The global fashion industry is bracing for 2026, navigating a market defined by geopolitical instability, macroeconomic uncertainty, and, above all, unprecedented U.S. tariffs. As leaders pivot from focusing on “uncertainty” to acknowledging the environment is simply “challenging,” tariffs have emerged as the number one hurdle facing executives.

The severity of the trade landscape cannot be overstated, executives told McKinsey and the Business of Fashion for the 2026 edition of The State of Fashion report. U.S. tariffs on apparel and footwear imports, which had been around 13% earlier in 2025, dramatically spiked to 54% following initial government announcements in April. Although rates later eased, the weighted average tariff rate for apparel and footwear from the top 10 importers stood at 36% as of mid-October, well above historical norms. This sudden surge places the apparel and footwear industry among those most exposed to the tariffs’ profound impacts. Reflecting this critical situation, 76% of fashion executives surveyed believe responses to trade disruptions and tariffs will be the single most important factor shaping the industry in 2026.

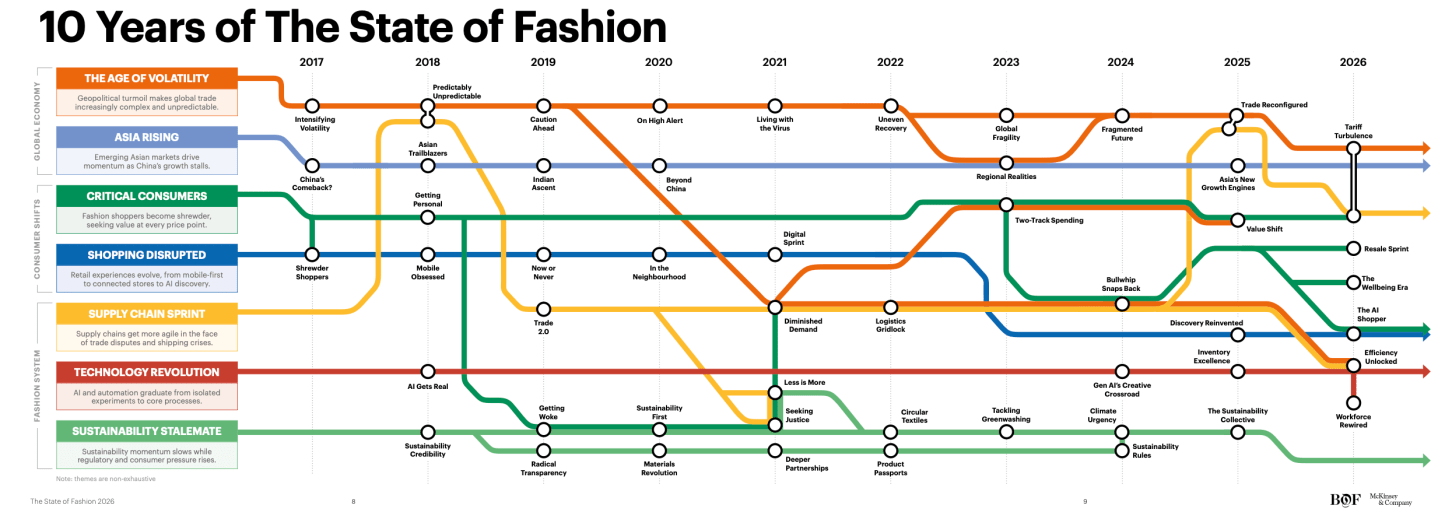

For the 10th anniversary of the report, which began in 2016, McKinsey and Business of Fashion charted the many changes for the industry since 2016, from a generalized “age of volatility” to Asia’s undeniable rise to disruptions in how shoppers shop. For 2026, they chart major issues, including “tariff turbulence” and three emergent shopper appetites: a focus on resale, a sense of “well-being” in their purchases, and a future marked by artificial intelligence (AI).

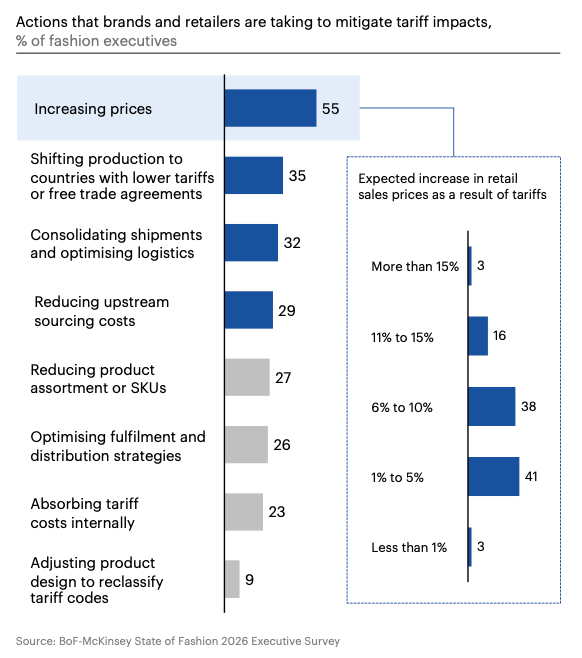

The report finds brands making price changes, shifting sourcing, and improving efficiency in a bid to counteract the impact of tariffs. Larger suppliers are responding by optimizing their footprints while chasing digitization and automation, and smaller players, meanwhile, are under mounting pressure. “Agility will be the defining factor enabling brands and suppliers to maintain their competitive edge.” Amid this economic disruption, Levi Strauss CEO Michelle Gass spoke to Joan Kennedy of Business of Fashion about how she’s adopted an aggressive and methodical tariff playbook, positioning the 170-year-old denim giant as a standout in managing the chaos.

Levi’s advantage, and painful truth

Crucially, Levi’s entered this period with a structural advantage: Approximately 60% of its business is international, reducing the tariff burden compared to many domestic competitors who are more heavily penetrated in the U.S. Yet, even with this advantage, the tariff increases demanded strategic action. Gass described the overall environment as “very complex,” encompassing macroeconomic forces, geopolitical issues, and massive disruption in technology and AI, and she articulated the necessary, unavoidable reality of passing some costs on to the consumer, stating plainly: “There’s only so much you can absorb from the tariffs, because they’re just very high.”

Levi’s approach to pricing is multifaceted: First, targeted and surgical pricing increases are being implemented, a measure also being taken by most apparel retailers (55% of executives expect further price increases in 2026 in response to tariffs). Second, the company is utilizing promotional levers, specifically pulling back on discounts such as “20% off” events, which helps elevate the brand and mitigate tariff impact by improving margins. Third, the company is pricing for innovation, leveraging new products where consumers are “likely willing to pay more.”

Levi’s did not respond to Fortune’s request for comment on more specifics about pricing increases to come.

Beyond pricing, Levi’s has prioritized internal operational prowess. Gass, who took over as CEO in 2024, has been driving a course correction focused on transformation, streamlining the business and reducing unwieldy inventory. Tactical moves included cutting slower-selling SKUs. More significantly, the company is undergoing a fundamental “rewiring” to reduce complexity across its network of 120 countries. By increasing the commonality of product across all global stores from less than 10% to about 40%, Levi’s is generating efficiencies across design, sourcing, and merchandising. As Gass summarizes this strategy: “We’re operating in a complex environment, but we ourselves are becoming less complex.”

This disciplined approach has delivered results. Levi’s reported a 7% year-on-year increase in quarterly sales in October 2025, posting its fourth consecutive quarter of high-single-digit growth. The company also raised its full-year revenue outlook, even as it cautioned that tariffs would impact margins in the fourth quarter.

The industry overall is adapting to the new trade map, with 35% of executives planning to shift sourcing to markets with more favorable trade agreements. However, Levi’s emphasizes that in a volatile trade environment, agility depends heavily on strategic supplier partnerships built on collaboration. Gass noted that Levi’s teams talk to vendors 24/7, treating it as a “relationship business” where sourcing from multiple countries offers crucial flexibility against tariffs and supply-chain disruptions.