’s AI chips

Nvidia is usually the company other firms have to respond to. Not the other way around.

But on Tuesday, the $4 trillion chipmaker did something rare: It took to X to publicly defend itself after a report suggested that one of its biggest customers, Meta, is considering shifting part of its AI infrastructure to Google’s in-house chips, called TPUs.

The move came after Nvidia stock fell over 2.5% on the news, while shares of Alphabet—buoyed by its well-reviewed new Gemini 3 model—climbed for a third day in a row.

The catalyst was a report from The Information claiming that Google has been pitching its AI chips to outside companies including Meta and several major financial institutions.

Google already rents those chips to customers through its cloud service, but expanding TPU use into customers’ own data centers would mark a major escalation of its rivalry with Nvidia.

That was enough to rattle Wall Street and also Nvidia itself.

“We’re delighted by Google’s success—they’ve made great advances in AI, and we continue to supply to Google,” Nvidia wrote in a post on X. “Nvidia is a generation ahead of the industry—it’s the only platform that runs every AI model and does it everywhere computing is done.”

It’s not hard to read between the lines. Google’s TPUs might be gaining traction, but Nvidia wants investors, and its customers, to know that it still sees itself as unstoppable. —Eva Roytburg

HP will cut up to 6,000 jobs in favor of AI

A Silicon Valley icon is feeling the squeeze.

HP Inc. on Tuesday shared a full-year profit outlook that fell short of Wall Street estimates.

What’s more, the company said it would cut between 4,000 and 6,000 employees (of its roughly 58,000 total) through its fiscal 2028 and offset the loss with AI tools that will save it $1 billion per year.

The changes will particularly affect customer support, manufacturing, product development, and sales roles.

CEO Enrique Lores said layoffs at HP—which, reminder, is the PC- and printer-making half of the company formerly known as Hewlett Packard; the other half now stands alone as HPE—were “something we have to do to make sure the company stays competitive.”

HP made a nearly identical cut three years ago.

As for that profit outlook: Excluding restructuring charges, HP expects between $2.90 and $3.20 per share for the year. Analysts were looking for $3.32.

Why the disconnect? Not tariffs, for once, but rising costs for memory chips. —AN

Suno strikes a deal with Warner Music

The AI music generator Suno and Warner Music Group have struck a partnership that settles previous copyright infringement litigation between the companies.

The new arrangement allows Suno users to work with licensed WMG music—think: Coldplay, Cardi B, Fleetwood Mac, Red Hot Chili Peppers—provided the artists opt in.

New tools will allow artists to have “full control over whether and how their names, images, likenesses, voices, and compositions are used in new AI-generated music.” Presumably they’ll see incremental revenue from that, too.

Suno will also be more restrictive about what can be done with finished works. Free users, for example, won’t be able to download their creations.

As part of the deal, Suno will acquire Songkick, WMG’s live music discovery platform. Suno, by the way, is backed by a number of household-name VCs including Lightspeed, Menlo Ventures, and Nvidia’s venture arm, NVentures.

Will a deal with one of the recording industry’s Big Three facilitate arrangements with the other two? We’ll find out. Like Warner, both Universal and Sony have ongoing litigation with Suno. —AN

More tech

—TSMC, Intel in trade secrets spat. SVP Lo Wen-jen left the Taiwanese giant after more than two decades for the American icon.

—TikTok taps Ziad Ojakli. The government affairs vet will become head of public policy for the Americas, replacing Michael Beckerman.

—Klarna debuts first stablecoin. Dollar-backed KlarnaUSD comes to a ‘chain near you' next year.

—Alibaba beats Q2 revenue estimates and ramps cloud spending.

—On the rise: dark factories. Round-the-clock, automated manufacturing facilities proliferate in China.

—Kalshi endures a legal setback. The prediction market is subject to Nevada gaming regulations, a judge rules.

—TikTok Shop adds luxury retail. An $11,000 handbag? After all, why not?