Striking out on your own can result in much more income than holding a steady job with steady pay, but many entrepreneurs won’t enjoy that premium, according to a recent study from the Federal Reserve Bank of Minneapolis.

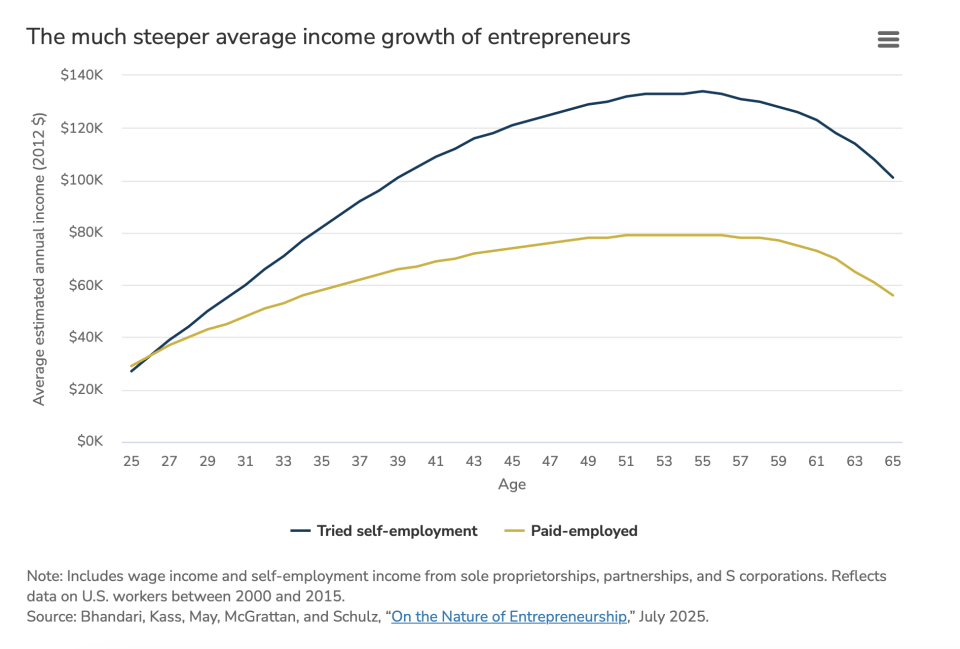

In an analysis of tax and income data from 2000 to 2015, the study found the average entrepreneur made $27,000 annually (in 2012 dollars) at age 25—slightly less than the $29,000 for a paid employee at the same age.

But those workers soon switched places, and by age 30 entrepreneurs made $55,000 versus $45,000 for paycheck workers, or 22% more.

As they got older, the average income gap between them widened, and by age 55 the self-employed made 70% more: $134,000 versus $79,000 a year.

The study also noted that entrepreneurs often have other sources of income when starting out, either from paid employment or a separate business, allowing them to post positive overall earnings even if their new businesses haven’t yet turned a profit.

But the data on average earnings also masks sharp inequality among self-employed workers, meaning that “the typical dollar in self-employment does not come from the typical self-employed individual,” according to the study, which was published in July and highlighted in a separate post from the Minneapolis Fed last week.

In addition, 80% of the income earned by the self-employed came from those making $100,000 a year or more.

“IRS data show that many of the primarily self-employed earned less over the sample years than paid-employed peers with similar characteristics, but in the aggregate this subgroup has a much lower share of the total income than those that earned more than their peers,” the study—authored by Anmol Bhandari, Ellen R. McGrattan, Tobey Kass, Evan Schulz, and Thomas J. May—said.

The findings come as small businesses, especially in trades, have emerged as lucrative opportunities for private equity.

By investing in businesses and partnering with their founders, some PE firms can help scale up companies and grow earnings.

Other findings from the Minneapolis Fed study sought to dispel some myths about the self-employed, such as being “a gig worker seeking flexible arrangements, a misfit avoiding unemployment spells, an inventor seeking venture capital, a tax dodger misreporting income.”

For example, entrepreneurs overall didn’t get a big cash windfall or rely heavily on debt to start their businesses. In addition, data showed those who switched to self-employment had previously earned more than peers who were paid employees, contrasting with notions that they were pushed into starting their own business.

“Most entrepreneurs that persist in business have higher earnings growth than in paid employment,” the study said. “With insurance from the most adverse shocks, we find that self employment is an attractive option and not puzzling from a risk versus return perspective as previously thought.”