The trust funds that support Medicare and Social Security—a financial backbone for nearly 70 million Americans—are at serious risk of insolvency within the next seven years, threatening to slash benefits by up to 24% for retirees unless legislative action is taken immediately. For a typical couple turning 60 this year, this could mean a staggering loss of approximately $18,400 in Social Security benefits annually, according to the Committee for a Responsible Federal Budget (CRFB), one of Washington DC’s top nonpartisan budget watchdogs.

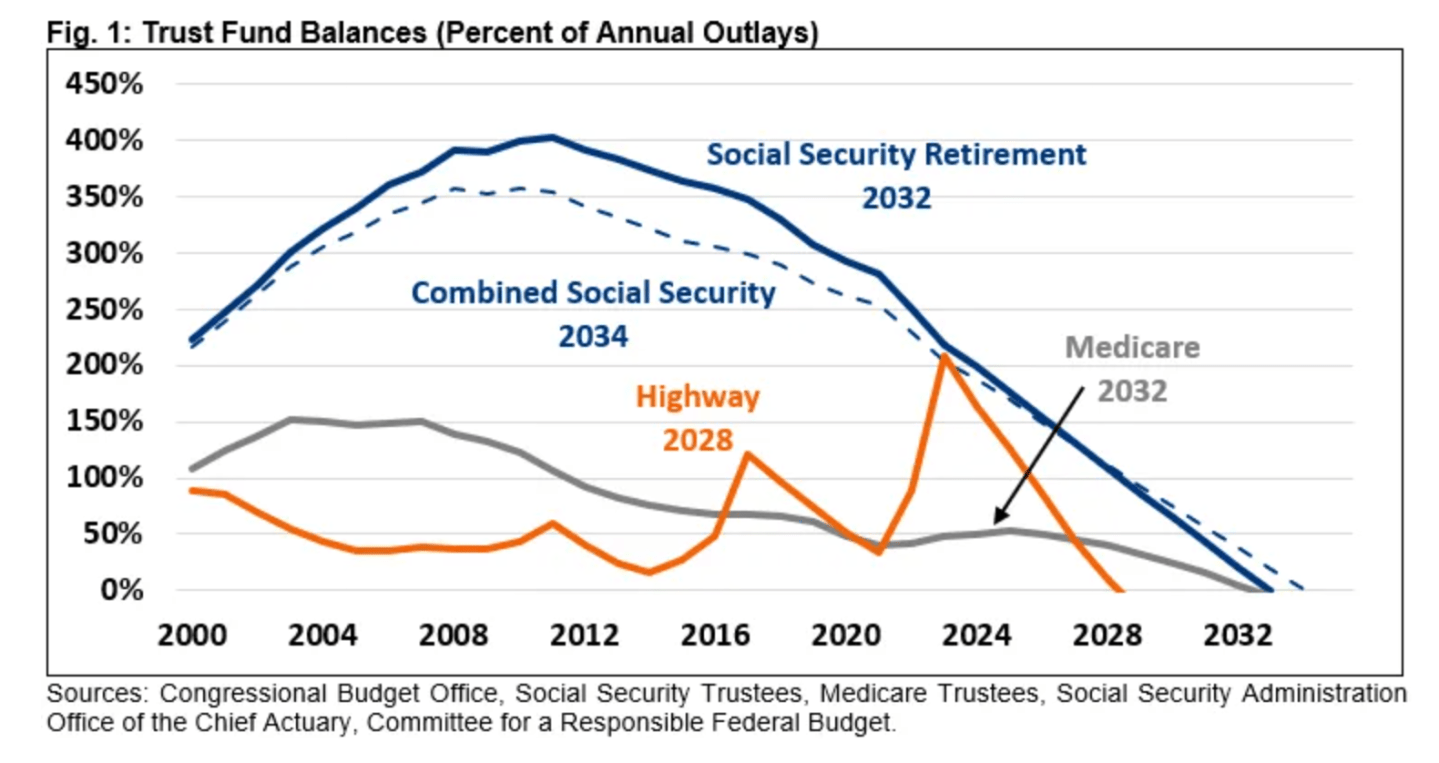

Financial projections from both program trustees and the Congressional Budget Office (CBO) paint an alarming picture, the CRFB says: the trust funds that finance Social Security’s retirement program, Medicare’s hospital insurance, and the Highway Trust Fund will all be depleted by or before 2032.

Specifically for Social Security, projections indicate that the retirement trust fund will be depleted in late 2032, with the combined retirement and disability trust funds exhausting their reserves by 2034. Medicare’s associated hospital insurance fund faces a similar fate, with policymakers now estimating insolvency by 2032 as well.

What happens when the money runs out?

Current federal law mandates that these programs cannot spend more than the revenue they collect. Once their reserves are depleted, the programs will be forced to impose immediate and sweeping cuts to balance their budgets.

For Social Security, this translates into a 24% across-the-board cut in benefits—equal to an $18,400 reduction per year for the typical couple entering retirement in 2033. Medicare would simultaneously be forced to cut outlays by 12%, which could disrupt payments to hospitals and health providers and reduce access to care. The Highway Trust Fund faces a whopping 46% reduction in spending, threatening maintenance and construction of critical infrastructure.

The insolvency of these trust funds doesn’t just jeopardize retirees; it has drastic implications for the entire economy. Over the next decade, the combined shortfall between trust fund spending and revenues will reach approximately $4.3 trillion—about 1.1% of GDP—with the annual gap ballooning to 1.7% of GDP by 2050 and projected to just keep rising. If benefit cuts are implemented as scheduled by law, the debt trajectory could slow, potentially lowering the national debt-to-GDP ratio from a projected 170% by 2060 (status quo) to 125% under strict benefit reductions.

The programs currently provide direct benefits to nearly 70 million Americans and serve or insure at least 200 million, according to the CRBF.

Thoughtful reforms have the potential to go even further—possibly stabilizing the debt entirely and boosting economic growth. Analyses suggest that restricting benefits to available revenue, although initially painful, could raise real Gross National Product by 3.7% by 2050 due to increased personal saving and labor force participation. Broader, more comprehensive reforms could yield even greater economic benefits.

Paths to a solution

Restoring solvency will require a mix of difficult choices and innovative policies—lowering costs, increasing system revenues, or both. Some proposed ideas include a new employer compensation tax to replace payroll taxes, capping cost-of-living adjustments for higher-income retirees, and raising the retirement and eligibility ages for Social Security and Medicare by two years. Policymakers might also consider reforms to how benefits are calculated, changes to Social Security taxation, and improvements to Medicare payment systems.

The Committee for a Responsible Federal Budget emphasizes that no single solution will fix the problem in isolation, but a comprehensive approach—embracing both time-tested and novel strategies—could meaningfully extend the life of these trust funds, preserving crucial benefits and economic security for future generations. “Changes are needed to rescue these trust funds from insolvency,” the CRFB urges, saying that it’s come up with a Trust Fund Solutions Initiative that has concrete and novel policy ideas for each major trust fund. But the CRFB notes that it’s just a think tank, and “legislative action is needed.”

The report was issued during the latest of the many government shutdowns that have occurred with increasing frequency in the 21st century, returning to a 1970s pattern although longer in duration. They have occurred three times alone under President Donald Trump.

For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.